Exciting Updates!

We have moved over to Discord, thank you as we have over 100+ that moved over already! This is very exciting and as a growing community we need a new home. A home that has more flexibility to scale and manage everything!

Discord has:

- Option Flow Bot built in

- Volume Profile Guides

- Live Streams high quality

- Earnings / News bot flow

- Think or Swim MY Studies

- +more coming soon

Once in, you will be in the VERIFY Channel, to unlock and view everything.

- Make sure you verify your email

- Click the “GREEN CHECK MARK”

VIP From Telegram - How To Join!

You will see a channel #VIP_from_telegram just click that and answer the 2 questions in the form so I can verify your email and ID and get you in!

I will have you ALL ADDED BY TONIGHT

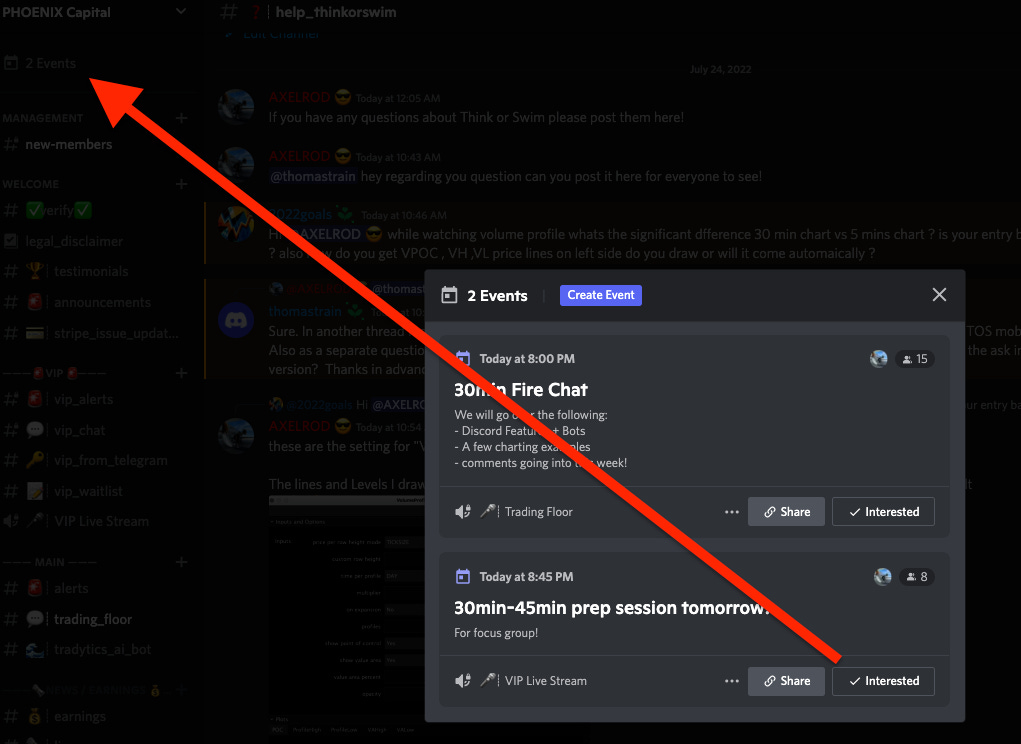

LIVE STREAM TONIGHT

We will do our first live stream tonight!

Click “EVENTS” top left to see all events and click interested, you can even add it to your calendar!

Thoughts on /ES /CL /BTC🤔

/ES

Look at 2 PURPLE Candles before Friday, we traded in a very tight range and then sold off hard. We could becoming to a pivot very soon and right around 4200 if we get there before FOMC we could see a sell off then. This week I expect to be very volatile with FOMC. You can read the full agenda as I check this site every morning - https://www.forexfactory.com/calendar?week=this

If we get over 4008 we could possibly see 4093 vPOC tested and a push to the 4165/4180 range again where there will be some resistance. Back below 3834 we could see downside to 3807 then eventually to 3743 where we bounced. It is a strong zone but could be possibly taken out to expose 3679 vPOC.

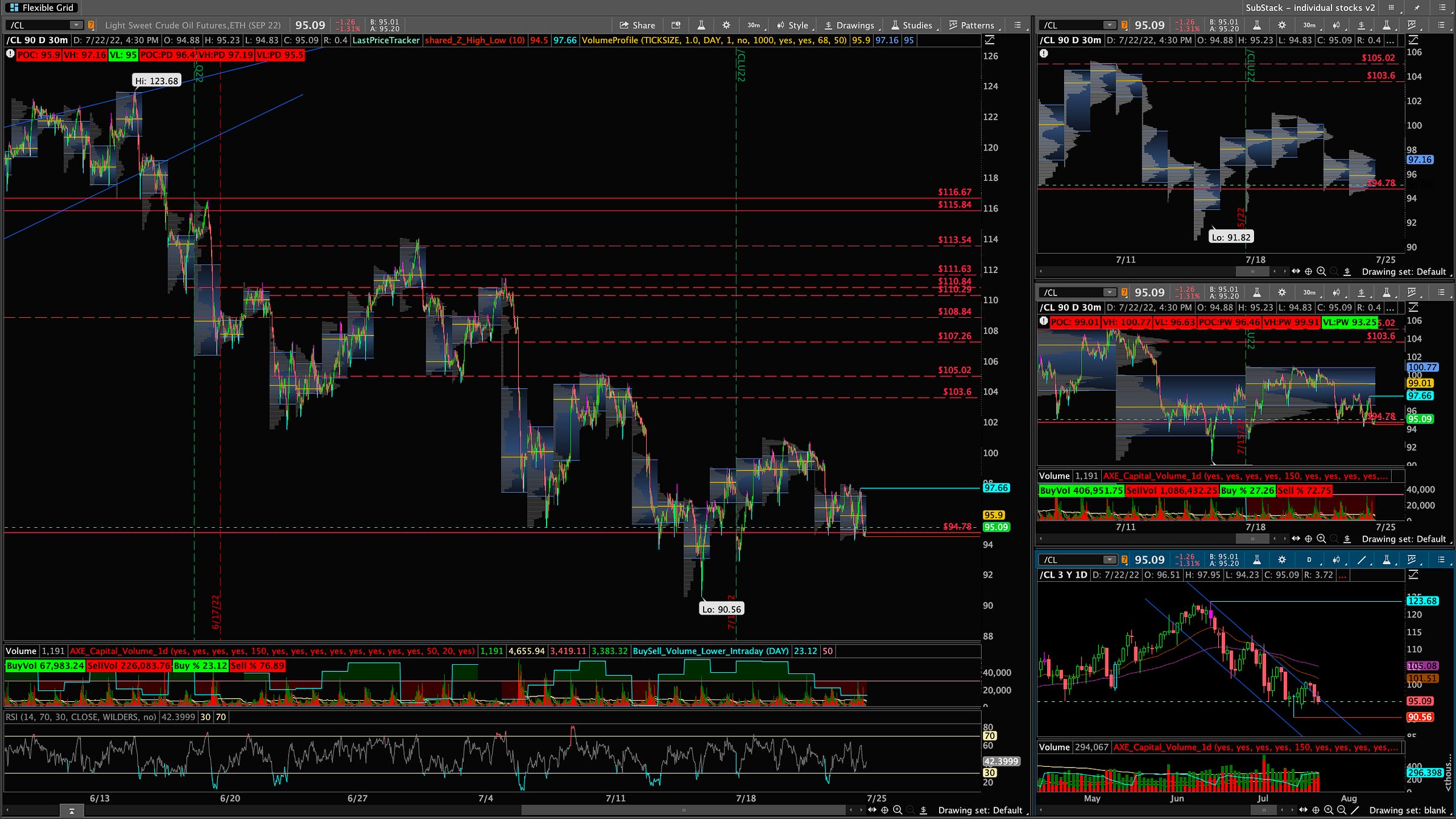

/CL

Oil has a strong support above my 94.78 line. If we can push back over 103.6 vPOC we will see 105.02. However, that is were we rejected and have had that level noted for quite some time. So keep an eye on that because over that 107.26 we will see and higher. We are currently in a channel down see bottom right daily pic, If we break out of this to the upside we will se that run back to 110 possibly and higher.

/BTC

Overall had a solid week as I posted the falling wedge and we had a pop to the upside! We didn’t quite rally as hard to fill the gap and still below the 50ema on the daily chart. From here I expect we slide down and back test the trend line around 20000/1900 zone. However, if we give up 19000 zone again and break 18525 we will see 16480 and 12750 are my targets eventually.

Want To Learn Volume Profile?

🐦 BIRD’S EYE VIEW

Stocks We Will Be Reviewing

- FUTURES - /ES & /NQ

- ETFs - QQQ (tech) & IWM (small caps)

- VIX - Volatility Index

- STOCKS - AAPL / MSFT / AMD / NVDA / AMZN / GOOGL / TSLA

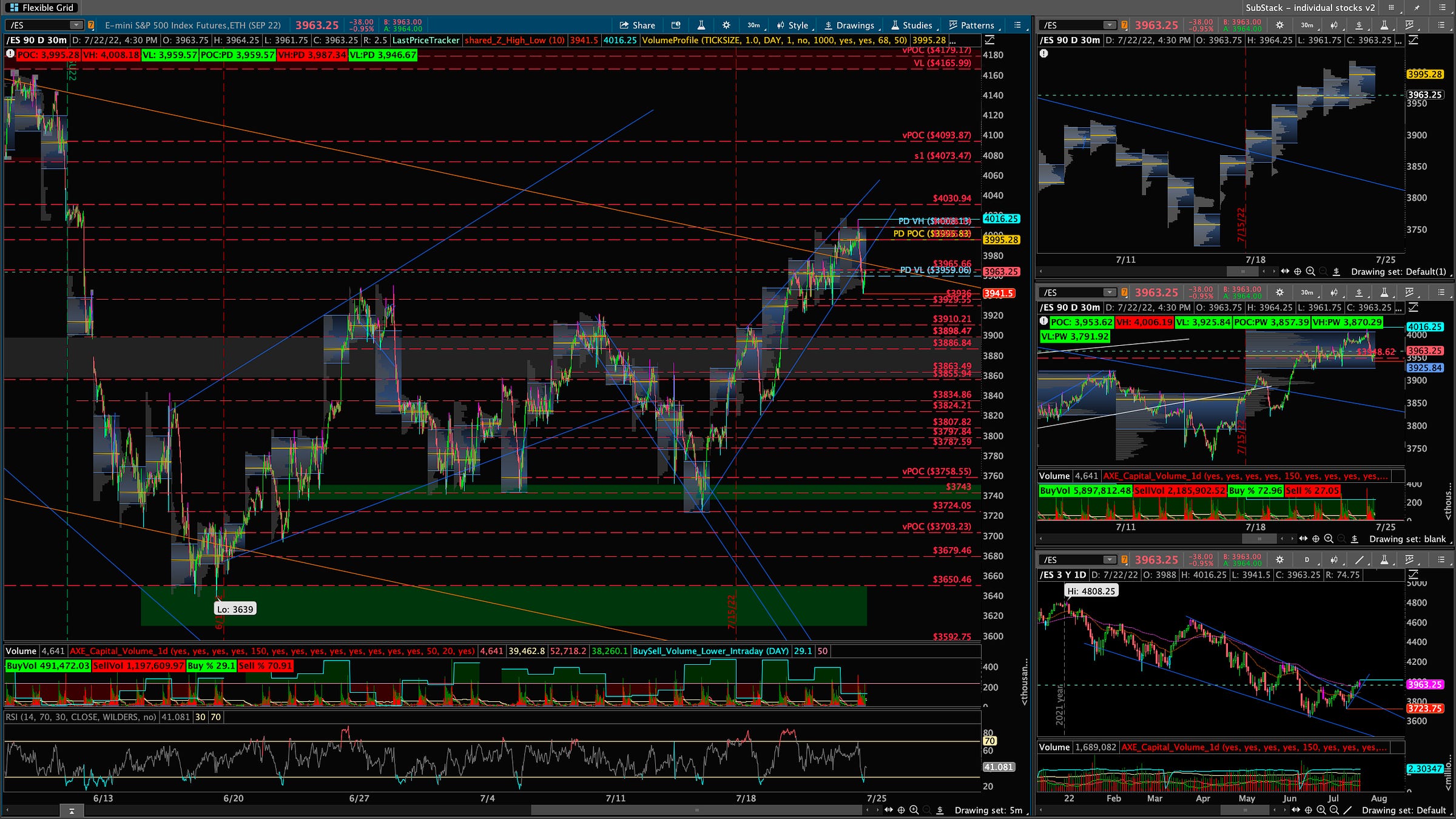

/ES

Game Plan: Really need over 40008 for any upside and a base over 4030 if we are going to see 4093 vPOC tested. Otherwise, we could just start our next leg down here. FOMC this week so will take it light as I expect it to be volatile!

- OPEN Above POC - 3995 - Need over 3965 for a pop possibly, since we are way below POC. We need back over 3995 for us to see 4008 retest. a break and hold will be key for us to see 4030 then 4093 vPOC.

Upside Levels: 3863 > 3886 > 3899 > 3914 > 3934 > 3950 > 3965 > 4029 > 4045 > 4073 > 4093 > 4165 - OPEN Below POC - 3995 - Below 3936 we will slide down and retest 3929 which provided decent support so far. Once that breaks we ca see 3910 to 3886 chop zone. If all fails we will see 3863 then 3854.

Further Downside Levels. 3834 > 3824 > 3807 > 3797 > 3758 > 3743 > 3724 > 3703 > 3679 > 3660 > 3639 > 3592.25 > 3423.25 > 3396.5 > 3227.5

POC: 3995 / VH: 4008 / VL: 3959

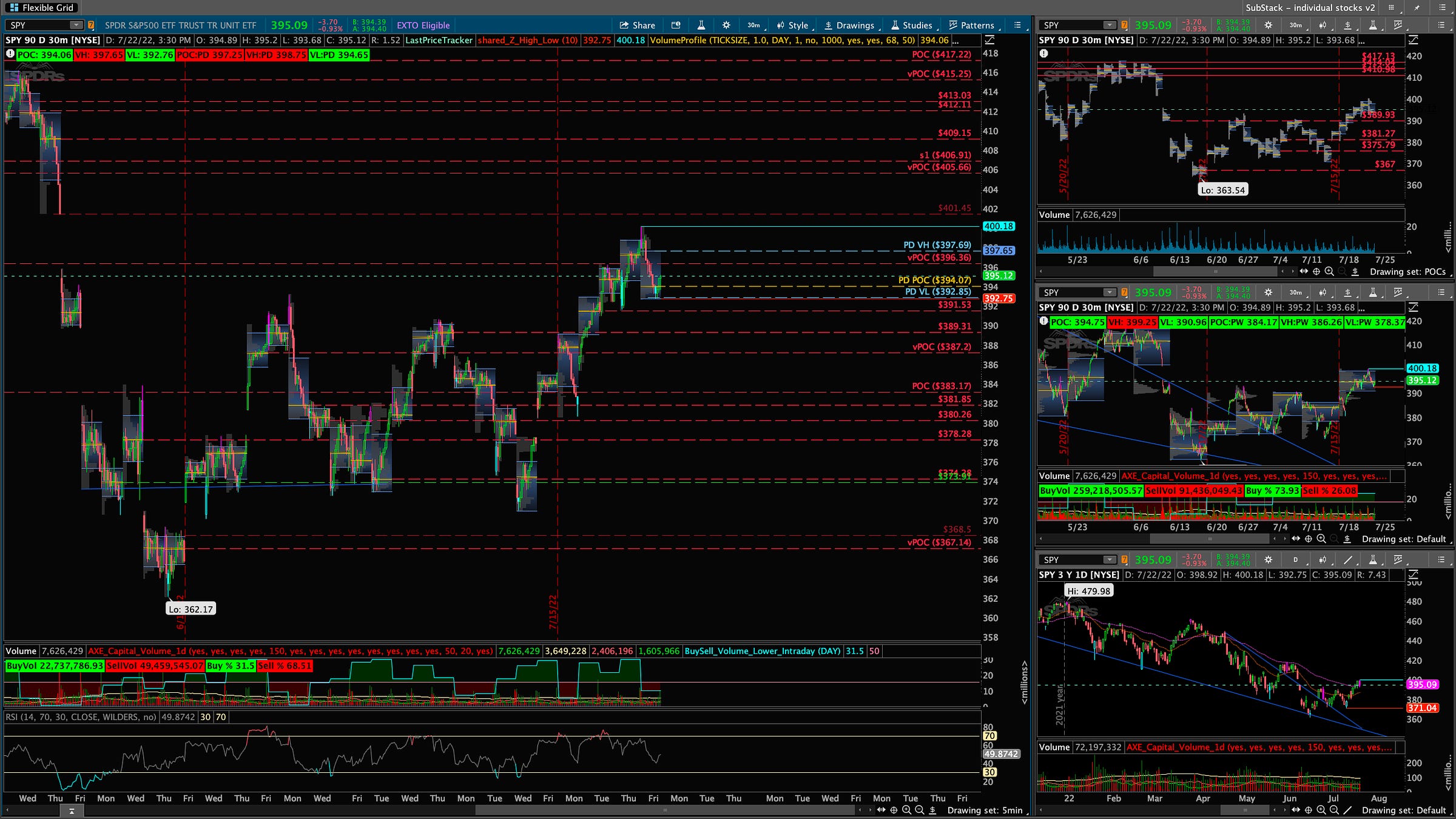

SPY

Game Plan: Need over 401.45 to fill the gap. From there we could get one more push to 409.15 vPOC. If not we will see the gap to the downside around 378 filled eventually.

- OPEN Above POC - 394 - Over 396.36 we could see upside to 400 zone again. Need to close the gap at 401.45 from there we can see 405.66 if we push then possibly 409.15 vPOC. Levels: 381.85 > 383.17 > 383.89 > 387.2 > 392.2 > 390.12 > 391.34 > 396.36 > 401.45 > 405.66 > 409.15 > 412.11

OPEN Below POC - 394 - Below 391.53 we will see 389.31 > 387.2 where possibly support may be found short term. If that fails we will 383.17 POC tested again for support. If all fails we will see 380.26 and if we give up 380 we will go for the gap fill and test 374.28 vPOC.

Further Downside Levels. 371.04 > 368.5 > 367.4 > 365.18 > 362.17

POC: 394 / VH: 397 / VL: 392

/NQ

Game Plan:

- OPEN Above POC 12430 - Need over 125222 for us to see close to that 12700 zone again. If so we can test 12727 then 12880 where we may run into resistance again.

Further Upside Levels: 11847 > 11973 > 12045 > 12514 > 12227 > 12295 > 12407 > 12473 - OPEN Below POC - 12430 - Below 12344 we can slide down to 12240. If that breaks we will likely see 12045 and 11973 zone. 11897 where we bounce could be support short term. If that fails we will see 11742 and lower. 11966 we see 11897 then 11847. If all fails 11742 then 11667 vPOC could be exposed. 11641 we see 11483 then 11373.

Further Downside Levels: 11742 > 11667 > 11641 > 11483 > 11434 > 11373 > 11288 > 11267 > 11174 > 11061 > 10937 > 10660 > 10304 > 10171

POC: 12430 / VH: 12573 / VL: 12342

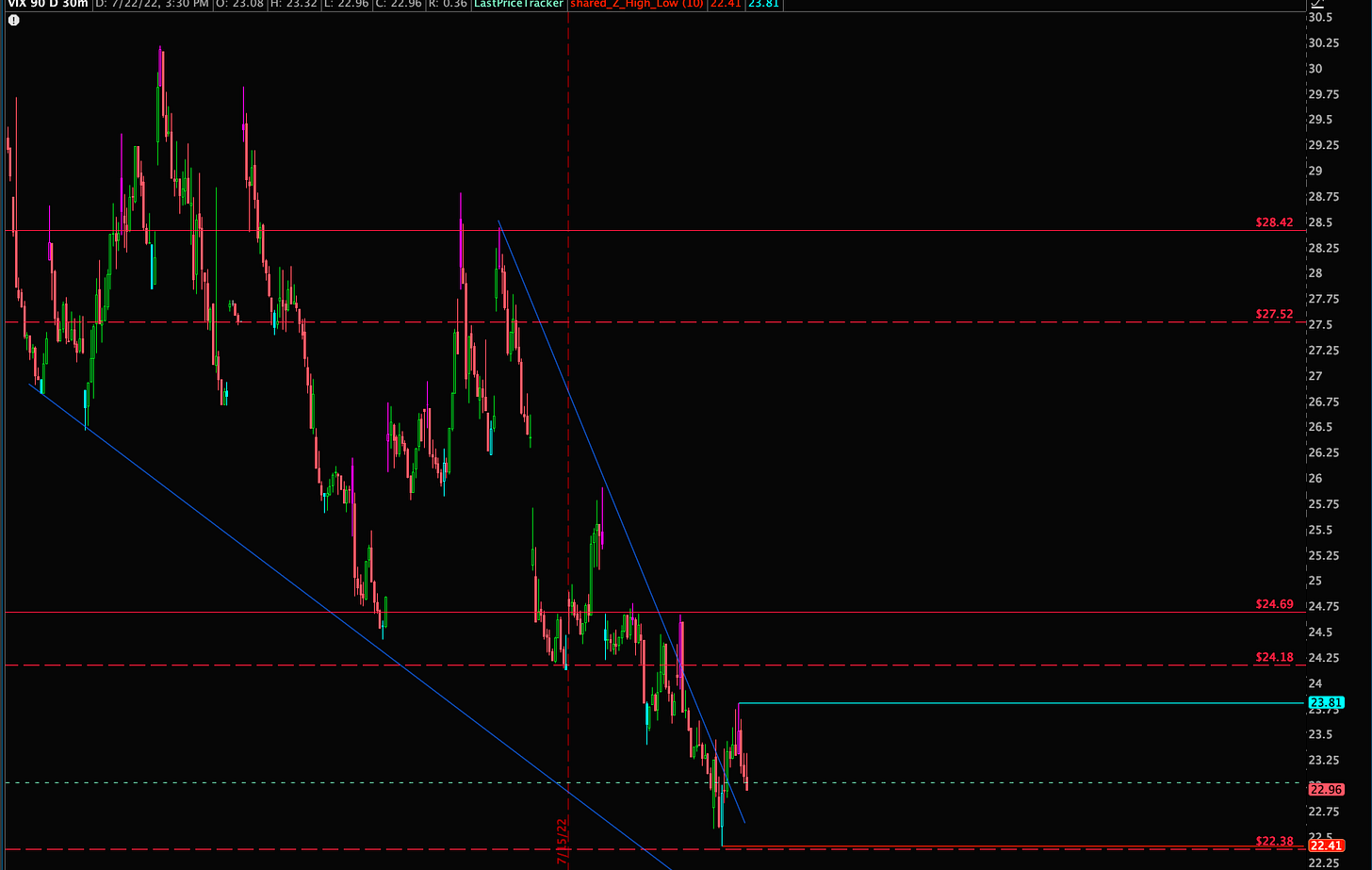

VIX

Game Plan: Hit our target around 24 so caution now.

- Bounced right off my 22.38 line! Let’s see if we test it again if so we can see 19.84 tested!

- Back over 24.69 we will push higher and eventually see 28.42

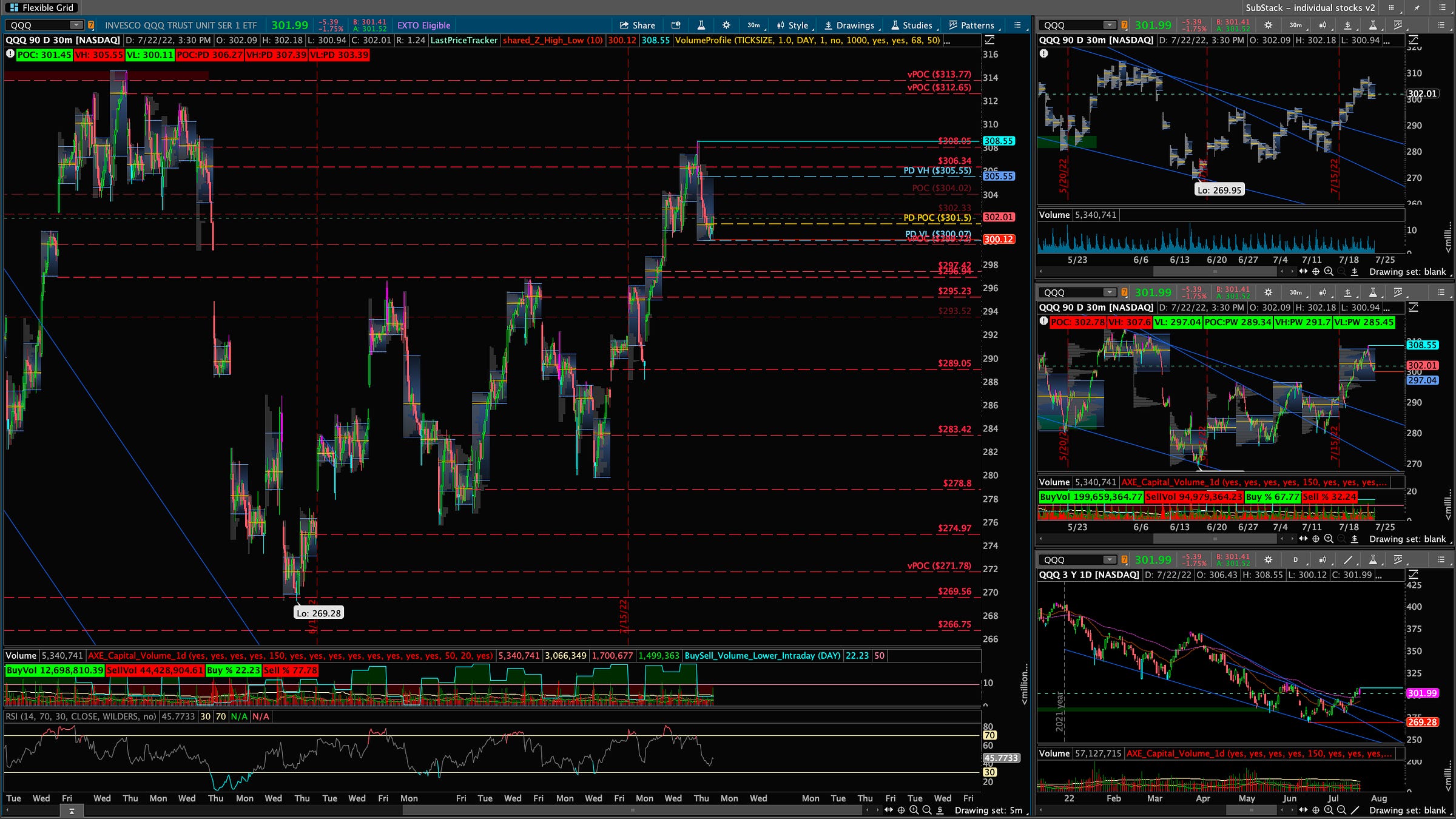

QQQ

Game Plan:

OPEN Above POC - 301 - Need over 305.55 for a push to 308.05. If we get over that we can see 312.65 vPOC tested then 313.77 zone.

Further Upside Levels: 296.94 > 299.72 > 302.33 > 304.02 > 306.34 > 308.05 > 312.65 > 313.77

OPEN Below POC - 301 - Below 300 we will see 297.42 vPOC tested. If that fails we will see 295.23 then 289.05 as not much support in between. 289.05 POC we can go for the gap fill and close it. If we continue down 283.42 vPOC will be tested most likely.

Further Downside Levels: 278.8 > 274.97 > 271.78 > 269.56 > 266.75 > 259.65 > 256.84

POC: 301 / VH: 305 / VL: 300

IWM

Game Plan:

- OPEN Above POC - 178 - Back over 179.61 we can push to retest 182.11 zone were we may find resistance again. If not we can try for a retest of 183.51 zone.

Further Upside Levels: 174.58 > 176.44 > 178.67 > 179.67 > 182.11

OPEN Below POC - 178 - Below 178 we will see 175.64 vPOC tested. if that fails we will head down to 172.78k. Then we see 171. 65 and 170.7. If all fails not much support till 167.93 vPOC then 165.56

Further Downside levels: 166.55 > 165.56 > 164.03 > 162.78 > 159.68 > 153.51 > 144.88

GAPS: 175.01 > 174.34 / 168.34 > 165.71 / 157.71 > 155.89

POC: 178 / VH: 180 / VL: 178

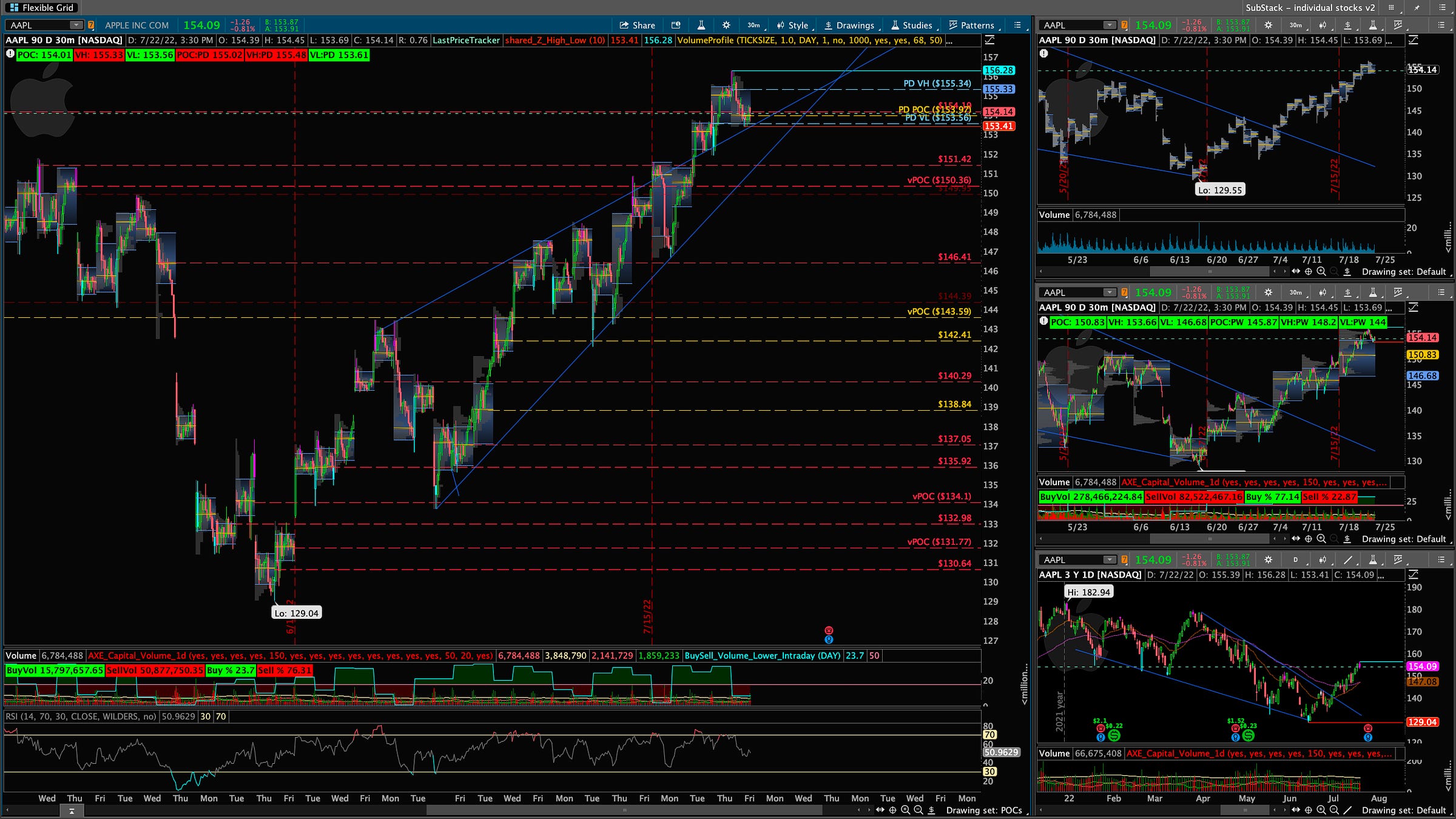

AAPL

Game Plan:

OPEN Above POC - 154 - over 155.34 we can see 157.82 vPOC tested. From there 160.21 vPOC.

Further Upside Levels: 148.07 > 149.95 > 150.36 > 154.19 > 157.82 > 160.21

- OPEN Below POC - 154 - Below 153 we will see 151.42 then 150.36. If that fails 148.3 zone is next. That opens the doors to 146.41 then 144.39/143.59.

Further Downside Levels: 143.59 > 142.41 > 140.29 > 138.84 > 137.05 > 135.92 > 134.1 > 132.98 > 131.77 > 130.64 > 128.65. 126.65 > 124.07 > 123.02 > 120.56 > 118.94

POC: 154 / VH: 155 / VL: 153

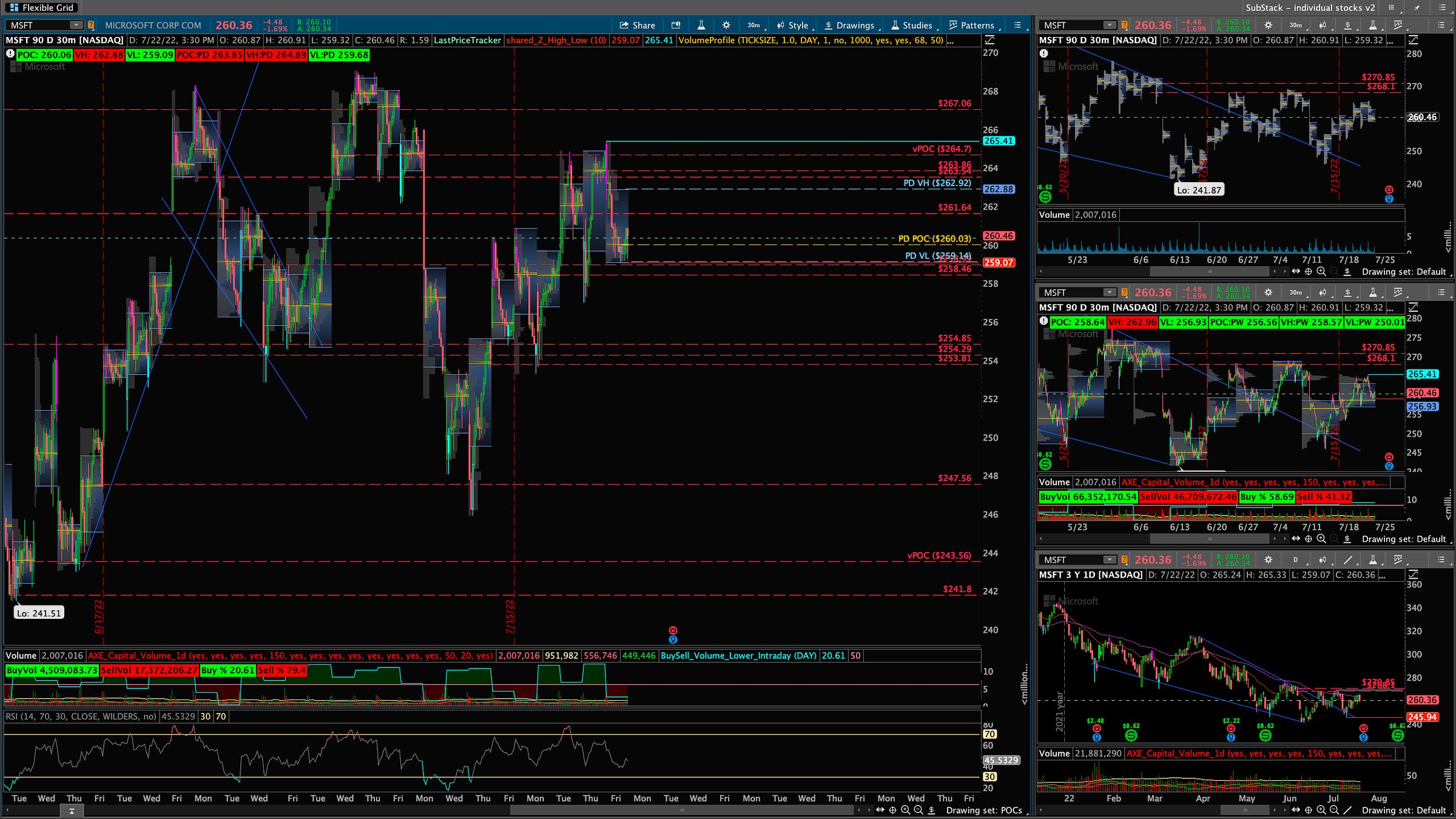

MSFT

Game Plan:

- OPEN Above POC - 255 - Needs to hold 260. However, through 260 we can make a push back to 263.86 POC zone where it could get dicey. Over 264.7 we see 267.06 tested.

Further Upside Levels: 258.82 > 261.64 > 264.7 > 267.22 > 270.9 > 273.81 > 277.97 - OPEN Below POC - 255 - Below 259.14 we see 254.85 eventually but may not be a straight line down. It get’s dicey between 254.85 and 253.81 again. Below that not much support till 247.57.

Further downside levels: 245.94 > 243.56 > 241.8 > 238.01 > 231.78 > 229.16 > 227.3 > 224.35 > 220.86

POC: 255 / VH: 258 / VL: 255

AMD

Game Plan:

- OPEN Above POC - 87 - Over 88.46 we could possibly push to 90.38 POC for a retest of 91.53 were we topped out.

Further Upside Levels: 80.4 > 81.03 > 83.46 > 85.92 > 87.72 > 91.53

OPEN Below POC - 87 - Below 88.77 we will see 85.92 and 85.2 tested again.If that fails we will see 83.14 POC as not much support in between. If all fails 81.03 is next then 79.81 vPOC.

Further Downside Levels: 77.28 > 76.36 > 74.47 > 72.54 > 69.74 > 62.3

GAPS: 116.38 > 118.59 (up)

POC: 87 / VH: 88 / VL: 87

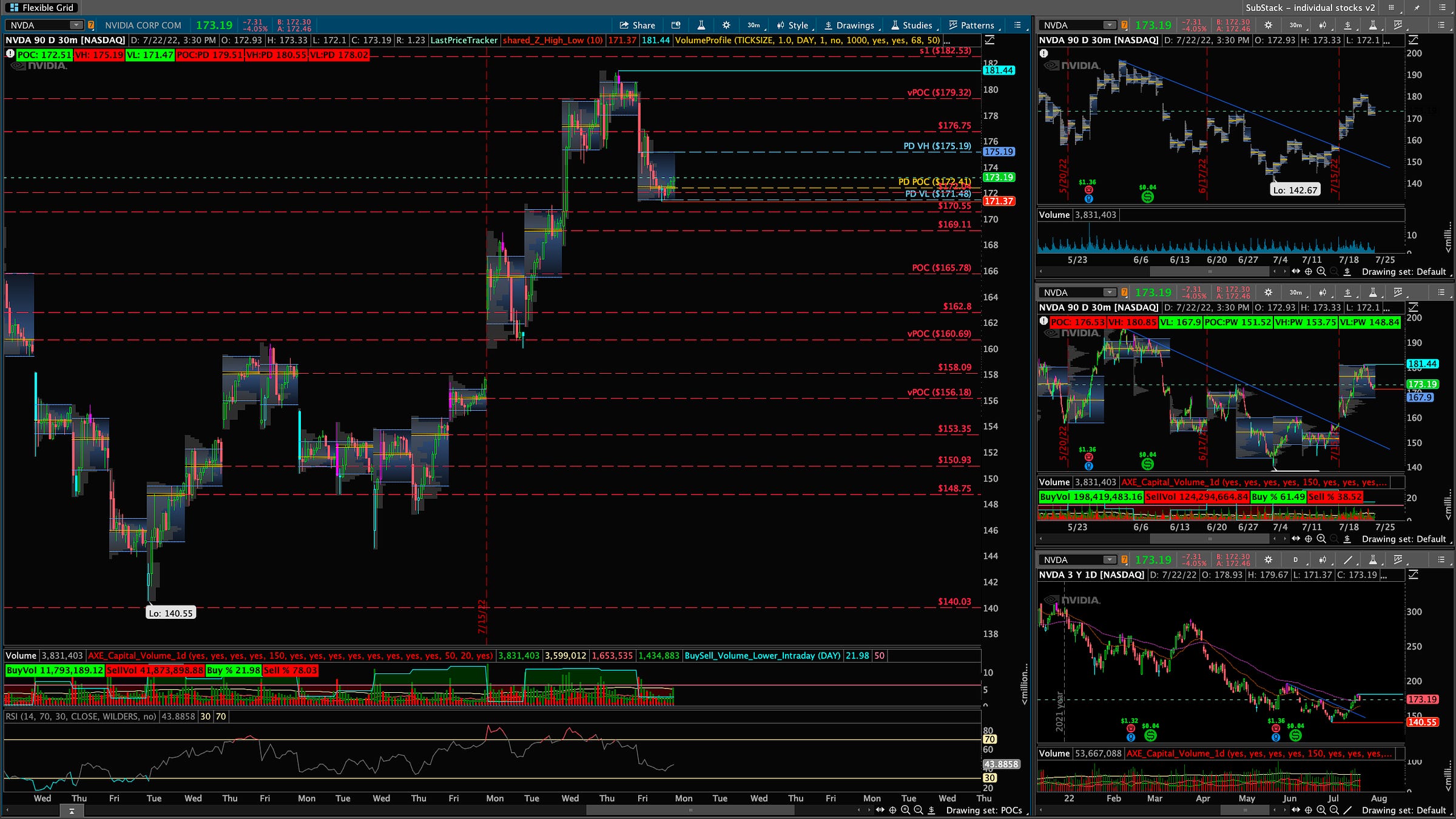

NVDA

Game Plan:

OPEN Above POC - 172 -Need over 175.19 for us to retest 176.75. If we clear that 179.32 POC we can test and possibly 182.

Further Upside Levels: 162.8 > 165.78 > 168.48 > 170.55 > 172.04 > 175.19 > 176.75 > 179.32 > 182.53

OPEN Below POC - 172 - Below 170.55 we will see 169.11 POC tested then 165.78. If that fails 160.69 POC we can test and break for the gap fill to 158.09.

Further Downside Levels: 156.83 > 153.05 > 150.93 > 148.75 > 140.03 > 135.04 > 126.3 > 116.93

POC: 172 / VH: 175 / VL: 171

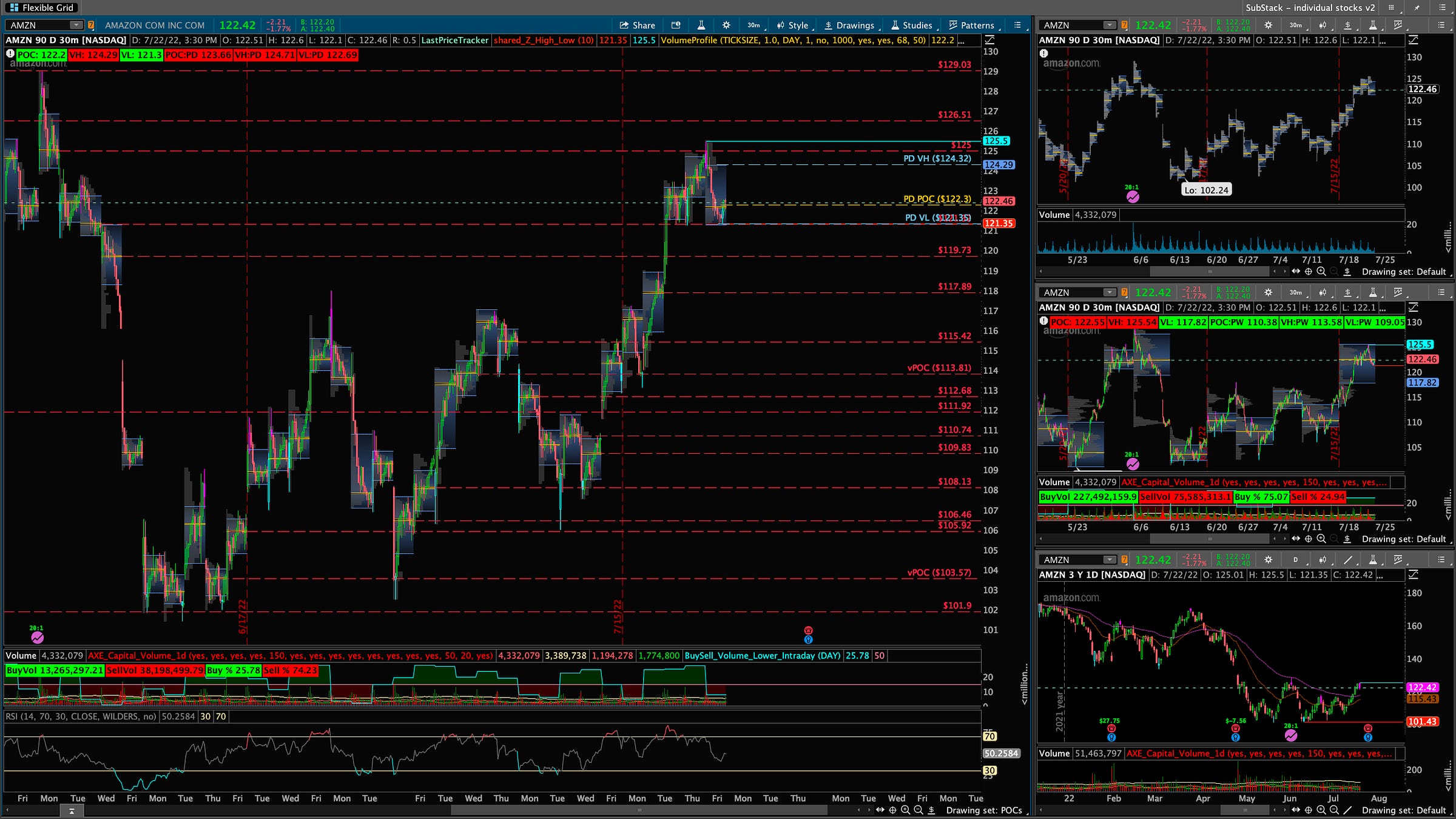

AMZN

Game Plan:

- OPEN Above POC - 122 - Need over 125 really as any short pop will be played just to test that zone…not really confident but will see. If we get over 125 126.51 we can see then 129.03

Further upside levels: 113.81 > 114.81 > 115.43 > 116.45 > 119.73 > 121.32 > 125 > 126.51 > 129.03 - OPEN Below POC - 122 - Below 121.35 we will see 119.73 possibly as support then 117.89 vPOC. If that fails 115.31 then 113.81 were we bounced originally.

Further Downside levels: 112.68 > 111.92 > 110.74 > 109.83 > 108.12 > 105.92 > 103.57 > 101.9 > 98.09 > 94.54 > 90.62 > 88.59 > 84.43 > 81.16

POC: 122 / VH: 124 / VL: 121

GOOGL

Game Plan:

- OPEN Above POC - 107 -Need over 109.68 for us to see 109.61 possibly. If we get over that not mush resistance to 112.57 but may not be a straight shot up.

Further Upside Levels: 108.68 > 109.61 > 112.57 > 114.04 > 115.47 > 116.26 > 116.95 > 111.05

OPEN Below POC - 111 - Below 107.6 we see 106.22. If that fails we could see 105.75/105.19 possibly but eventually test 104.06 vPOC.

Further Downside Levels: 106.22 > 105.73 > 104.06 > 102.42

POC: 107 / VH: 110 / VL: 106

TSLA

Game Plan:

- OPEN Above POC - 718 - Need to hold over 812 for us to retest 844.64 zone. Over that we can see 870.83 vPOC tested then 900 followed by 916.14

Further upside levels: 678.47 > 692.15> 707.25 >715.72 > 726.9 > 732 > 747 > 782 > 802.87 > 847.95 > 870.83 > 916.14 > 994 - OPEN Below POC - 718 - Below 812 we will see 802 then 782. Eventually 763 then 747 to close the gap. vPOC 742.81 then 726.35 vPOC is open.

Further Downside levels: 726.35 > 715.72 > 704.1 > 688.63 > 674.96 > 665.88 > 651.63 > 636.43 > 623.68 > 611.15 > 599.75 > 588.61 > 579.8

POC: 718 / VH: 722 / VL: 715

Did you enjoy this Post?

Thank you for reading PHOENIX Capital Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.