Welcome to the Weekly Game Plan. We have an array of topics to delve into, so pour yourself a glass of wine, find a comfortable seat, and let's get started. Here are the sections we'll be covering:

Discord Will Remain Open and is optional to join. It is COMPLETELY FREE no hidden channels - https://discord.gg/hdGXnnNTZ6

Overal, I want to grow this blog to be the most viewed blog and provide value and quality to all! That is why there are numerous changes which we will go over below.

Sections Will Cover In This Blog Post:

1. Welcome Old/New Members

2. My Trading Style for Futures + Options

3. Trading Tips to Become Self Sufficient

4. 12 Charts + Levels/Zones

- /ES, /NQ, SPY, QQQ, VIX, AAPL, MSFT, AMD, NVDA, AMZN, GOOGL, TSLA

1) Reacquainting Ourselves

To our faithful readers, your continued support is deeply appreciated. To our newcomers, allow me to introduce myself, share my trading philosophy, and give you a glimpse into the structure of this blog. All Stripe subscriptions have been canceled, and everything has been made free. There are only 2 things that will remain as paid 1-on-1 mentorship, which involves over 20+ hours of my time and monthly levels I can share via Trading View Link. This will be released in coming weeks as structure of how I will share those levels/links will be determined later on.

2) My Trading Approach

Over the years, my trading journey has encompassed Options, OTC, Commons, and Futures, with a current focus on Futures. The path to proficiency was not without its trials. I spent arduous months facing losses, scouring YouTube for the elusive "Holy Grail" trading indicator, only to realize that price action truly reigns supreme. A well-planned strategy complemented by a self-drafted checklist of criteria lies at the heart of effective trading. If you don't spot a setup, refrain from forcing a trade.

My preferred trading window is the first hour after the market opening. I check again at lunch, and if no setups are apparent, I'll review once more during the last hour, the "power hour," only trading if there's a setup. For Futures, I seldom hold overnight, unless I have a particularly competitive entry near a top or bottom. Options trades typically have a 1-2 week timeframe, as buying time often pays off. If I'm swinging, I am comfortable with buying several months out if required.

While managing this blog single-handedly, juggling my web design agency, and setting up a new venture, your support and understanding have been instrumental. This journey has been varied and enlightening, molding the multifaceted community we have today.

Let me clarify that trading isn't my full-time job, but rather a calculated venture relying on strategic timing, acute focus, and informed intuition. I'm eager to share a few key trading principles that have been crucial in fostering a sustainable and efficient approach:

3) IMPORTANT Trading Tips To Be Self-Sufficient

- Minimalistic Engagement: There's no need to be glued to the markets all day. A focused glance in the morning and an hour before the closing bell usually suffices. This helps prevent overtrading and retains your hard-earned gains.

- Discipline Over Impulse: The presence of a viable setup is a prerequisite for any trade. If there's no apparent setup, it's perfectly fine to step back and reassess the next day. Have a checklist of what criteria you look for before you enter the trade.

- The Power of Less: Fewer screens equate to fewer distractions. Over-analysis often leads to self-doubt and can potentially disrupt a sound trade. Simplifying your setup can lead to more clear-headed decisions.

- Trust Your Instincts, Not Social Media: Relying on others' opinions, especially through platforms like Twitter, often leads to a lack of confidence in your own decisions. Either you'll end up missing a good trade, or you'll follow someone else's advice only for the trade to go sideways. Reserving social media strictly for news during trading hours can help hone your personal judgment.

- Patience: Remember that trading is not a get-rich-quick scheme. It takes time, patience, and persistence to become proficient and successful. So, stay patient and enjoy the journey.

🚨__ALL DISCORD Rooms Are Open - NO PAID Channels 🚨

“Remember, the market transfers money from the impatient to the patient!”

4) 12 Stocks We Will Review

After a lot of feedback from our old members, I decided to change the style of the blog for the week. After the week is up I will send a survey out to see if everyone likes the new style and if it should be continued.

In the following charts, I simplified. Here is a table of contents. Support/Pivot/Resistance areas are highlighted, and Levels are in purple.

12 Charts + Levels/Zones Below

- /ES, /NQ, SPY, QQQ, VIX, AAPL, MSFT, AMD, NVDA, AMZN, GOOGL, TSLA

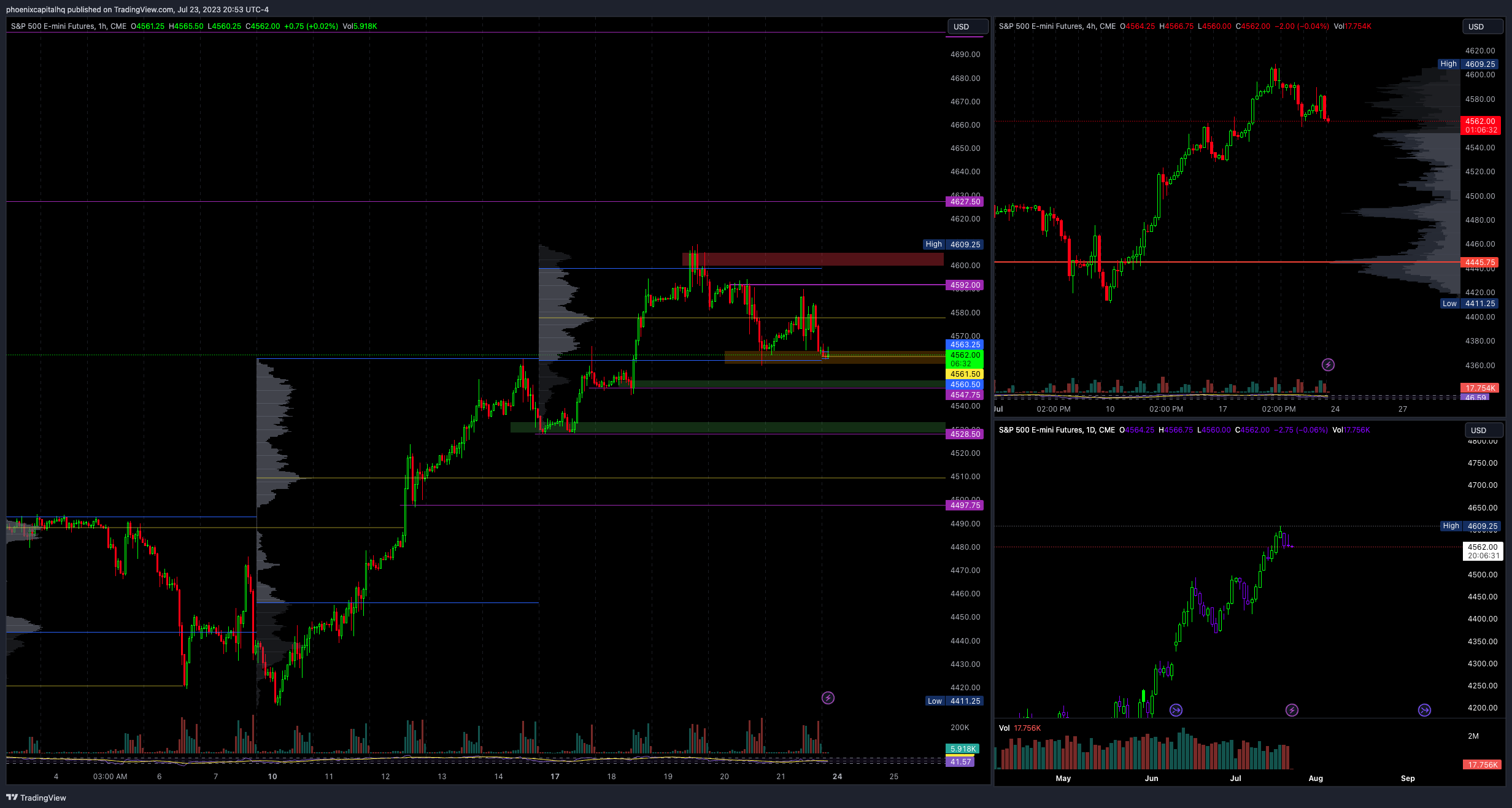

/ES

POC: 4577 / VH: 4599 / VL: 4560

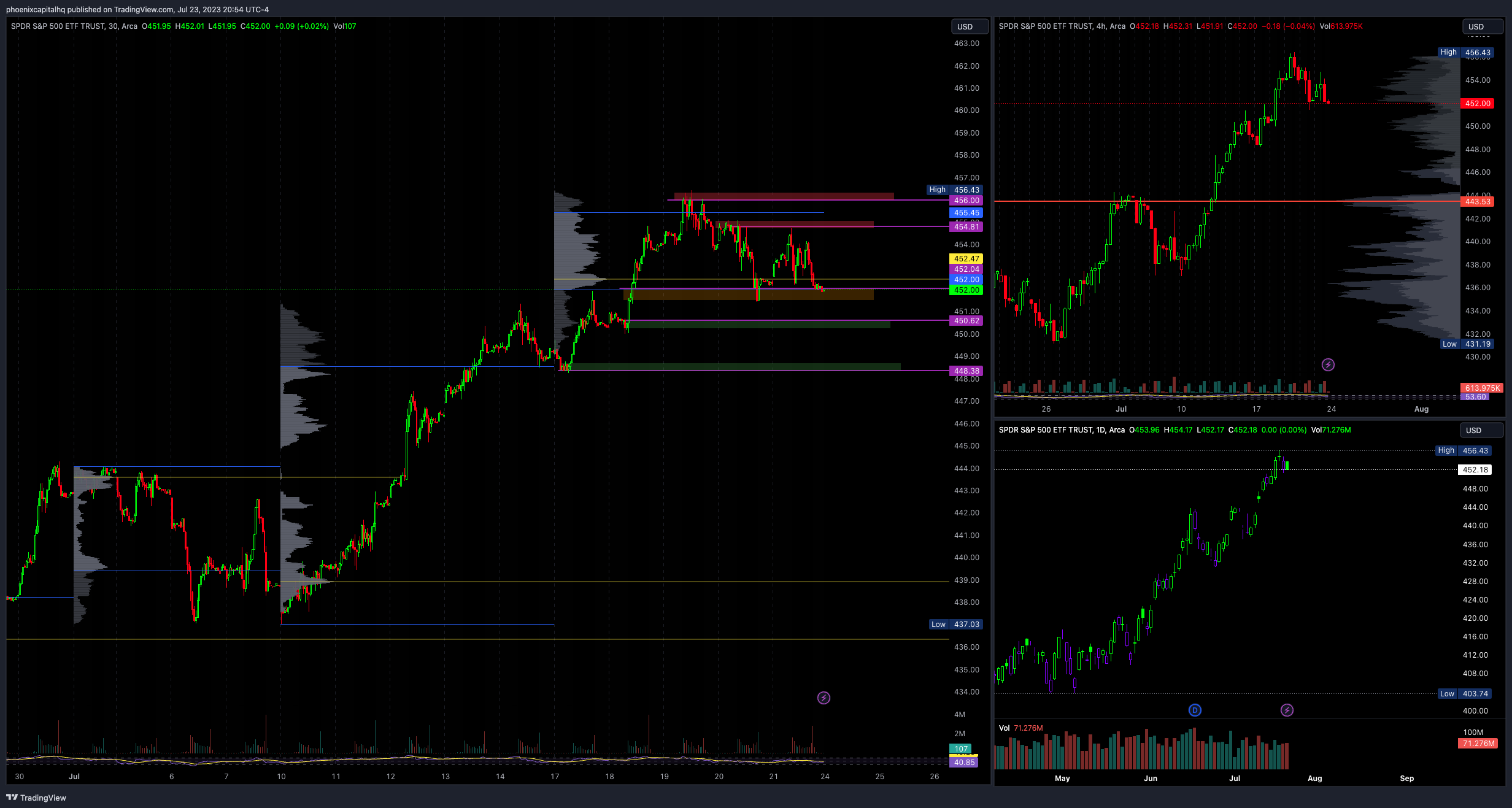

SPY

POC: 452.47 / VH: 455.45 / VL: 452.00

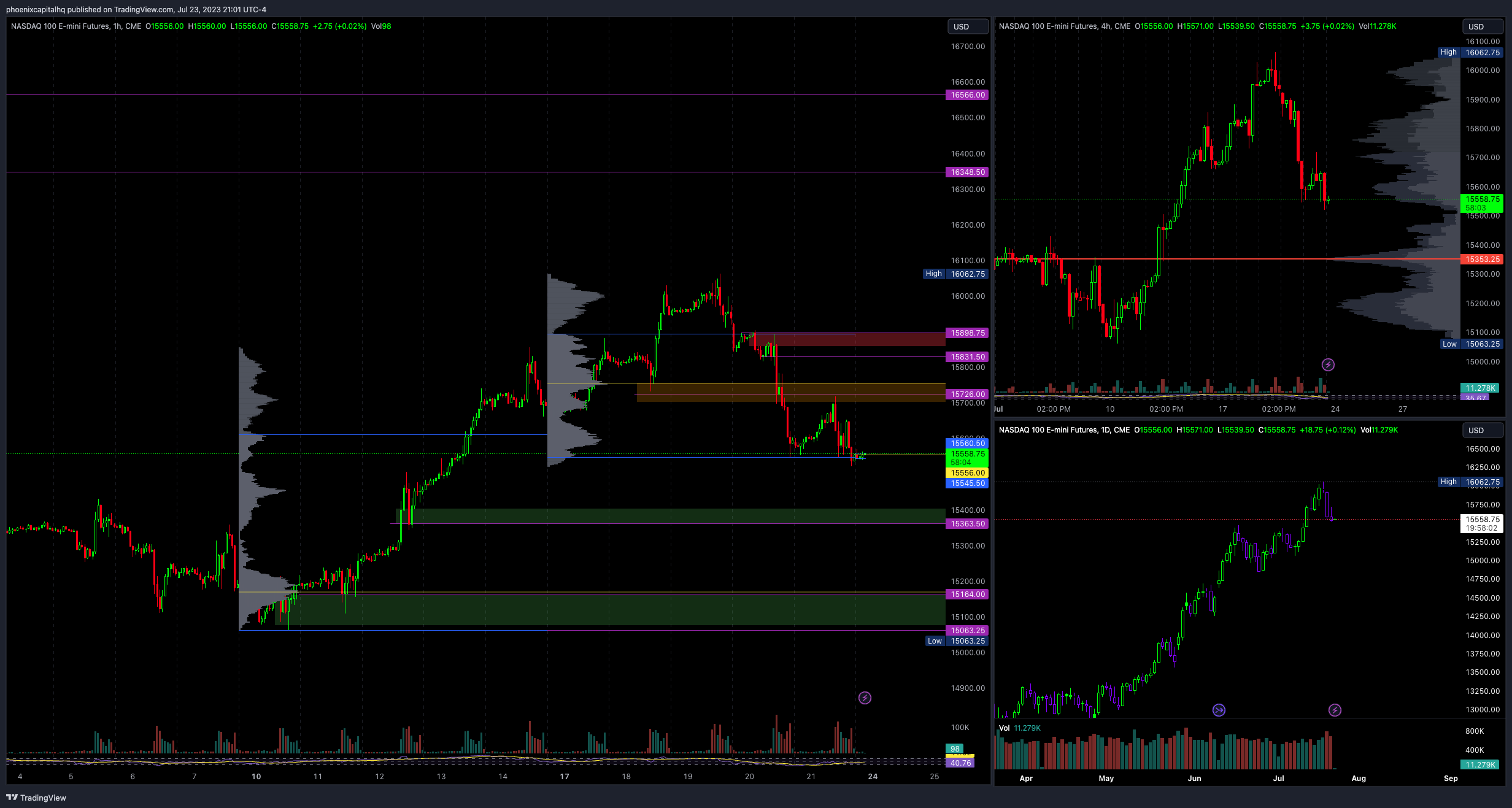

/NQ

POC: 15892 / VH: 15758 / VL: 15547

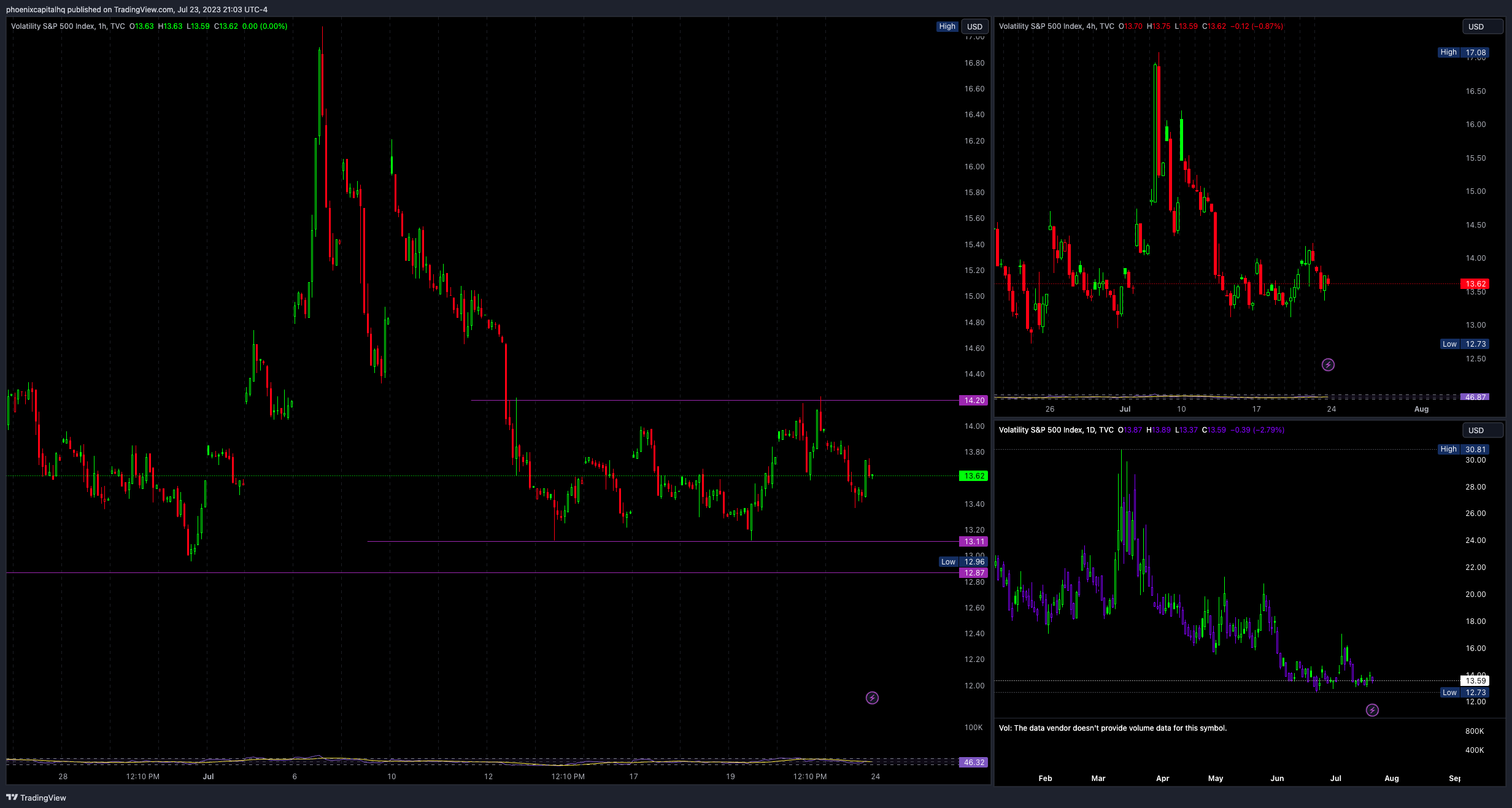

VIX

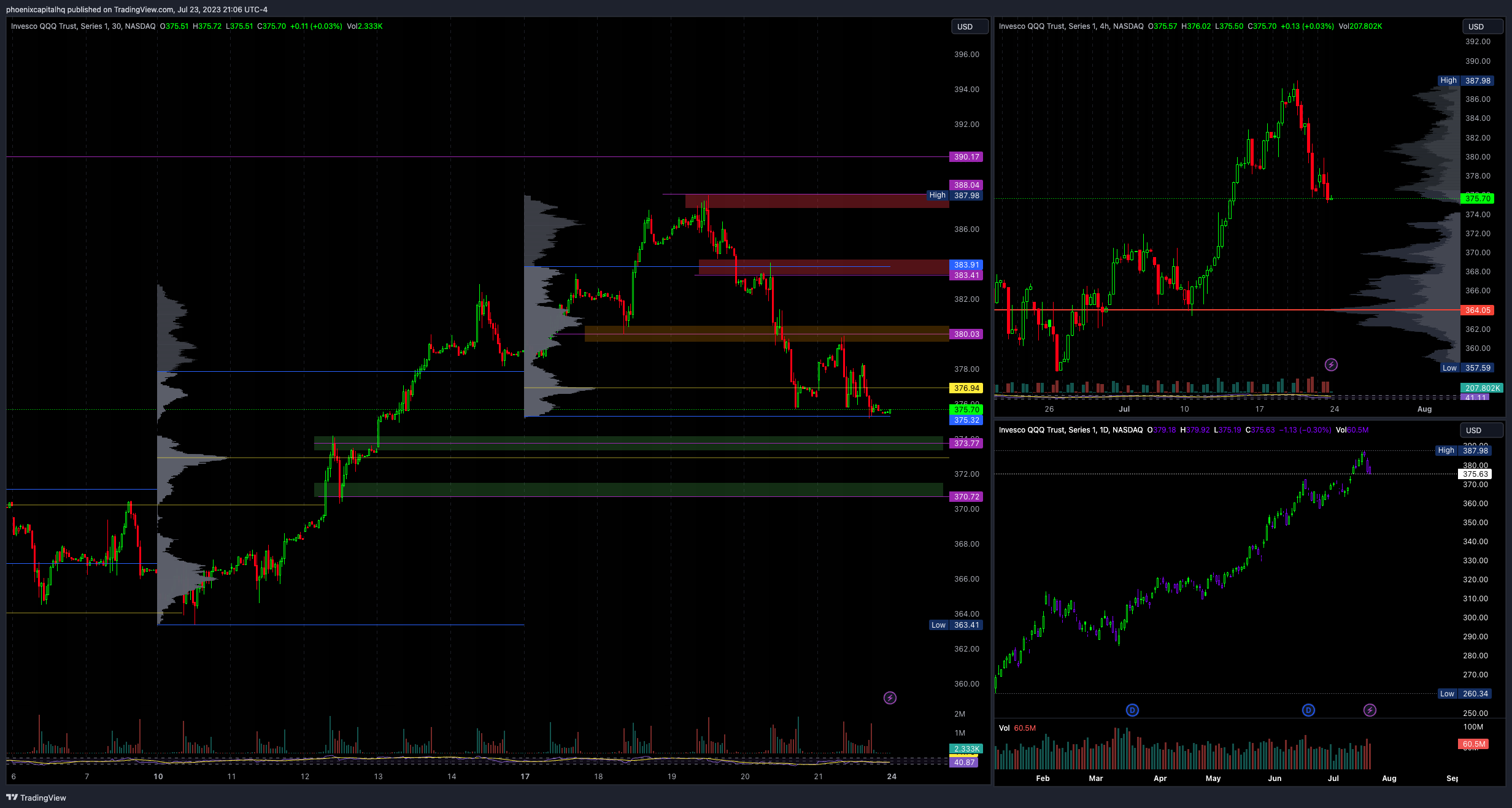

QQQ

POC: 376.94 / VH: 383.91 / VL: 375.32

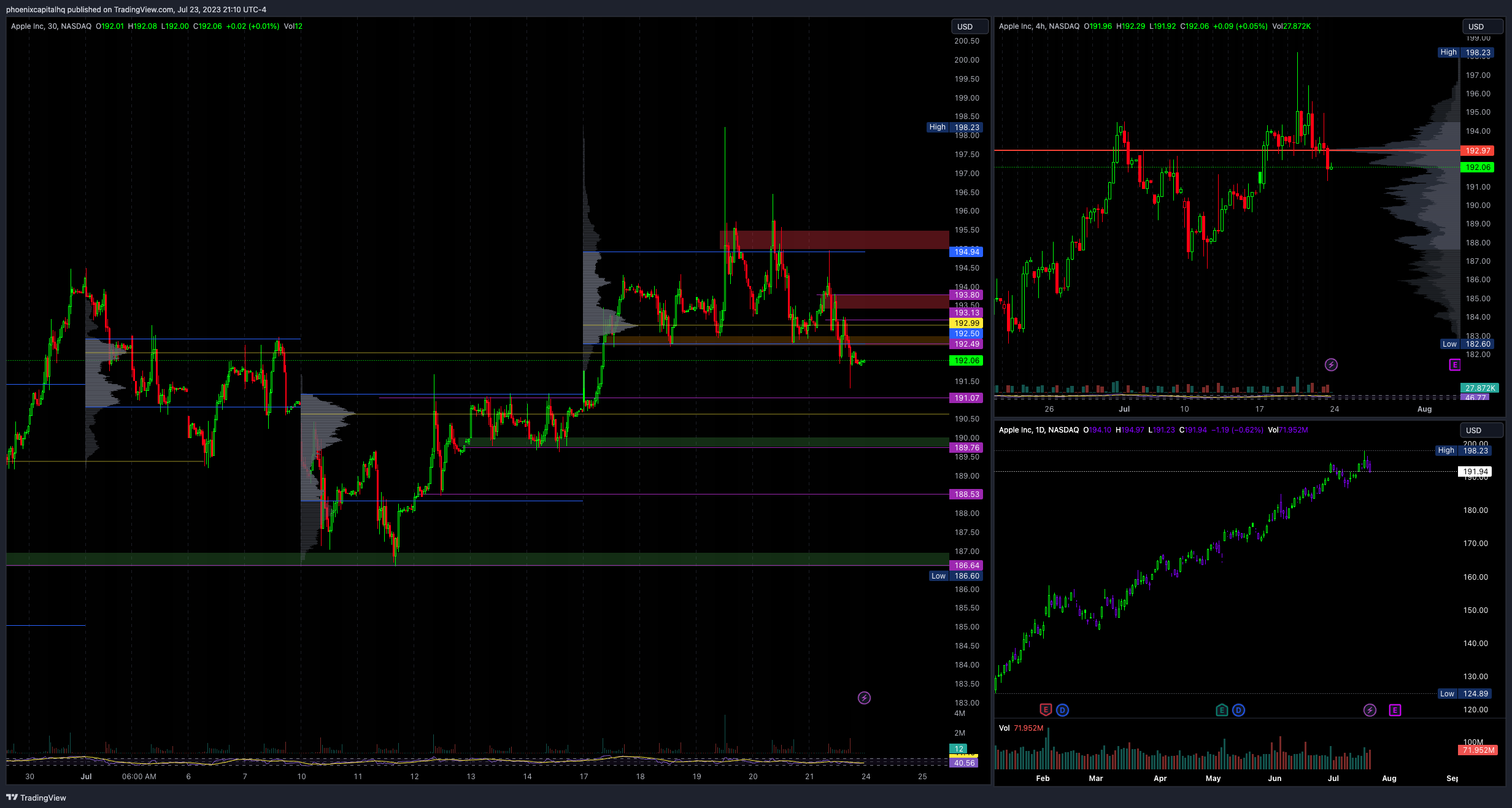

AAPL

POC: 192.99 / VH: 194.94 / VL: 192.50

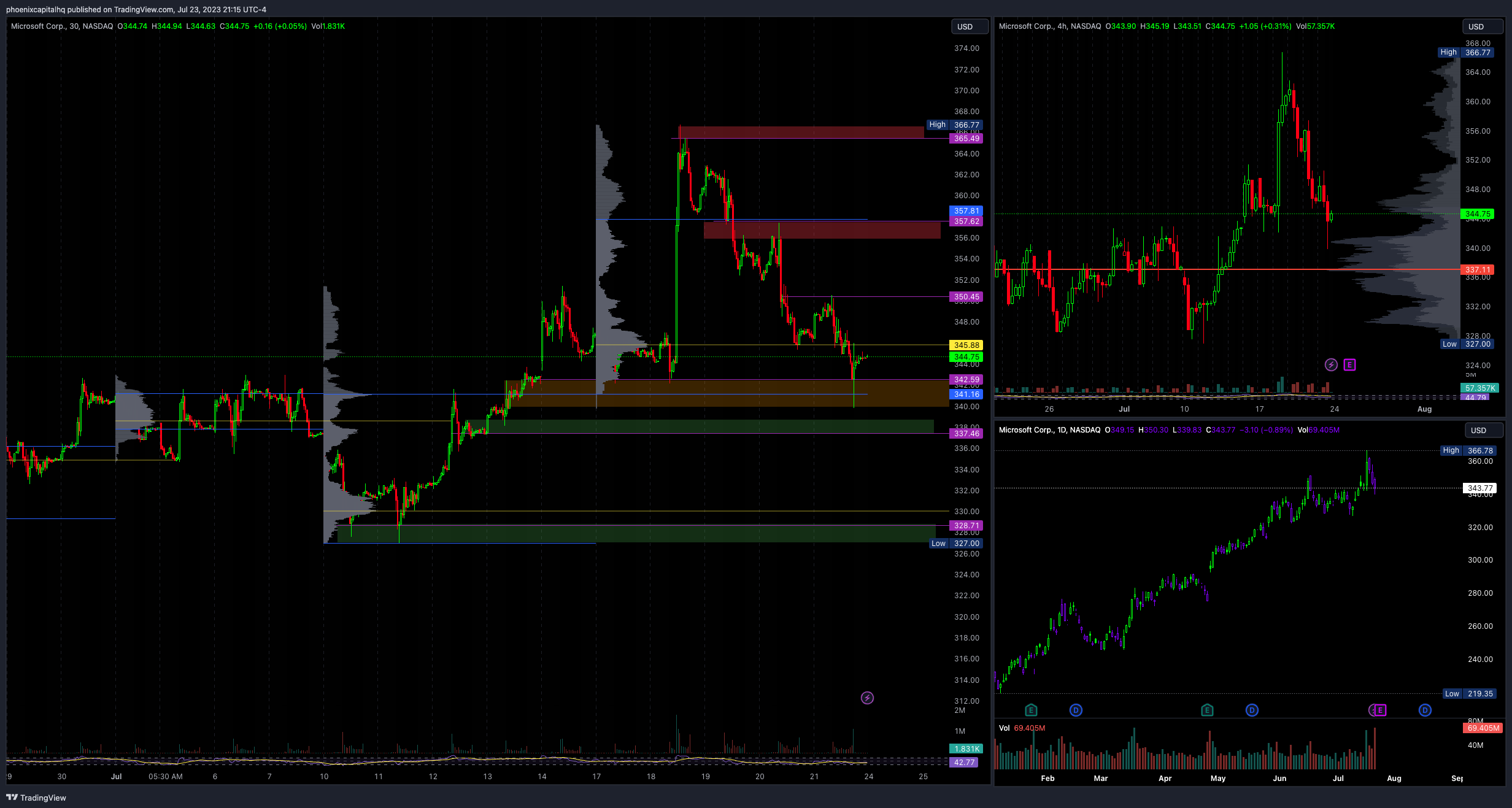

MSFT

POC: 345.88 / VH: 357.81 / VL: 341.16

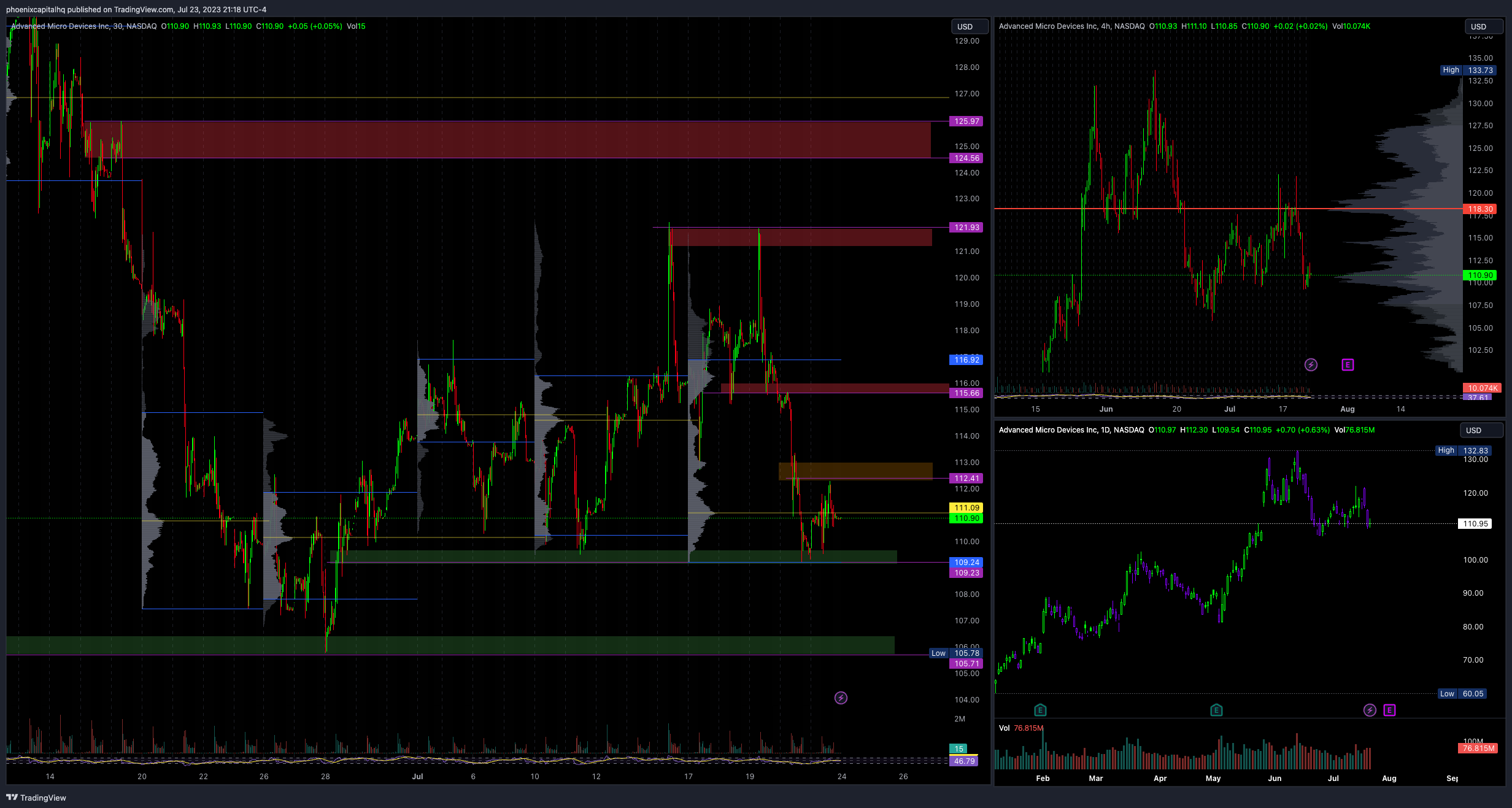

AMD

POC: 376.94 / VH: 383.91 / VL: 375.32

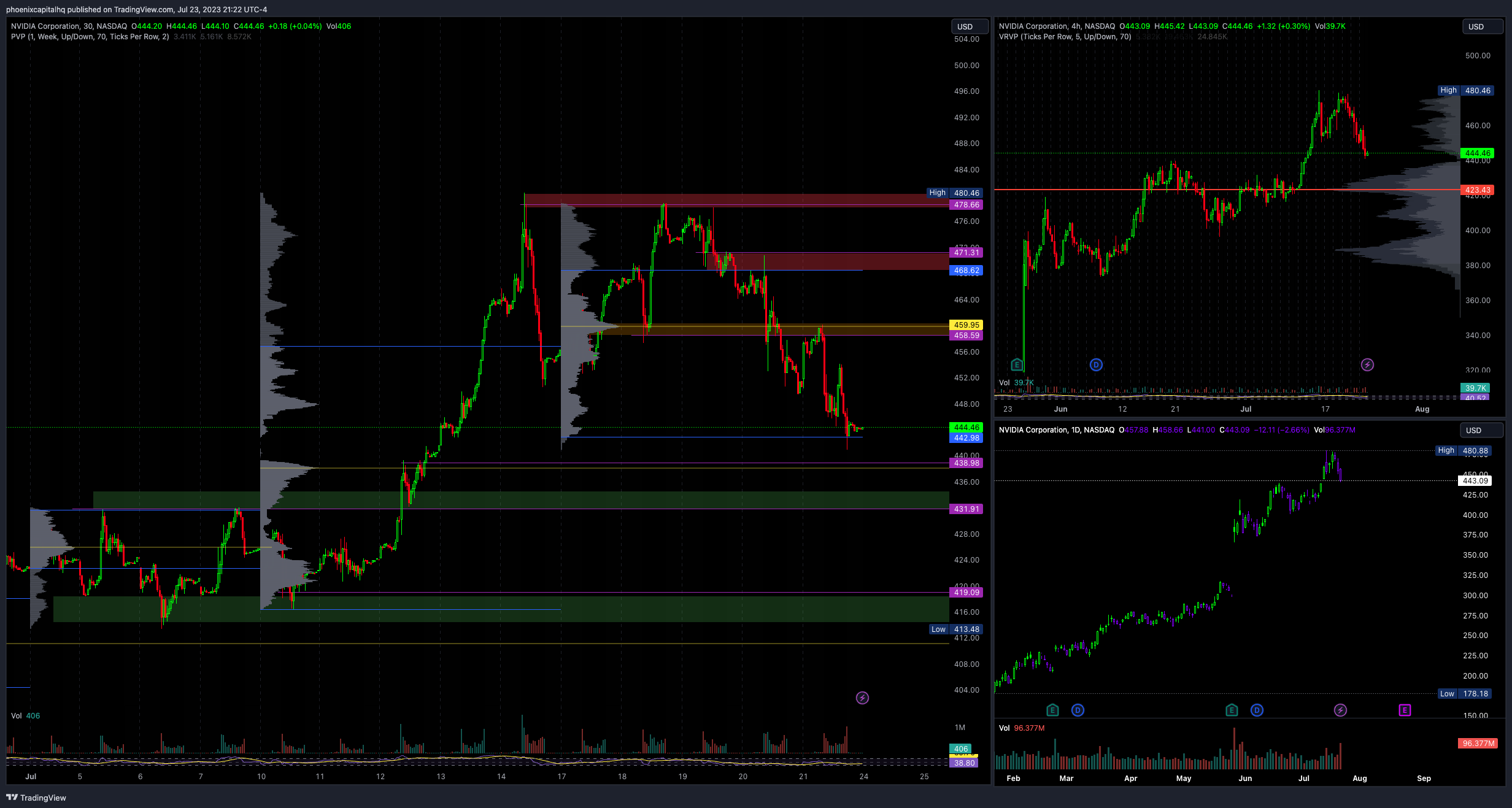

NVDA

POC: 459.95 / VH: 468.62 / VL: 442.98

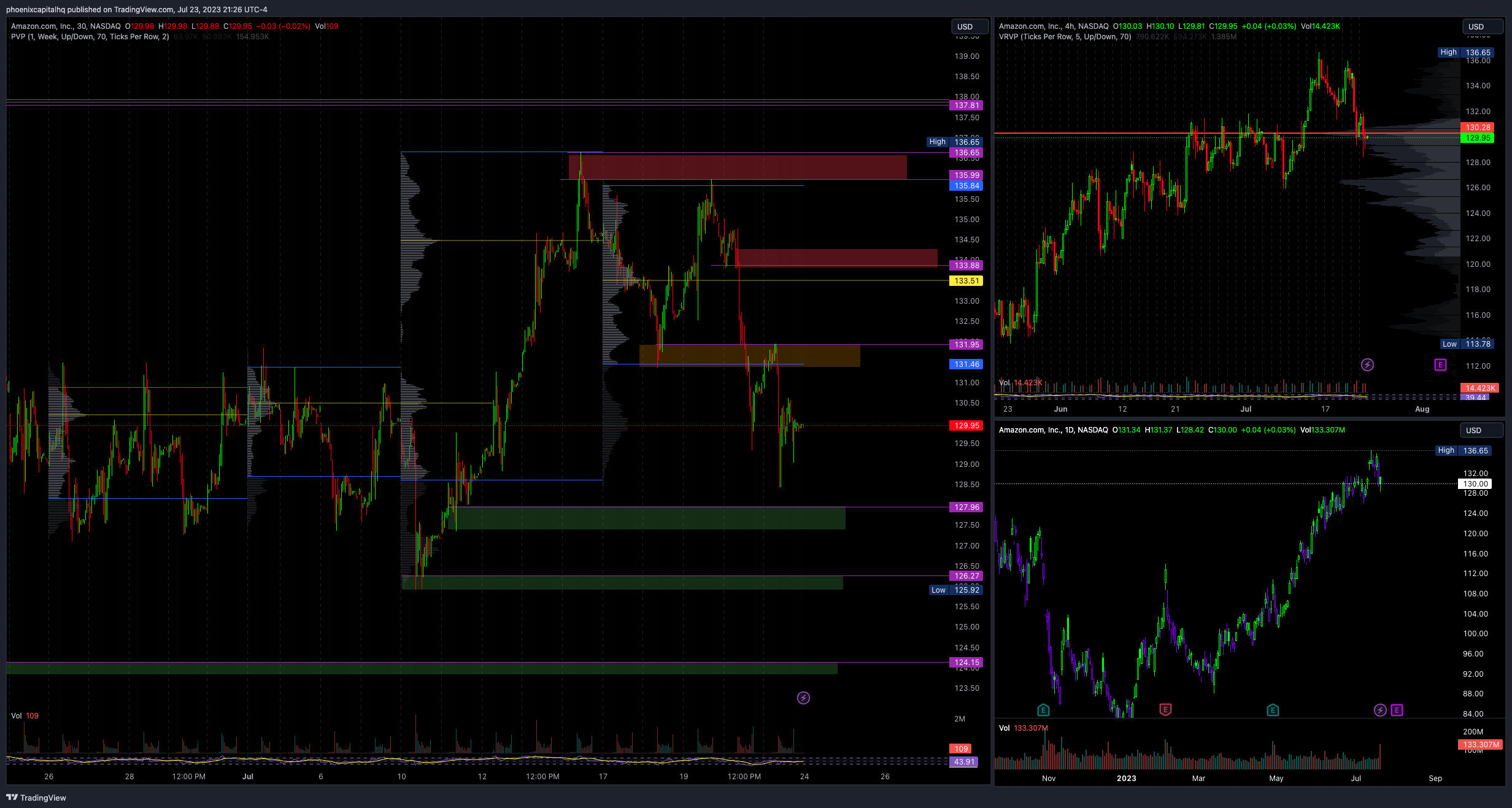

AMZN

POC: 133.51 / VH: 135.84 / VL: 131.95

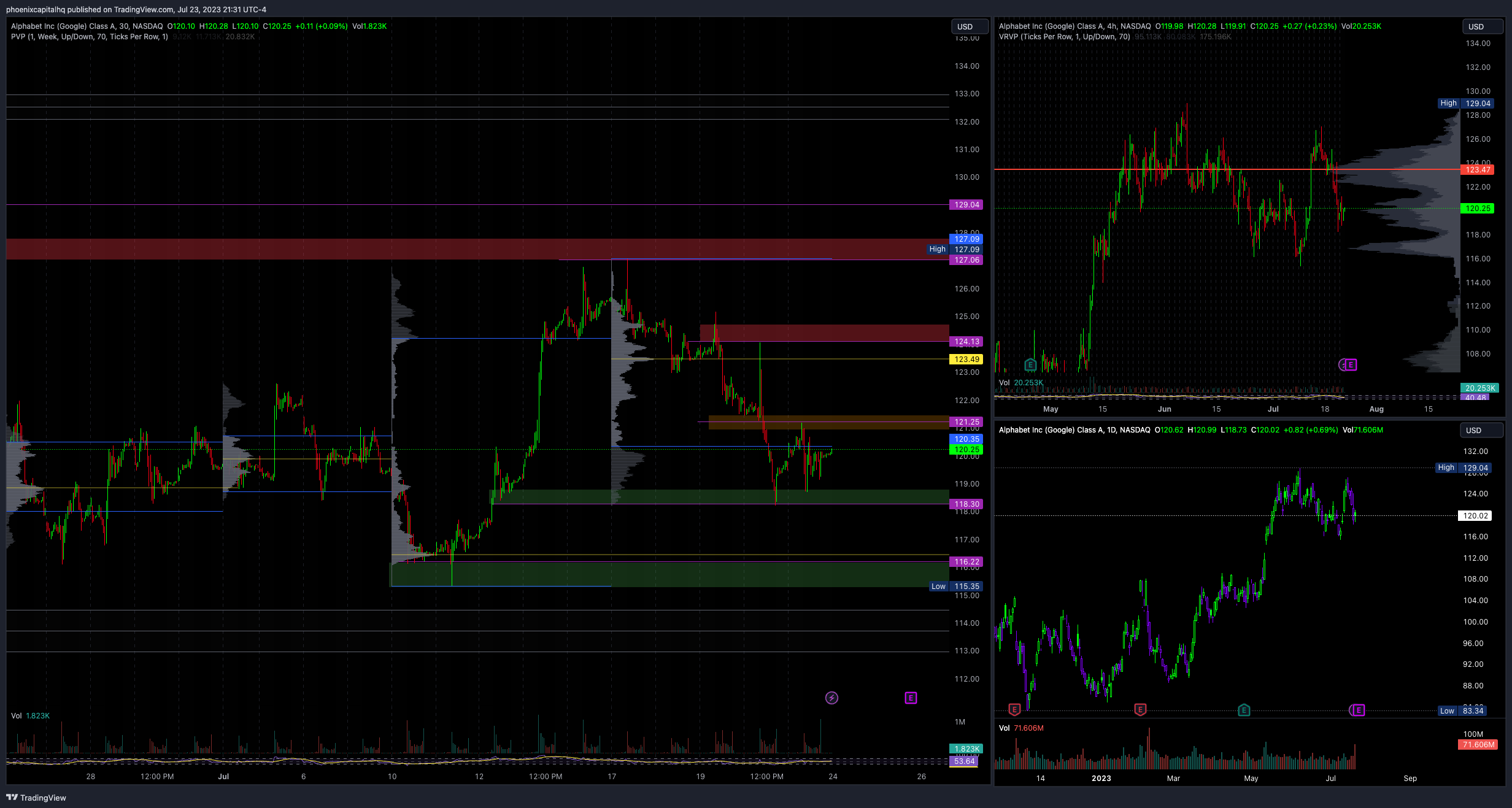

GOOGL

POC: 123.49 / VH: 127.09 / VL: 120.35

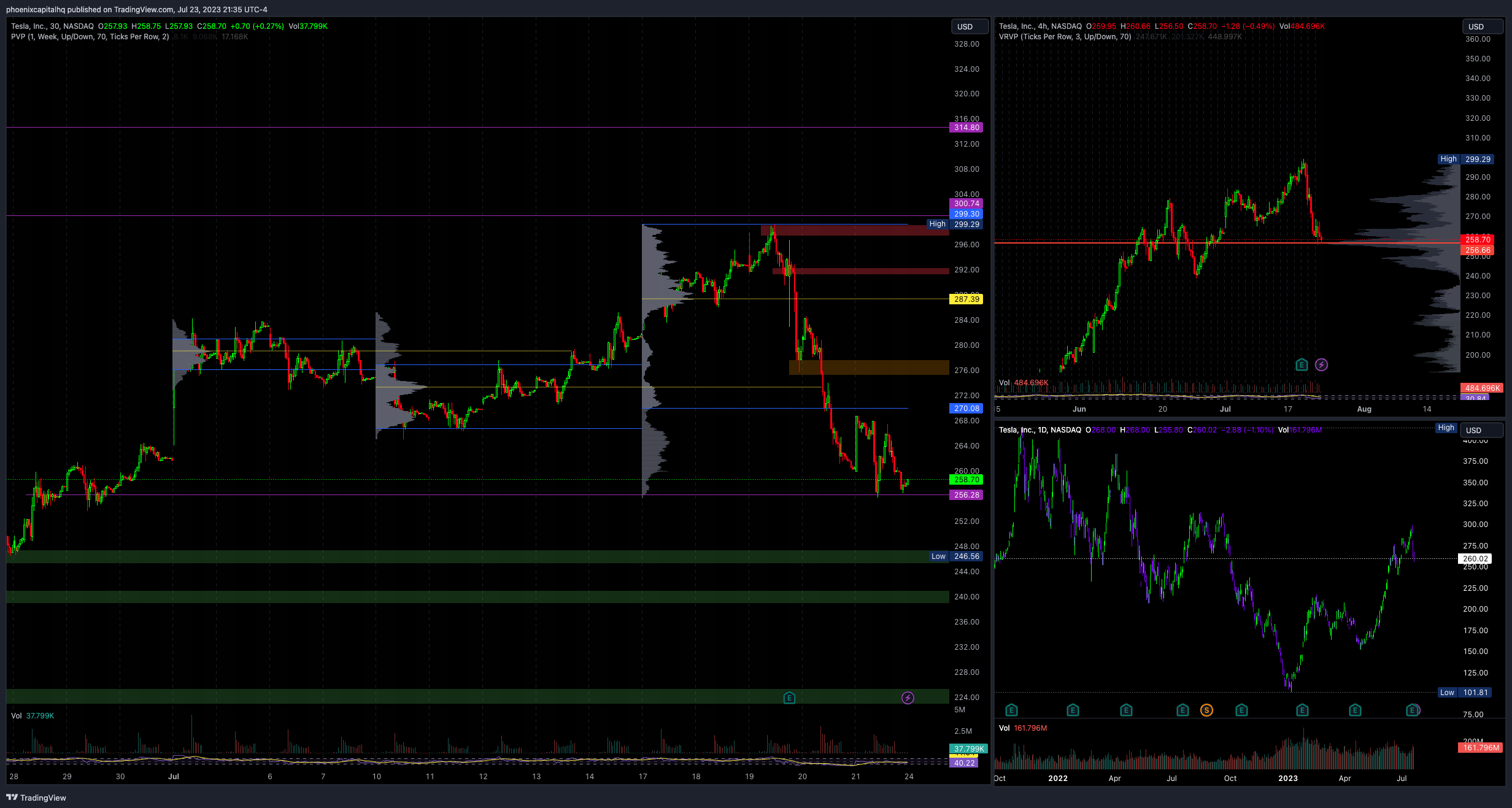

TSLA

POC: 287.39 / VH: 299.30 / VL: 270.08

Thank you for reading PHOENIX Capital Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work