Thoughts on /ES 🤔

/ES

I decided to OPEN this up to EVERYONE this game plan to give people some insight on my current thought process of what happened today. This is all in my own opinion and part of my trading journal that I keep track of that helps me improve my levels and accuracy.

So currently after a major face ripping today we tried to take out 4045 but couldn’t. That is the base we built on 5/26 into 5/27 session and that is currently our resistance. Over that we could see an overshoot to 4073 which was previous support until broken so a key level to note.

Overall this move up off Powell isn’t organic and may be short lived. This is a time about risk management. and being patient. A good trader will wait patiently and not chase and slap. Wait for the move to come to you.

“Remember, the market transfers money from the impatient to the patient!”

Something to also note is VIX, as much as we pushed up today VIX held up overall very will is still above my 22 line that I have which is key because if we do dive, VIX could explode from these levels to the upside to only make the downside more volatile. A sell is coming I do not know when but my senses are tingling so I’ll be very careful at the top up here. If it does run great it can without me but i will have my eyes out as the following are struggling.

- $QQQ-can’t get over and hold 308.05 line I have

- $NQ-couldn’t even get over 12727 and make a new high…

- $AAPL-is moving up but could run into issues around 157.82 and 160.21 level

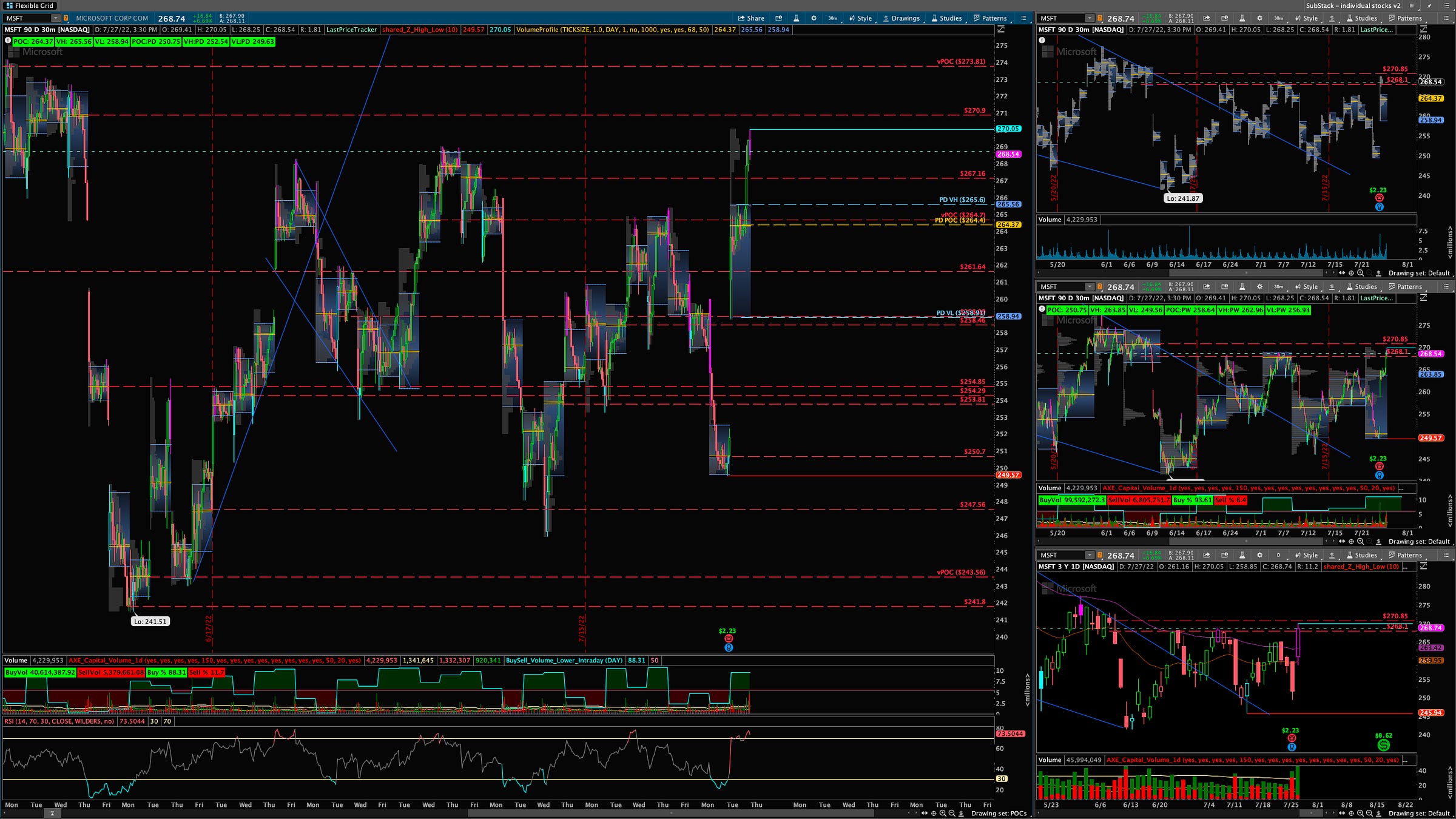

- $MSFT-near 270.9 level and could run into issues at that vPOC and then 273.81 a major POC that we rejected multiple times

- $NVDA-at resistance 179.32 that we have and if so possible we see 182.53

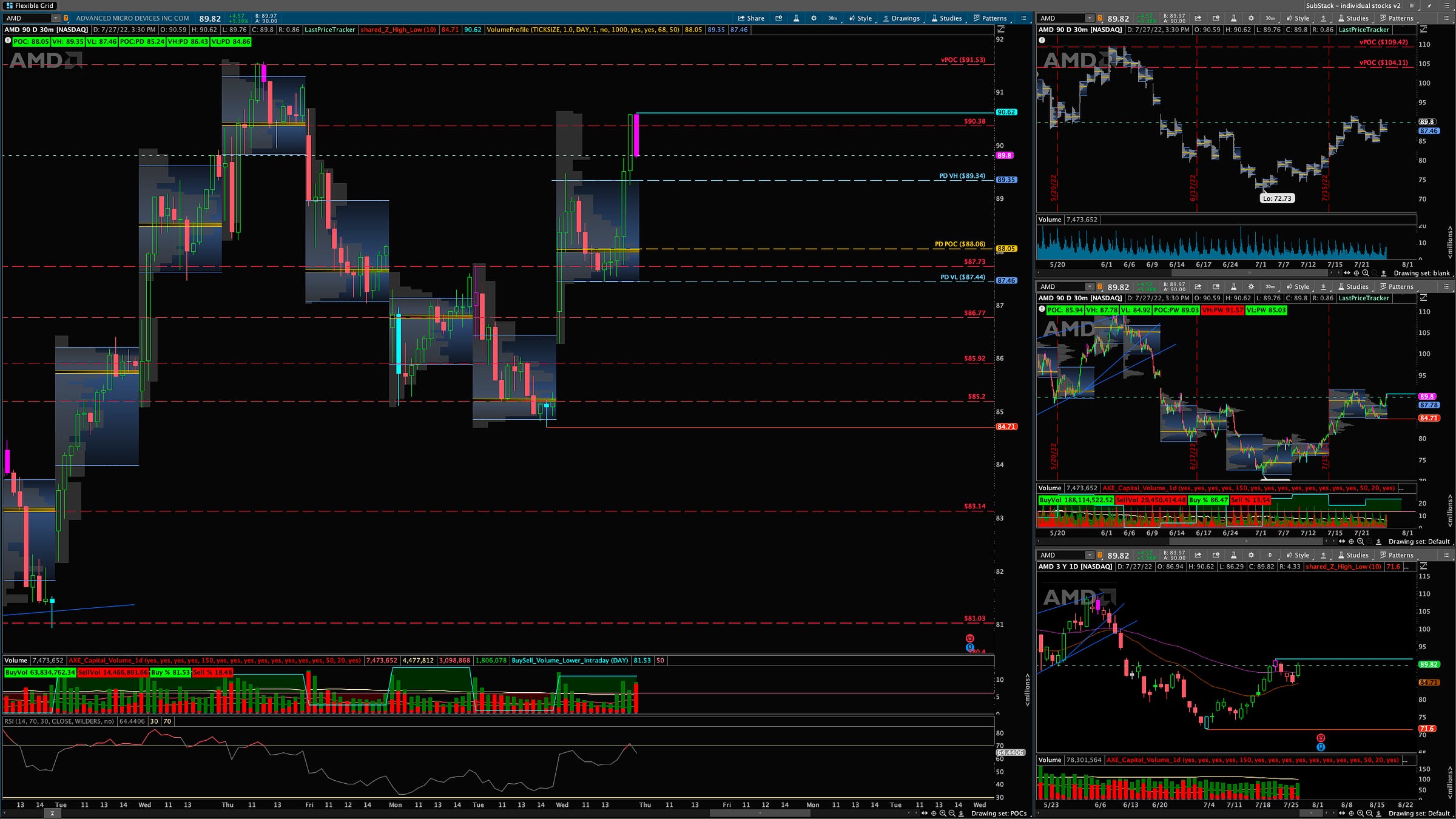

- $AMD-near 91.53 level but could reject and roll over and not the fill the gap but if so 95.57 vPOC is open eventually for testing.

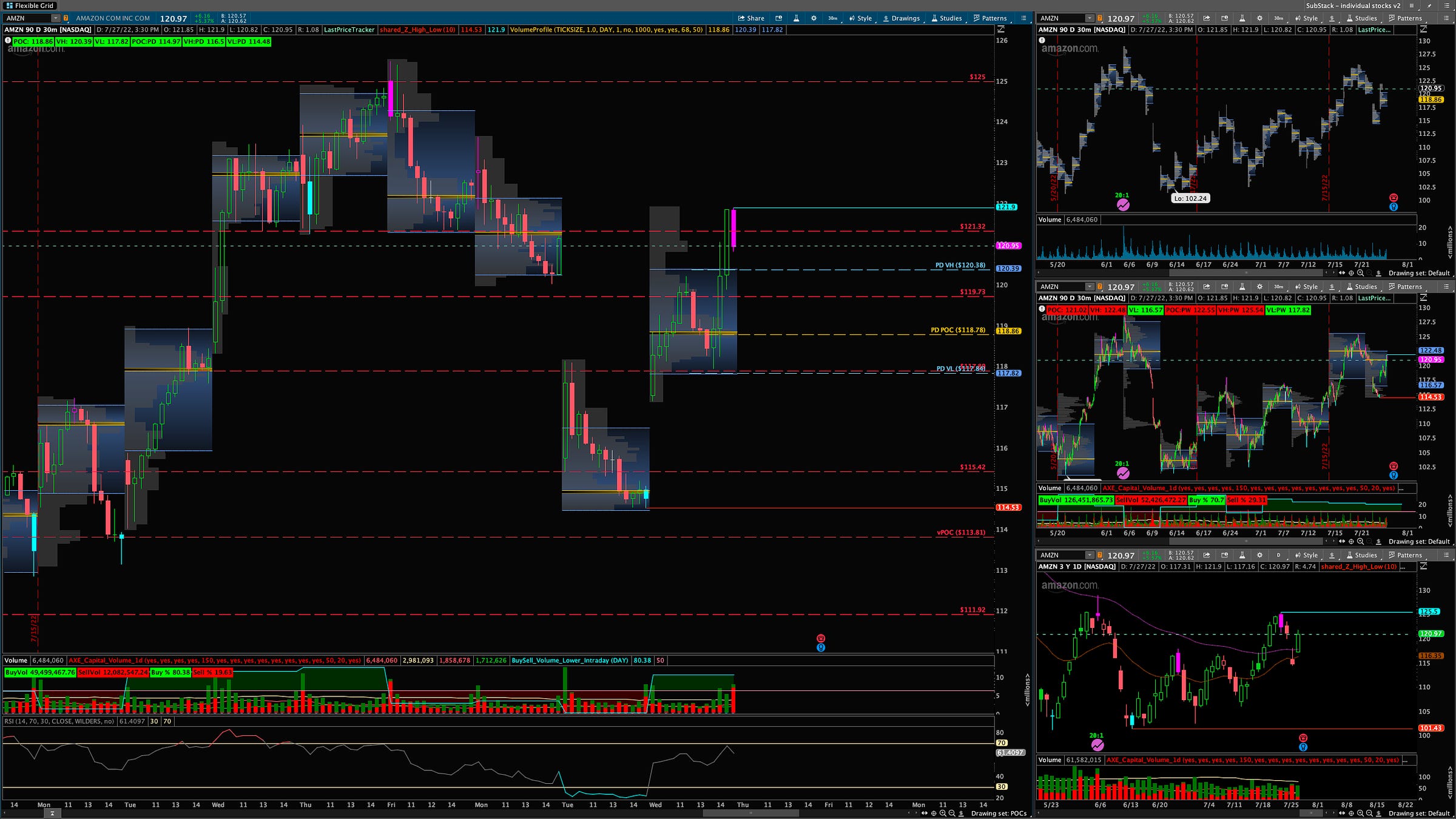

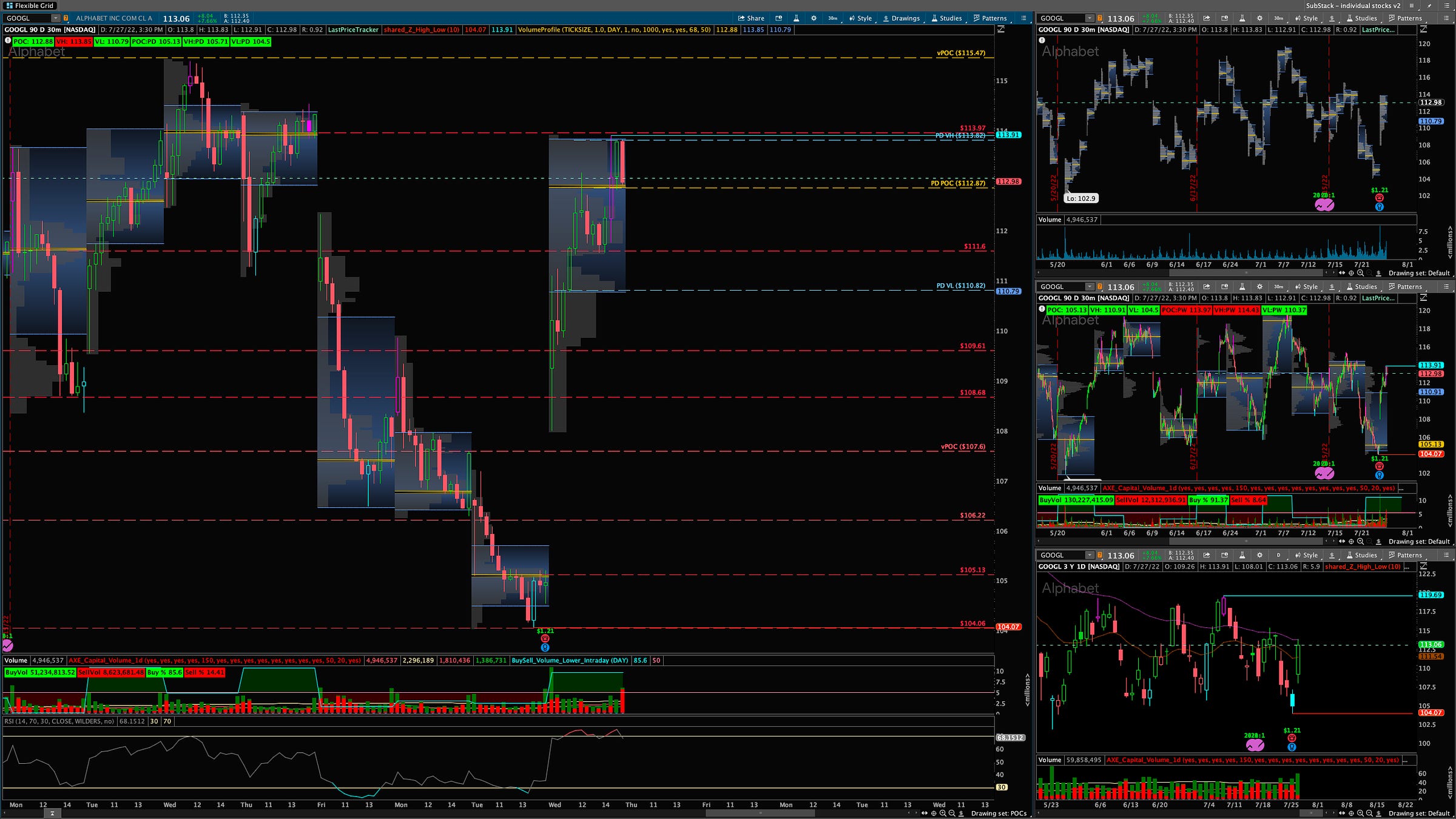

- TSLA AMZN GOOGL also just weak and not putting in new highs like /ES

Something doesn’t add up quite yet with this move up so let’s go over the break down of the levels for each stock individually and paint a picture of where we are.

Want To Learn Volume Profile?

How To Join Discord - FREE!

Link we will be blow read instructions - Once in, you will be in the #VERIFY_Channel, too unlock and view everything.

- Make sure you verify your email

- Click the “GREEN CHECK MARK”

🐦 BIRD’S EYE VIEW

Stocks We Will Be Reviewing

- FUTURES - /ES & /NQ

- ETFs - QQQ (tech) & IWM (small caps)

- VIX - Volatility Index

- STOCKS - AAPL / MSFT / AMD / NVDA / AMZN / GOOGL / TSLA

/ES

Game Plan:

OPEN Above POC - 3974 - Need over 4008 to hold. From there we can continue higher. and retest 4045 zone. If we get through that 4073 and then 4093 vPOC is exposed.

Upside Levels: 3863 > 3886 > 3899 > 3914 > 3934 > 3950 > 3965 > 4029 > 4045 > 4073 > 4093 > 4165

- OPEN Below POC - 3974 - Below 40008 not much support and we can test 3974. Below that we will likely see 3910 and lower.

Further Downside Levels. 3834 > 3824 > 3807 > 3797 > 3758 > 3743 > 3724 > 3703 > 3679 > 3660 > 3639 > 3592.25 > 3423.25 > 3396.5 > 3227.5

POC: 3974 / VH: 4010 / VL: 3949

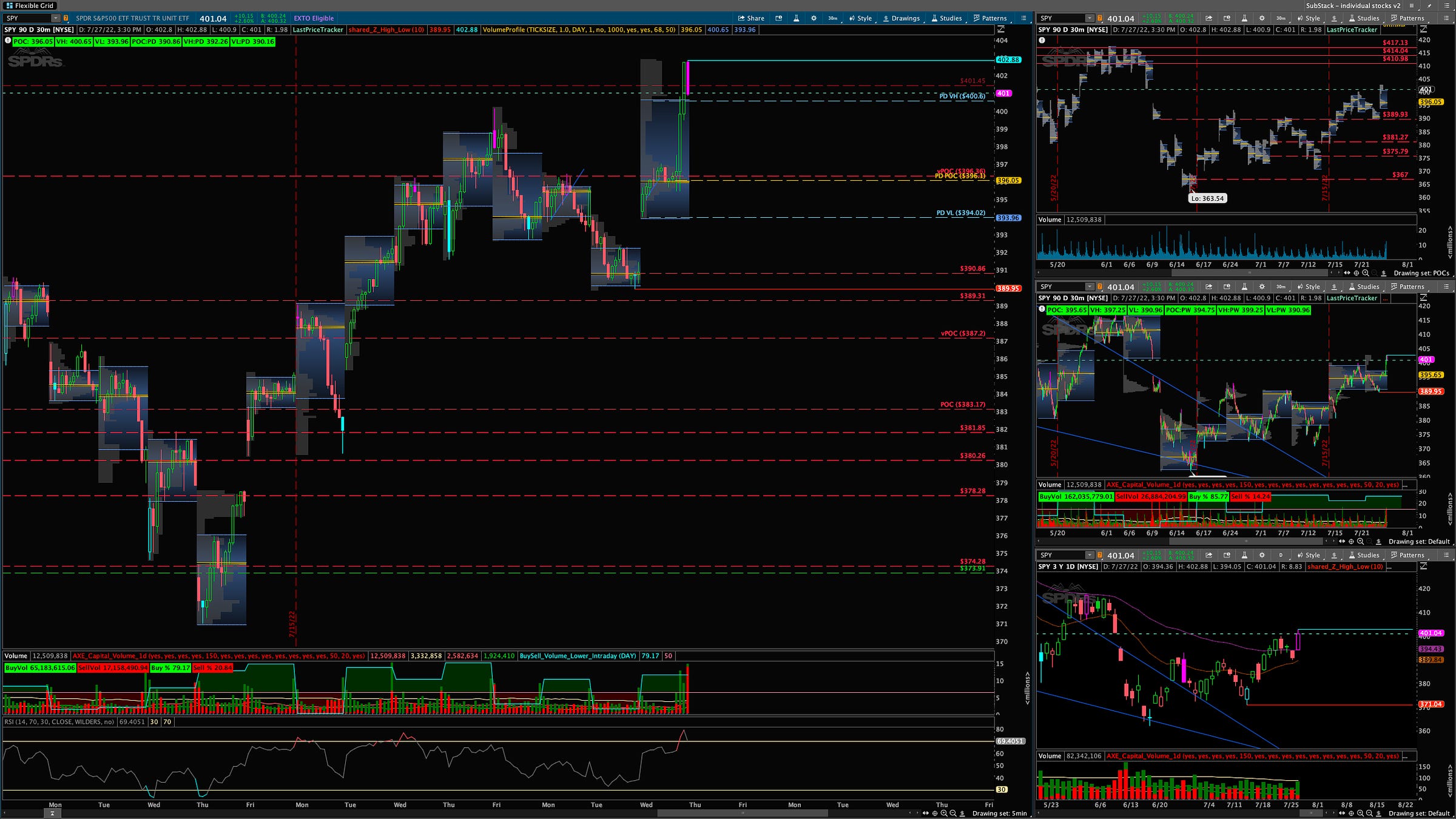

SPY

Game Plan:

OPEN Above POC - 396 - Over 401.45 if we hold we can push up and see 405.66 then 406.01 zone tested. If we really rally 409.15 vPOC could be tested.

Further Upside Levels: 381.85 > 383.17 > 383.89 > 387.2 > 392.2 > 390.12 > 391.34 > 396.36 > 401.45 > 405.66 > 409.15 > 412.11

OPEN Below POC - 396 - Below 400.7 we don’t have much support till 398.11 POC zone. Below that we could go for the gap fill and test 390.86 vPOC. Below that 389.31 > 387.2 follows. If all fails we will 383.17 POC tested again for support.

Further Downside Levels. 380.26 > 374.28 > 371.04 > 368.5 > 367.4 > 365.18 > 362.17

POC: 396 / VH: 400 / VL: 393

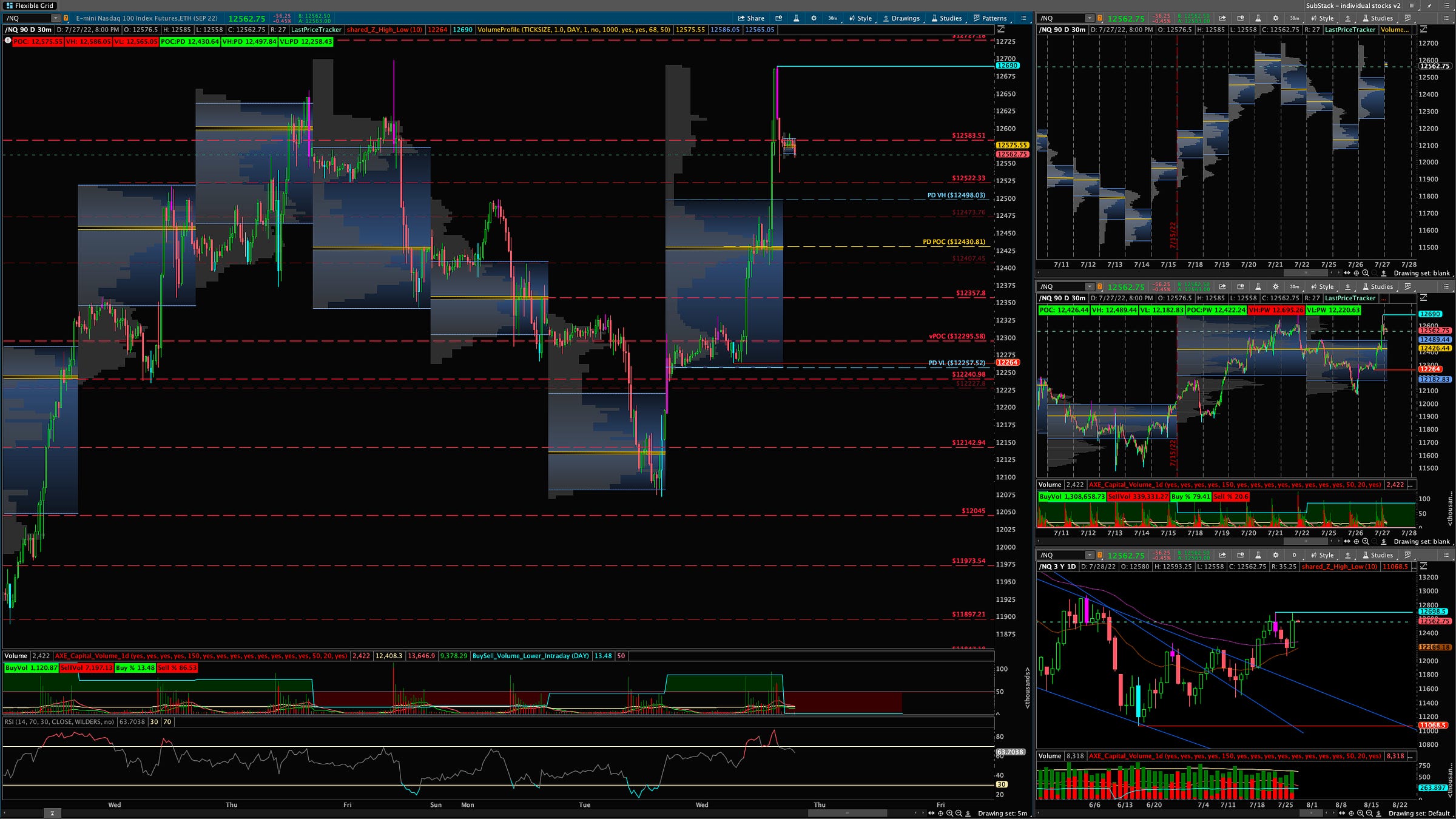

/NQ

Game Plan:

- OPEN Above POC 12430 - Need over 12583 to hold or back over for us to push any higher. From there we could see 12616 area tested then if we continue to push 12700 zone again. If so we can test 12727 then 12880 where we may run into resistance again.

Further Upside Levels: 11847 > 11973 > 12045 > 12514 > 12227 > 12295 > 12407 > 12473 - OPEN Below POC - 12430 - Below 12583 we will see 12522. if we continue down 12430 POC will be tested then 12295 to 12258 zone could get choppy.

Further Downside Levels: 12142 > 12045 > 11973 > 11897 > 11847 > 11805 > 11742 > 11667 > 11641 > 11483 > 11434 > 11373 > 11288 > 11267 > 11174 > 11061 > 10937 > 10660 > 10304 > 10171

POC: 12430 / VH: 12497 / VL: 12258

VIX

Game Plan:

- Back over 24.69 we will push higher and eventually see 28.42

- Downside we can retest 22.38 were we bounced before.

QQQ

Game Plan:

OPEN Above POC - 302 - Need over 306.34 to hold if so we can try and push over 308.54 were we struggled last time. Through that we will see 312.65 possibly.

Further Upside Levels: 296.94 > 299.72 > 302.33 > 304.02 > 306.34 > 308.05 > 312.65 > 313.77

OPEN Below POC - 302 - Below 306.34 we will see 302.2 POC tested eventually as not much support in between. Below that we could go for 298.55 then gap fill down to 294.96 vPOC.

Further Downside Levels: 289.05 > 283.42 > 278.8 > 274.97 > 271.78 > 269.56 > 266.75 > 259.65 > 256.84

POC: 302 / VH: 306 / VL: 300

IWM

Game Plan:

- OPEN Above POC - 180 - Need to hold over 183.51 zone. for us to see 185.49

Further Upside Levels: 174.58 > 176.44 > 178.67 > 179.67 > 182.11

OPEN Below POC - 180 - Below 182.11 we will see 181.02 vPOC tested then 178.67 tested eventually. we will see 175.64 vPOC tested. if that fails we will head down to 172.78.

Further Downside levels: 176.44 > 175.64 > 174.6 > 173.14 > 171.65 > 170.7 > 167.93 > 165.56 > 164.03 > 162.78 > 159.68 > 153.51 > 144.88

GAPS: 175.01 > 174.34 / 168.34 > 165.71 / 157.71 > 155.89

POC: 180 / VH: 182 / VL: 180

AAPL

Game Plan:

OPEN Above POC - 154 - over 155.72 hold we test 157.82. From there 160.21 vPOC.

Further Upside Levels: 148.07 > 149.95 > 150.36 > 154.19 > 157.82 > 160.21

- OPEN Below POC - 154 - Below 155..65 we will see 154.33 we will see 153.06 then 151.61 vPOC tested. If that fails 150.36 will be tested. If all fails 148.3 zone is next. That opens the doors to 146.41 then 144.39/143.59.

Further Downside Levels: 143.59 > 142.41 > 140.29 > 138.84 > 137.05 > 135.92 > 134.1 > 132.98 > 131.77 > 130.64 > 128.65. 126.65 > 124.07 > 123.02 > 120.56 > 118.94

POC: 154 / VH: 155 / VL: 152

MSFT

Game Plan:

- OPEN Above POC - 259 - Needs to hold 267 zone for us to push higher 270.9 vPOC test. From there 273.81 could be tested.

Further Upside Levels: 258.82 > 261.64 > 264.7 > 267.22 > 270.9 > 273.81 > 277.97 - OPEN Below POC - 259 - Below 267 we could see 264.4 vPOC tested then below that not much support till 261.64 then 258.91 zone.

Further downside levels: 256.79 > 254.85 > 253.81 > 247.57 > 245.94 > 243.56 > 241.8 > 238.01 > 231.78 > 229.16 > 227.3 > 224.35 > 220.86

POC: 259 / VH: 259 / VL: 257

AMD

Game Plan:

- OPEN Above POC - 88 - Over 90.38 POC test again we can see 91.53 were we topped out. Through that 95.57 eventually we could see.

Further Upside Levels: 80.4 > 81.03 > 83.46 > 85.92 > 87.72 > 91.53

OPEN Below POC - 88 - Below 90.38 not much support till 87.73 zone. Below that 86.77 we will see then 85.2 vPOC test.

Further Downside Levels: 83.14 > 81.03 > 79.81 > 77.28 > 76.36 > 74.47 > 72.54 > 69.74 > 62.3

GAPS: 116.38 > 118.59 (up)

POC: 88 / VH: 89 / VL: 87

NVDA

Game Plan:

OPEN Above POC - 173 -Need over 179.32 POC for us to go any higher. If so next is 182.53 then 185.52.

Further Upside Levels: 162.8 > 165.78 > 168.48 > 170.55 > 172.04 > 175.19 > 176.75 > 179.32 > 182.53

OPEN Below POC - 173 - Below 179.32 we will see 176.75 and lower. We could test 173.68 and then 169.11. If we dive 165.78 is in play.

Further Downside Levels: 169.11 > 162.8 > 160.89 > 158.09 > 156.83 > 153.05 > 150.93 > 148.75 > 140.03 > 135.04 > 126.3 > 116.93

POC: 173 / VH: 175 / VL: 169

AMZN

Game Plan:

- OPEN Above POC - 118 - Need over 121.32 to hold for us to push higher. We can head to 123.64. From there 125 really as any short pop will be played just to test that zone…not really confident but will see. If we get over 125 126.51 we can see then 129.03

Further upside levels: 113.81 > 114.81 > 115.43 > 116.45 > 119.73 > 121.32 > 125 > 126.51 > 129.03 - OPEN Below POC - 118 - Below 119.73 we could see 117.89 vPOC. If that fails 115.31 then 113.81 were we bounced originally.

Further Downside levels: 112.68 > 111.92 > 110.74 > 109.83 > 108.12 > 105.92 > 103.57 > 101.9 > 98.09 > 94.54 > 90.62 > 88.59 > 84.43 > 81.16

POC: 118 / VH: 120 / VL: 117

GOOGL

Game Plan:

- OPEN Above POC - 112 -Need over 113.97 for us to push higher. From there we can see 115.47 then 116.26

Further Upside Levels: 108.68 > 109.61 > 112.57 > 114.04 > 115.47 > 116.26 > 116.95 > 111.05

OPEN Below POC - 112 - Below 111.6 we will head right back down to 109.61 then 107.6. If we dive we can see 105.13 vPOC tested then 104.06 bottom tested again.

Further Downside Levels: 106.22 > 105.73 > 104.06 > 102.42

POC: 112 / VH: 118 / VL: 110

TSLA

Game Plan:

- OPEN Above POC - 807 - Need to hold over 807 for us to push higher and test 844/847 zone. From there we can make a run for 870.83 eventually.

Further upside levels: 678.47 > 692.15> 707.25 >715.72 > 726.9 > 732 > 747 > 782 > 802.87 > 847.95 > 870.83 > 916.14 > 994 - OPEN Below POC - 807 - Below 807 and hold we can head down to 792.06 zone and if that breaks right down to head down to 775 vPOC. If that fails 763 is next up.

Further Downside levels: 747 > 742.81 > 726.35 > 715.72 > 704.1 > 688.63 > 674.96 > 665.88 > 651.63 > 636.43 > 623.68 > 611.15 > 599.75 > 588.61 > 579.8

POC: 807 / VH: 817 / VL: 791

Did you enjoy this Blog?

Thank you for reading PHOENIX Capital Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.