Thoughts on Today🤔

/ES

Strong session but need to break out of this channel down for us to see a new trend for a few weeks take place otherwise right back down to 3700 and if that fails 3600 then 3500 will be exposed.

Back bellow 3834 we could see downside to 3807 then eventually to 3743 where we bounced. We had a slight overshoot to 3724 and if that gives up we are going down.

/CL Oil made its way down to 90 however is holding above my 94.78 line. If we can push back over 100 we will see 105.02. However, that is were we rejected and have had that level noted for quite some time. So keep an eye on that because over that 107.26 we will see and higher.

Weekly Game Plans are FREE. If you want more in-depth analysis, live streams, and DAILY SubStack Levels click subscribe and support my work. 😎

*ALL EDU content will remain free such as Volume Profile Guide below and other education content I will release.

Want To Learn Volume Profile?

🐦 BIRD’S EYE VIEW

Stocks We Will Be Reviewing

- FUTURES - /ES & /NQ

- ETFs - QQQ (tech) & IWM (small caps)

- VIX - Volatility Index

- STOCKS - AAPL / MSFT / AMD / NVDA / AMZN / GOOGL / TSLA

/ES

Game Plan:

- Above Weekly POC - 3854 - Need over 3870 for us to test 3886. We have a Weekly vPOC around 3903 that has yet to be tested where we can run into som sellers again. However if we push through 3903 we can test the upper range around 3936. then 3965.

- OPEN Below Weekly POC - 3854 - Below we can test 3834 then 3807. IF that fails 3787 then 3743 we can can likely see.

POC: 3867 / VH: 3867 / VL: 3863

SPY

Game Plan: We have a Gap to fill from Friday now so could fill that earlier week if we give up the weekly POC of 384.

- Above Weekly POC - 384 - Over 384 if we hold we can test 387.2 then 389.31 weekly vPOC that is yet to be tested. If we get through that and hold we can head to 396.36 weekly vPOC that has not been tested yet.

- Below weekly POC - 384 - Below 383.17 we can test 380.74 POC that we gapped over on Friday. If we give that up we can see 378.28 and below that 372.86. If all fails 371.04 Low of last week then 367.14 weekly vPOC that has not been tested.

POC: 384 / VH: 386 / VL: 378

/NQ

Game Plan: Currently making Higher Lows but not higher highs as the range is getting tighter so manage positions accordingly as a move is coming out of this.

- Above Weekly POC 11905 - Need over to hold over 11973 for us to test 12145 weekly vPOC. If we manage to get over 12227 and break 12295 we can possibly test 12583 weekly vPOC that hasn’t been tested yet.

- Below Weekly POC - 11905 - Below weekly POC 11903 we can possibly test 11847 but once we head down to 11742 near weekly VL and if that breaks we can possibly bounce again off 11483 zone but if not then not much support till 11351 and 11267 zone.

POC: 11905 / VH: 11993 / VL: 11729

VIX

Game Plan: Hit our target around 24 so caution now.

- Below 24 we see 22.38 then 19s but unlikely.

- Back over 28.42 we can push to 30s and make a fast move to 32s

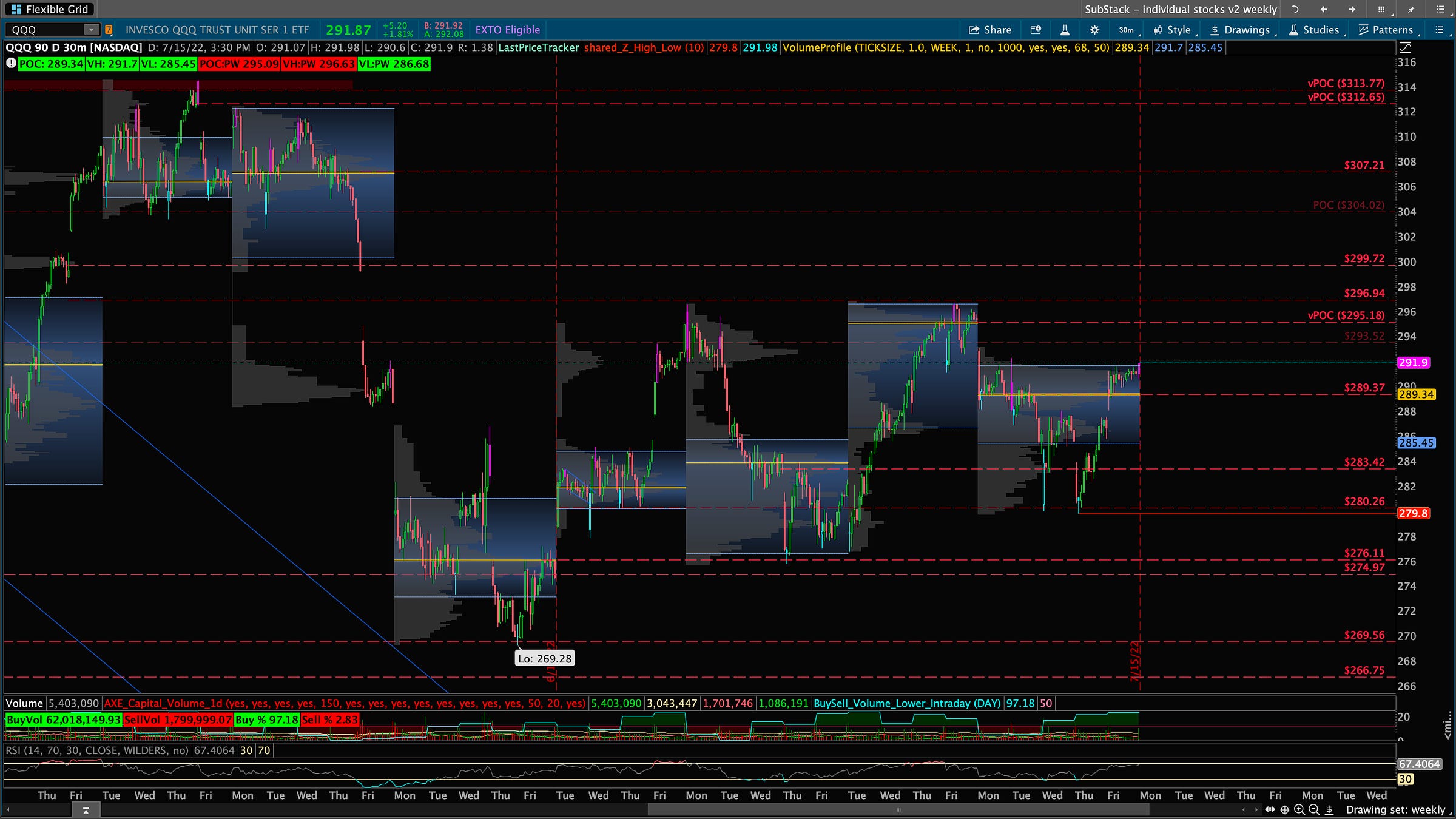

QQQ

Game Plan: May go for gap fill this week around 299!

- Above Weekly POC - 289 - Need to hold over 289.37 POC for us to possibly test 293.52 then we can test 295.94 weekly vPOC that has not been tested yet. If we break through 296.94 they pay finally close the gap at 299.72 zone and rip it to 307.21 weekly vPOC.

- Below Weekly POC - 289 - Below 289.37 we could lightly test 283.42 zone but below 280.2 is next. If that fails 274.97-296.11 zone is where a Weekly POC is.

POC: 289 / VH: 291 / VL: 285

IWM

Game Plan:

- OPEN Above POC - 167 - Back over 171.65 we can see 173.14 we can see 174.89

Further Upside Levels: 174.89 > 176.44 > 178.67 > 179.67 > 182.11

OPEN Below POC - 167 - Below 168.44 we can see 167.02 then 165.56

Further Downside levels: 166.55 > 165.56 > 164.03 > 162.78 > 159.68 > 153.51 > 144.88

GAPS: 175.01 > 174.34 / 168.34 > 165.71 / 157.71 > 155.89

POC: 167 / VH: 169 / VL: 167

AAPL

Game Plan: As we come to the top of this rising wedge we can possibly break down to 145 and below that 142 and lower.

- Above Weekly POC - 145 - over 150.36 vPOC we can head test 151.42 and then head toward 154.19. Through that 156.72-157.45 can get a little choppy..

- Below Weekly POC - 145 - Below 148.07 we can head to test 145.87 weekly POC that is a vPOC. Below that 142-143 range could be lightly test. If we knife through that 137.59 vPOC to 140.44 range could be exposed.

POC: 145 / VH: 148 / VL: 144

MSFT

Game Plan:Needs to hold over this 254.85 zone for us to push higher otherwise below 253 it can get ugly back to 245.04

- Above Weekly POC - 256 - Over 256.55 we can push to 258.99 zone then 260. 261.64 to 263.54 would be next targets in between there.

- Below Weekly POC - 256 - Below 253.74 we can see 250 zone which is last week VL. Below that 245.04 vPOC could finally be tested then it gets choppy below that through 241.51.

POC: 256 / VH: 258 / VL: 250

AMD

Game Plan:

- Above Weekly POC - 76 - Needs to hold 80.4 for us to break through 81.03. If we get through that 84 zone could get choppy but eventually push up toward 85.92 to 87.73 range. If we manage to clear that we can see 91.37 vPOC tested.

- Below Weekly POC - 76 - Below 79.13 we can head to 77.79 as first possible bounce level. If that fails and through POC of 76.75 we will see 74.47 tested again. We bounced there 2x and could make it 3x for a triple bottom. If now 72.54 is exposed and lower.

POC: 76 / VH: 78 / VL: 76

NVDA

Game Plan:

Above Weekly POC - 151 - Hold over 158.09 vPOC we can test 160.69 through that 166.54 would my next target. Finally 172.04 were we

Further Upside Levels: 162.8 > 165.78 > 168.48 > 170.55 > 172.04

- Below Weekly POC - 151 - Below 153.05/.75 we can head down to 148.75. Below that we will see 144.65 tested which we bounced off hard mid week last week. If all fails 140.03 then 135 we will see.

POC: 151 / VH: 153 / VL: 148

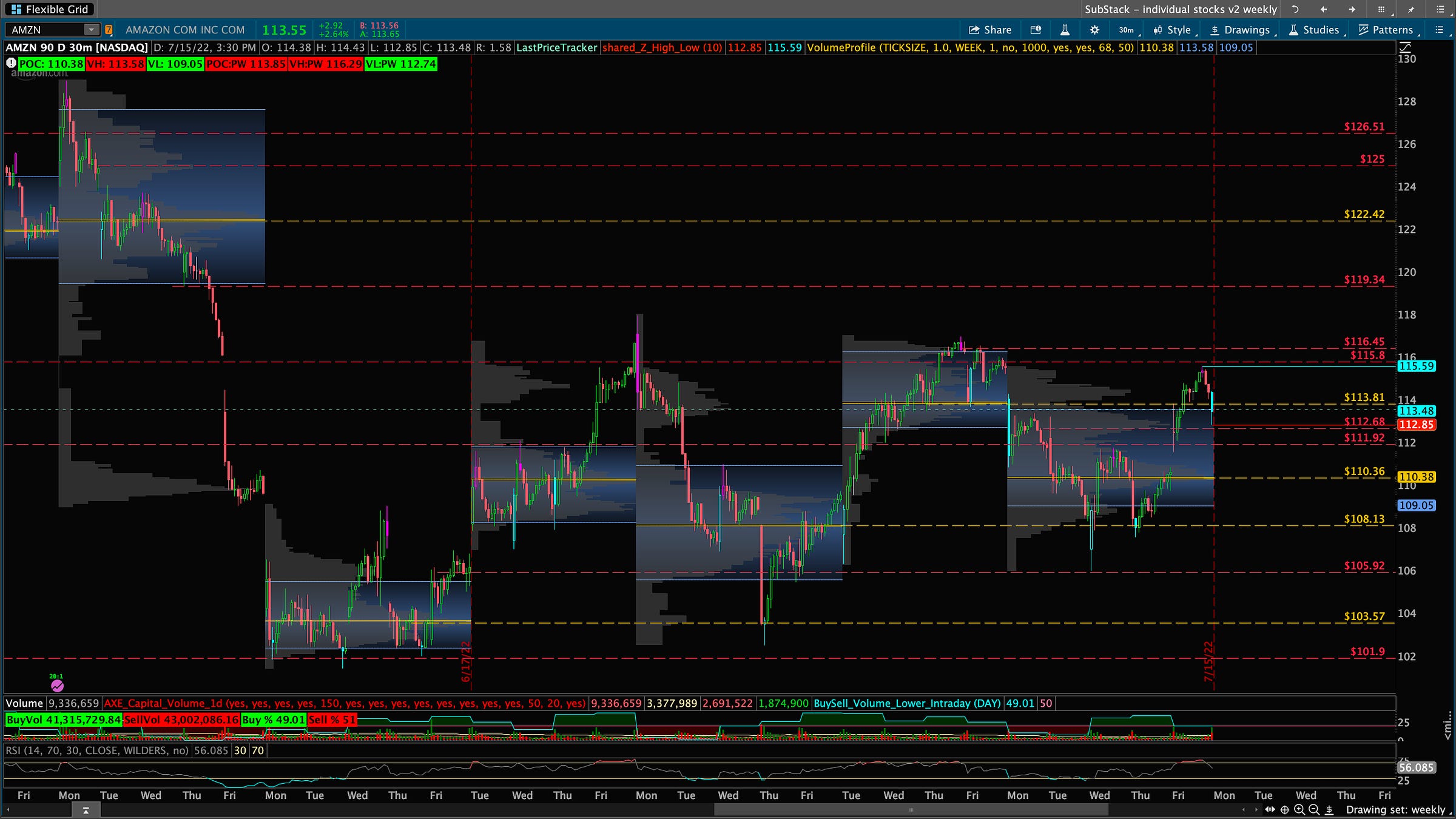

AMZN

Game Plan:

- Above Weekly POC - 110 - Need to get over 113.81 POC again for us to retest 115.8 - 116.45 zone. If can clear that we can possibly push up toward 119.34 then 122.42 vPOC.

- Below Weekly POC - 110 - Below 111.92 we will close the gap up we had and test last week 110.36 vPOC. If we go through it 108.13 will be exposed all the way down to 105.92 where we bounced hard to put in a double bottom.

POC: 109 / VH: 113 / VL: 109

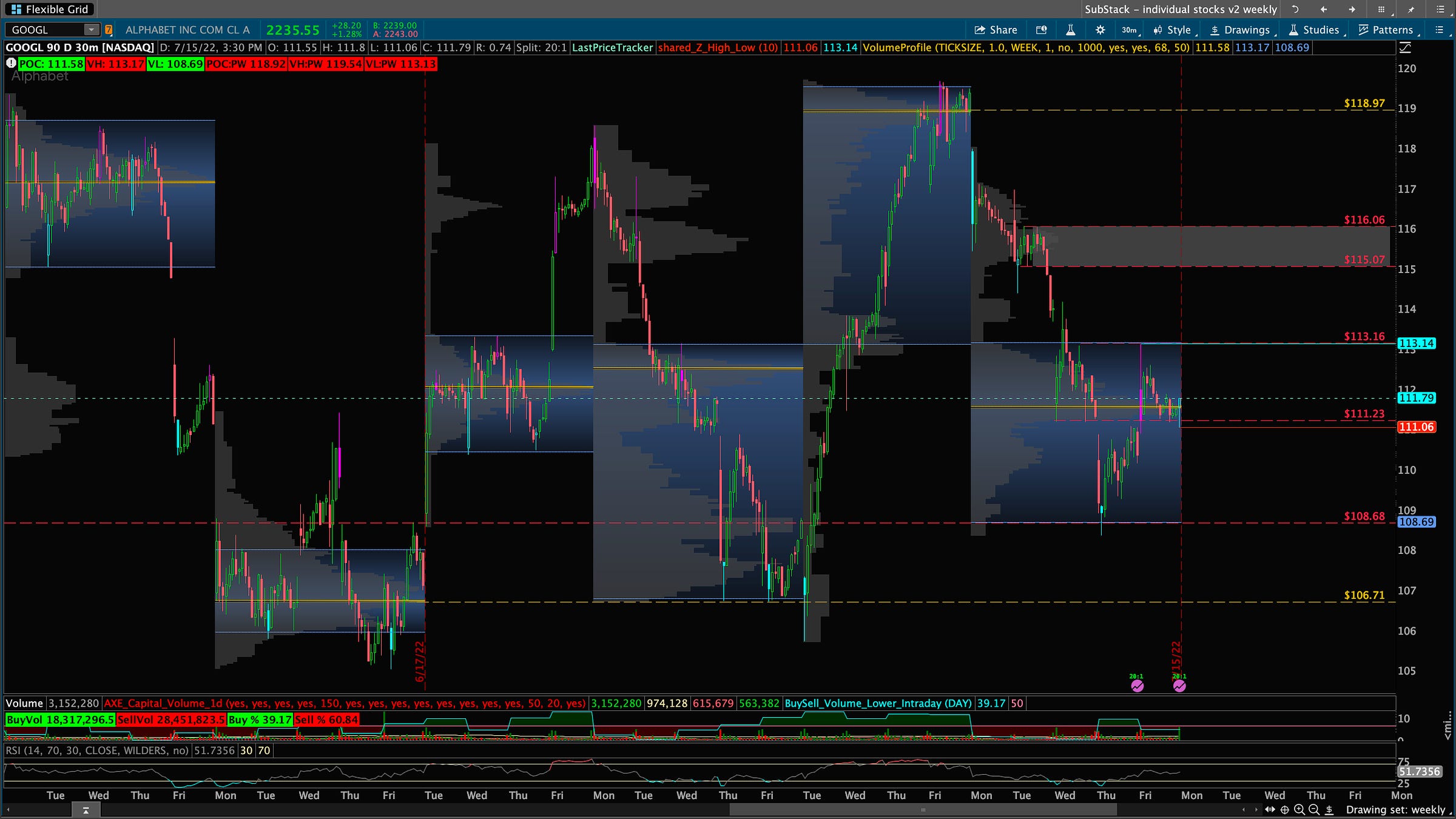

GOOGL

Game Plan: Stock split just happened will see how it trades but could end up like AMZN where premiums get killed so be careful.

- Above Weekly POC - 111 - Need to stay above 111.23 POC and for us to get over 113.16. Over that we can test 115.07 to 116.06 zone.

- Below Weekly POC - 111 - Below 111.23 we will see 108.68 where we bounced last Thursday off. From there if we can’t hold that zone we will head down to 106.22 where we bounced multiple times 2 weeks ago from where decent support is.

POC: 111 / VH: 113 / VL: 108

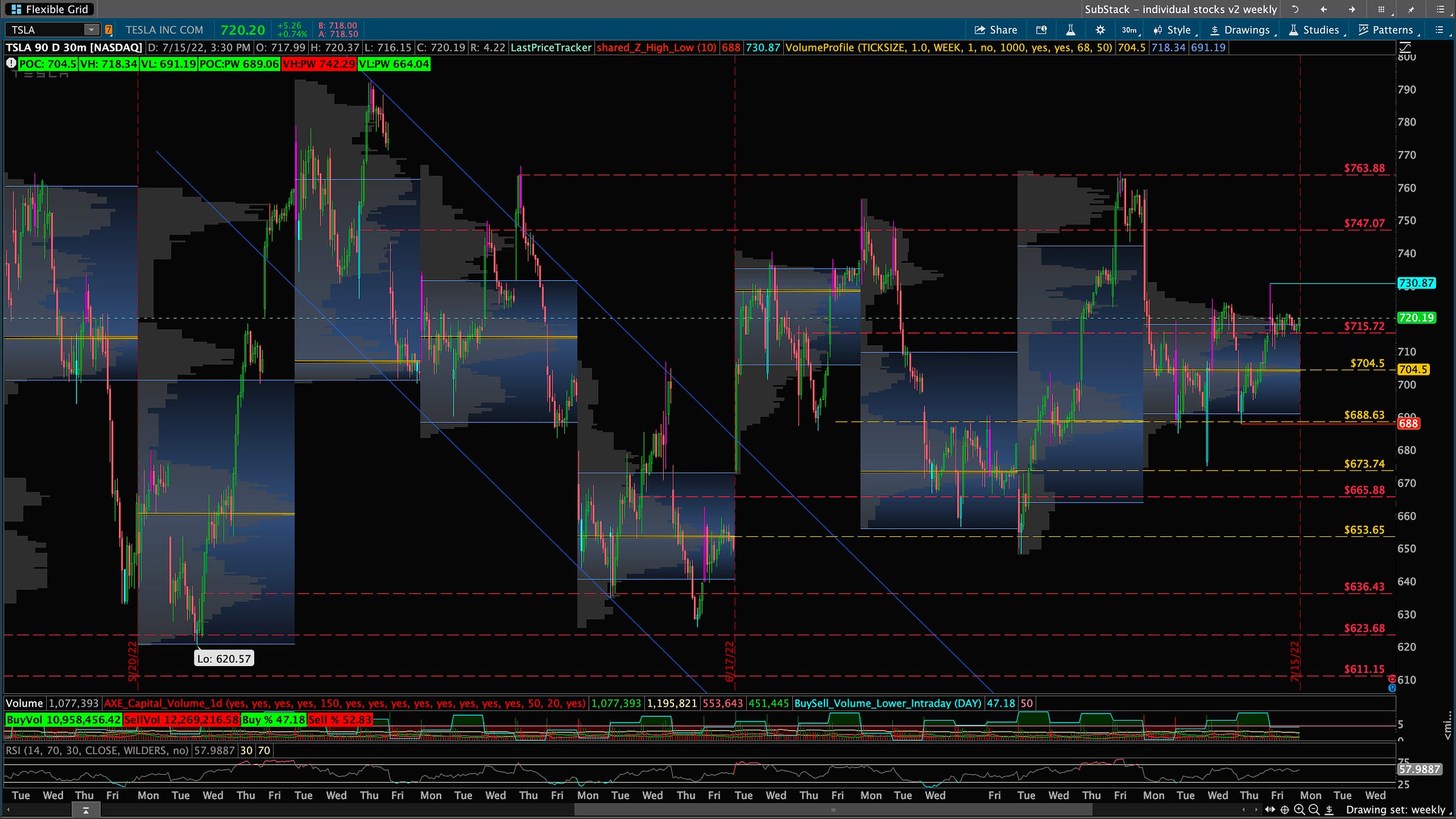

TSLA

Game Plan:

- Above Weekly POC - 704 - Need over to hold over 715.72. From there if we can clear 730 we will see an overshoot back to 747.07. Up here we have a nice zone between 747 - 763 that we could base out and possibly rip higher if we don’t reject one of the two levels.

- Below Weekly POC - 704 - Below 715.72 we test 704.5 last week POC then can make our way down to 673.74 that zone we bounced hard from however if we attack it again and if it fails, 665.88 could be light support. Below 653.65 we see 636 and 623.

POC: 704 / VH: 718 / VL: 691

Did you enjoy this SubStack?

If you want more detailed levels and game plan check out the Daily SubStack:

- Daily Levels for all 12 stocks

- User stock posts if you want a stock charted with levels, let’s talk about it and create a game plan

Live Streams with Q&A

To continue supporting my work I put into these blog posts you can subscribe to the monthly or annual plan!

Thank you for reading PHOENIX Capital Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.