Thoughts on /ES /CL /BTC🤔

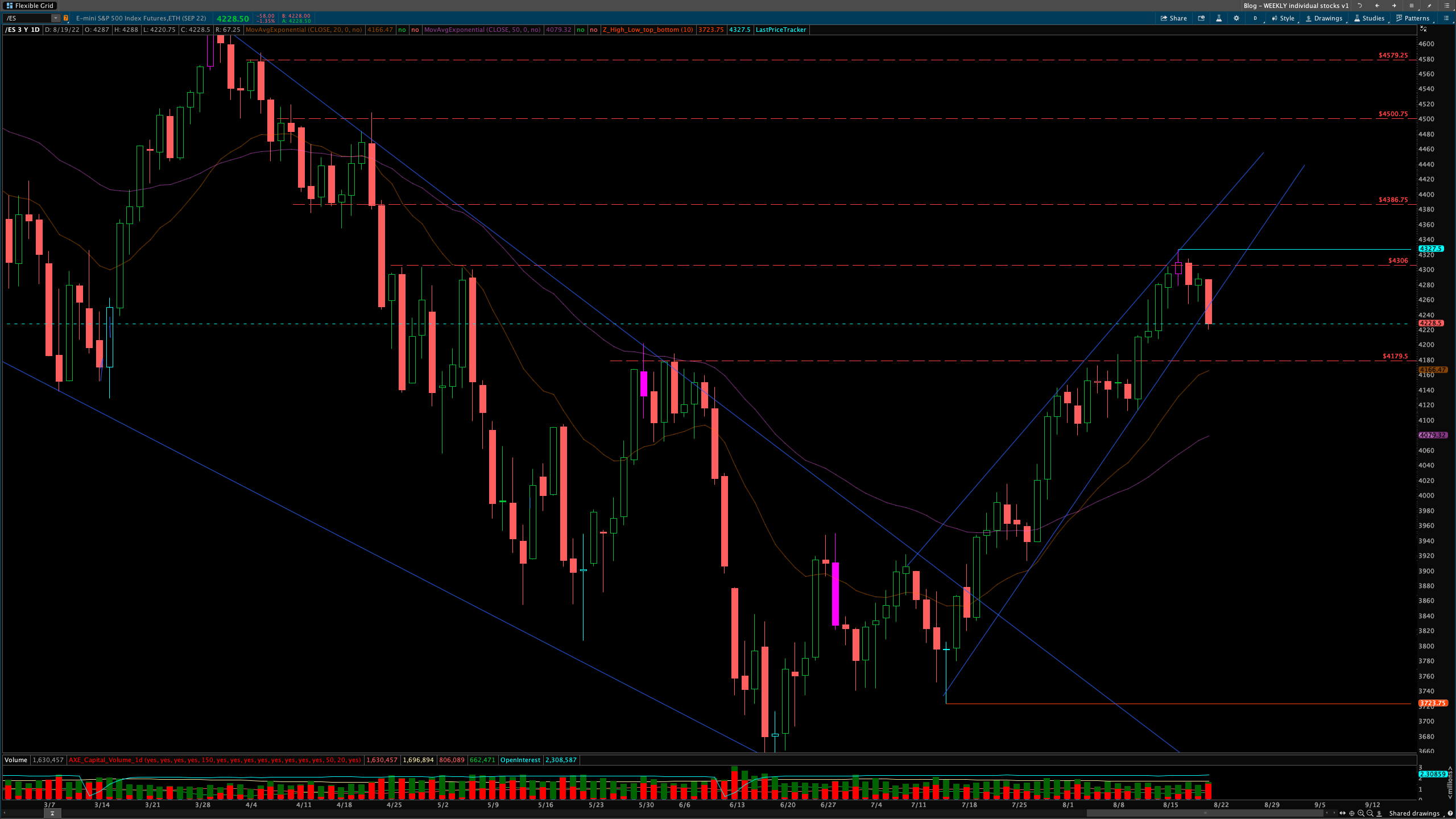

/ES

Head, Shoulder, Knees & Toes

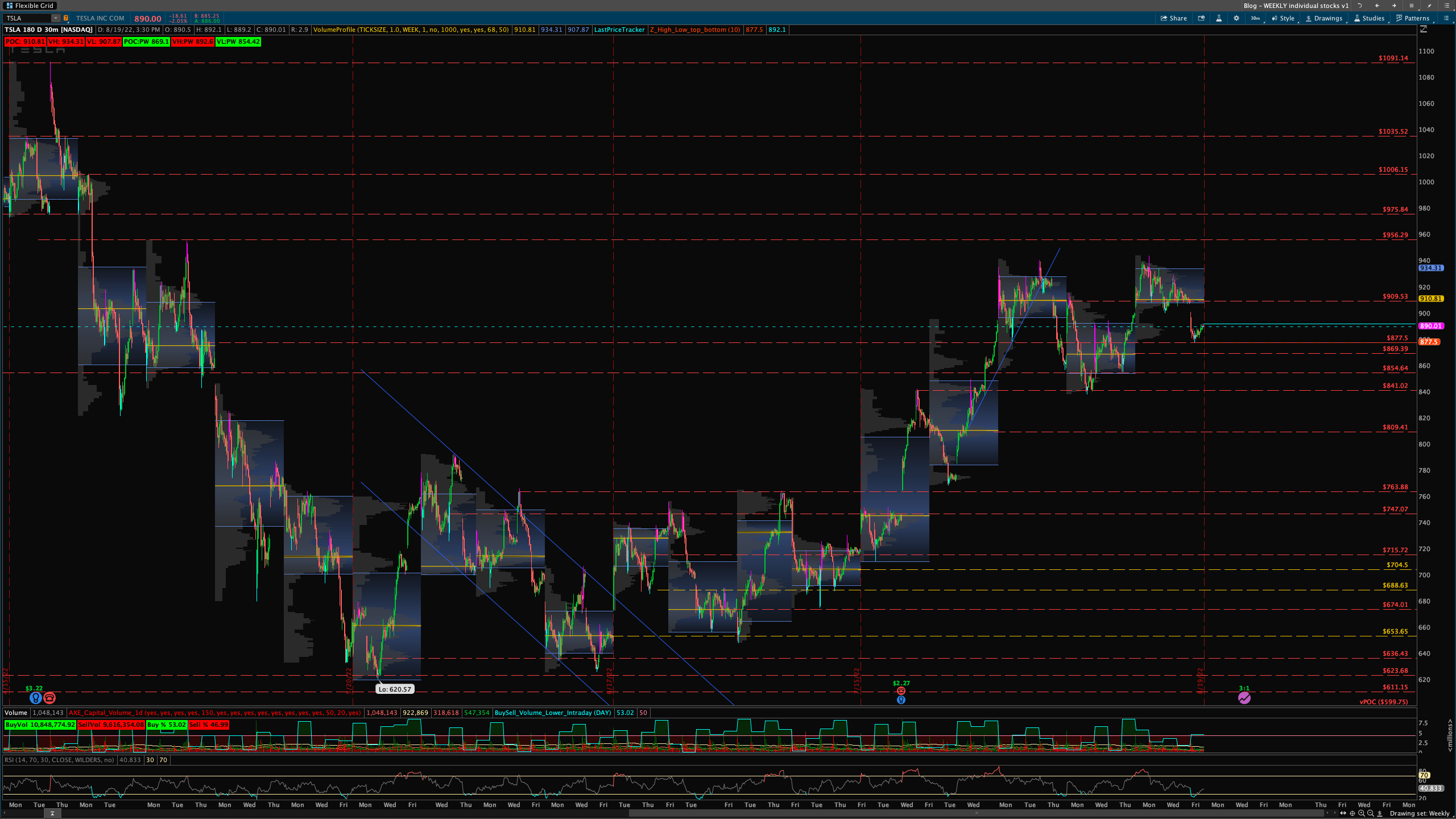

Last week game plan called for us to possibly pop to 4306 and overshoot and pull back and that is exactly what happened! Going ahead into this week TSLA will be my main focus.

TSLA could possibly be making a massive inverse head and should and 877 will be the key level to hold. AAPL did the lifting last week so now it is TSLA turn to push otherwise we will see things start to pull back heavy.

“Remember, the market transfers money from the impatient to the patient!”

/ES

Last we called for 4306 possibly being top with and overshoot and that is exactly what happened. Going forward we have to pull back up early into next week. If not I see 4180s being tested and if that hold we bounce from there to retest the 4306 zone for a retest failure if we manage to really push.

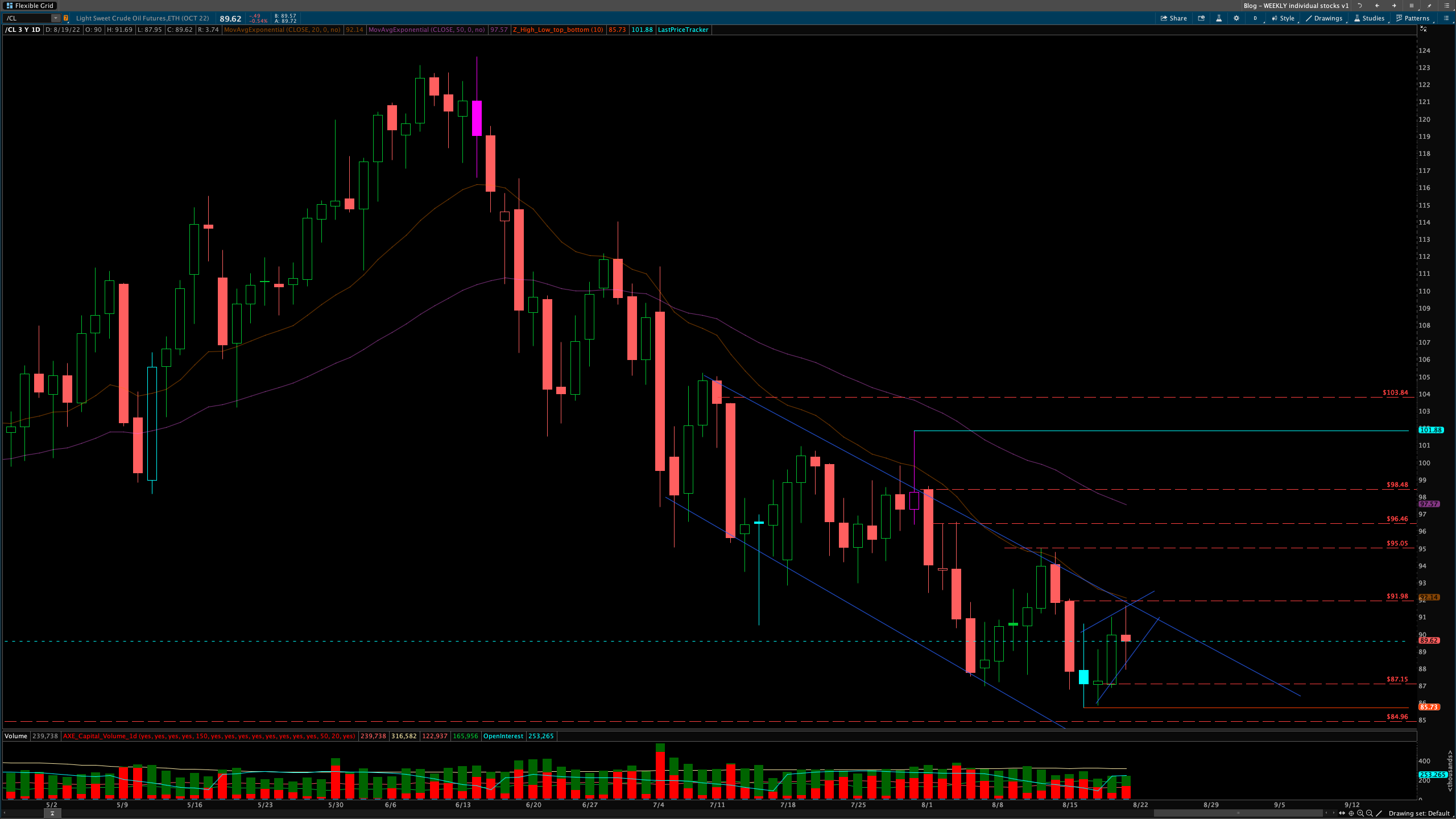

/CL

Currently in a channel down. We are at the upper trend line and will be pivotal for us to break out of it if we are going to push up. If so we need to take out 91.98 level. From there 95.05 > 96.46 and 98.48 levels are above. If we clear all that we can see 104.53 possibly.

/BTC

Last week we called for the rising wedge to finish out and that is exactly what happened. Now we flushed out down to 21,000 zone. If we break 2071 we can see 19795 tested. if that fails we retest low of 18610 zone and below that not much support. We can easily see 16480 and 12750 eventually.

Want To Learn Volume Profile?

Stocks We Will Be Reviewing

- FUTURES - /ES & /NQ

- ETFs - QQQ (tech) & IWM (small caps)

- VIX - Volatility Index

- STOCKS - AAPL / MSFT / AMD / NVDA / AMZN / GOOGL / TSLA

IMPORTANT NOTE - About Upside Levels This WEEK!

- We are WELL BELOW Weekly POC so for everyone section that says "Above POC" I put levels blow it as upside targets as if we were to bounce from where we currently are!

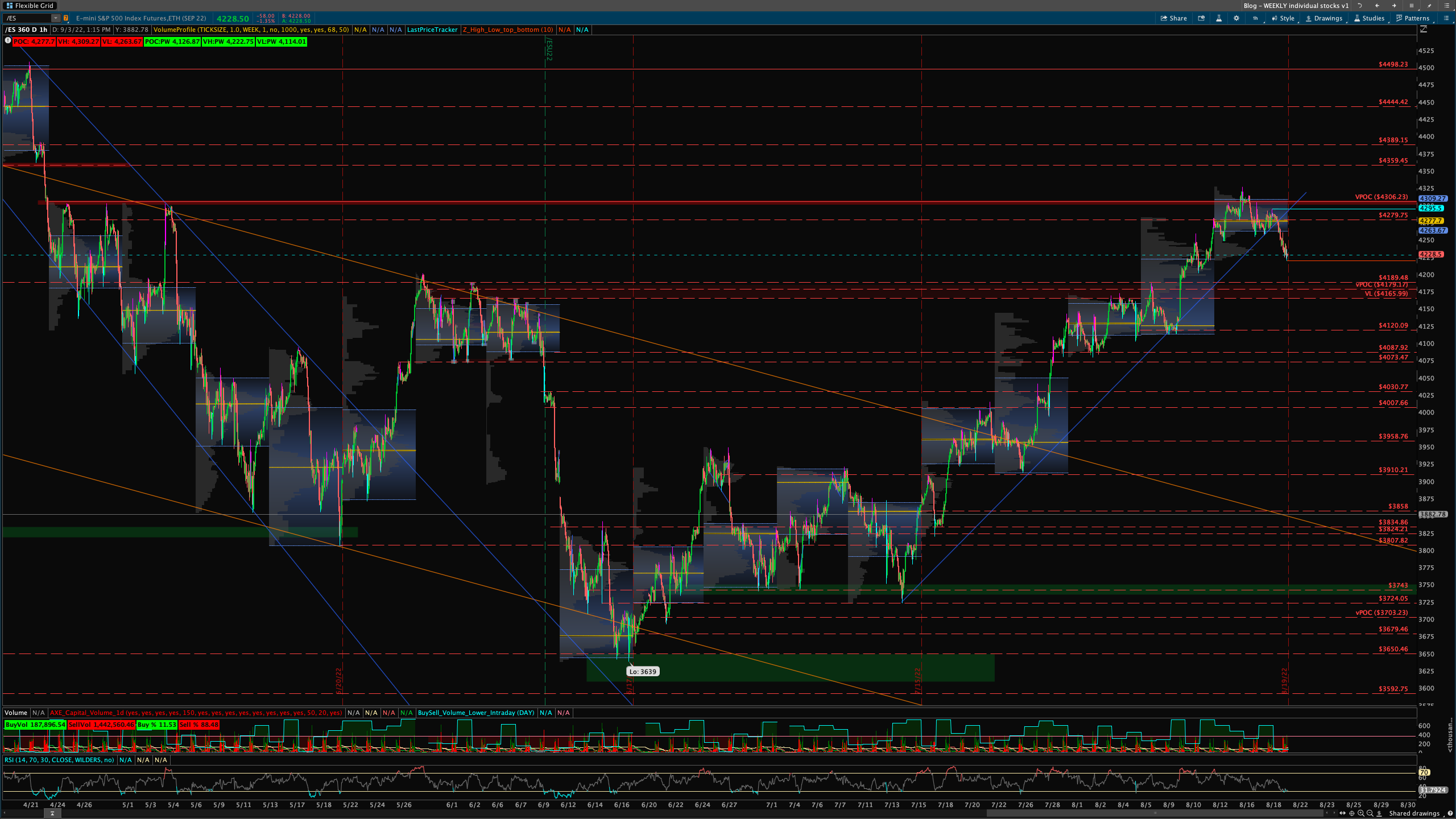

/ES

Game Plan:

- Above Weekly POC - 4275 - If we can reclaim 4279 we can see 4306 tested. Through that, I'd like to see 4360 tested. Over that 4389 light level but 4444 vPOC.

- Below Weekly POC - 4275 - Below 4120 we can see 4203 light level then 4189. Below that 4165. If that breaks we will see 4120 zone then 4087. Once that gives up 4007 may trade and lower.

POC: 4275 / VH: 4309 / VL: 4263

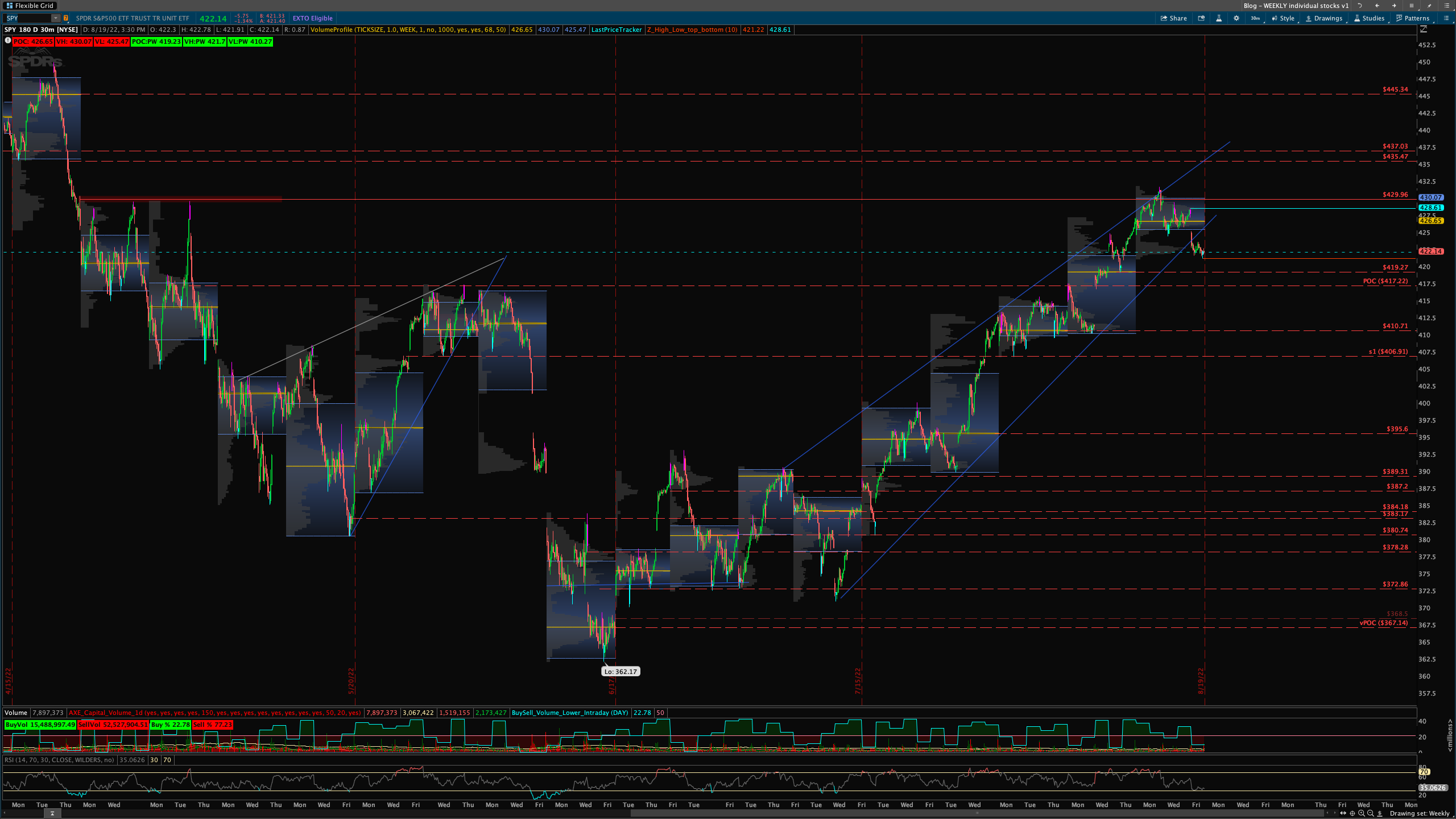

SPY

Game Plan:

- Above Weekly POC - 426 - Need back over VL 425 zone then we can test POC 426.65. Over that back to heavy resistance at 429.96. From there we need to break and hold. If so we can see 435.47/437.03 range tested. Over that 445.34 POC is next.

- Below weekly POC - 426 - Below 419.27 POC we can see 417.22 and lower. Below 410.71 POC zone and 406 is up for testing. If we give up 406 not much support below. 395.6 vPOC then 389.31 .

POC: 426 / VH: 430 / VL: 425

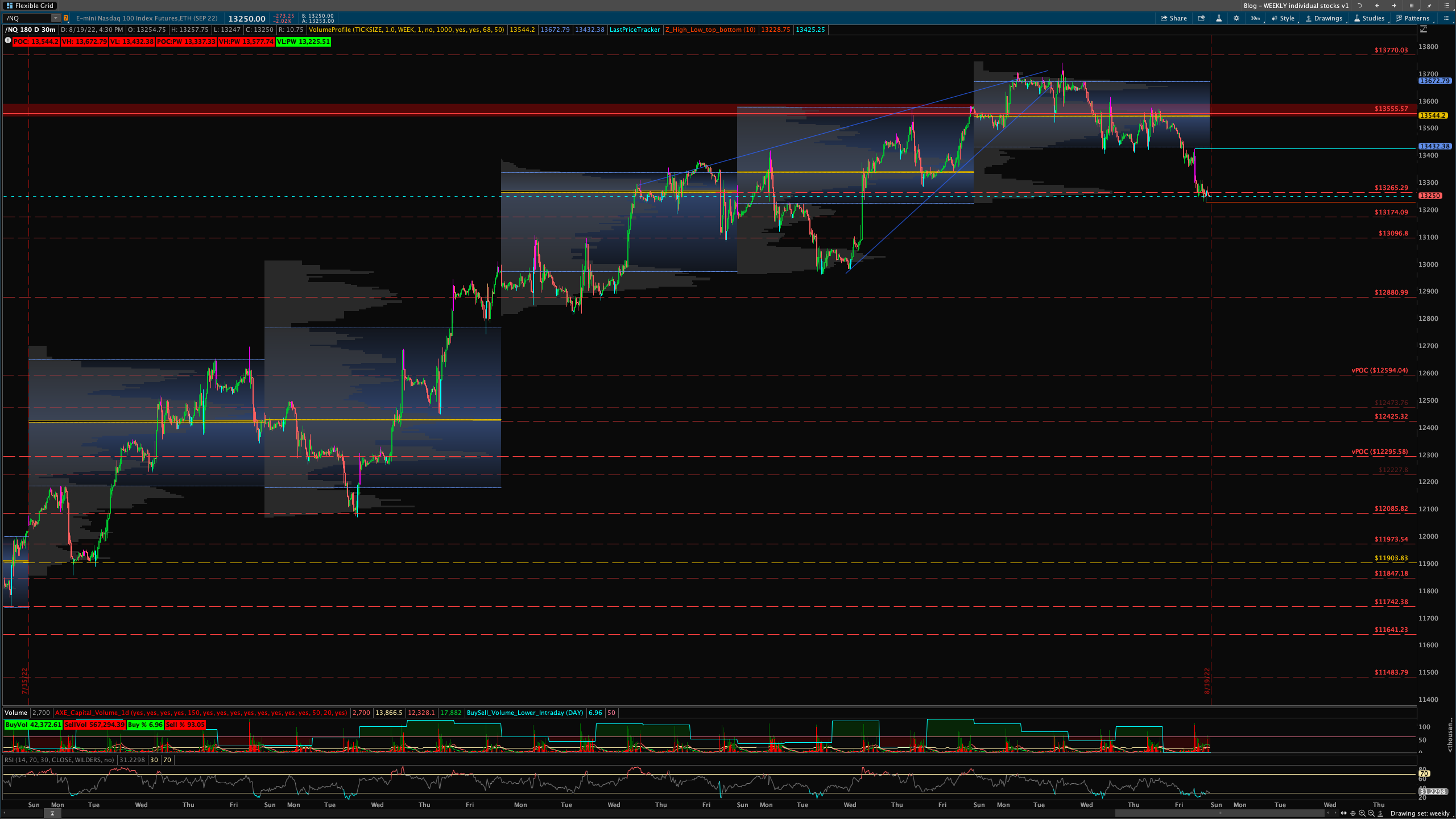

/NQ

Game Plan:

- Above Weekly POC - 13544 - Need back over 13265 first off before anything happens. If so we can then try for 13350 zone then 13432 VL and finally back to 13555 vPOC. From there we can test 137770 . If we really manage to pust 14141 POC then 14294 is where another heavy resistance zone is at.

- Below Weekly POC - 13544 - Below 13265 we can break down to 13906 then a weekly VL 12971 and finally 12880. If all breaks we head down to last weekly POC 12425 > 12295 zone then 12045 zone. If we collapse 11903 is exposed then 11742 and 11483 can follow.

POC: 13544 / VH: 13672 / VL: 13432

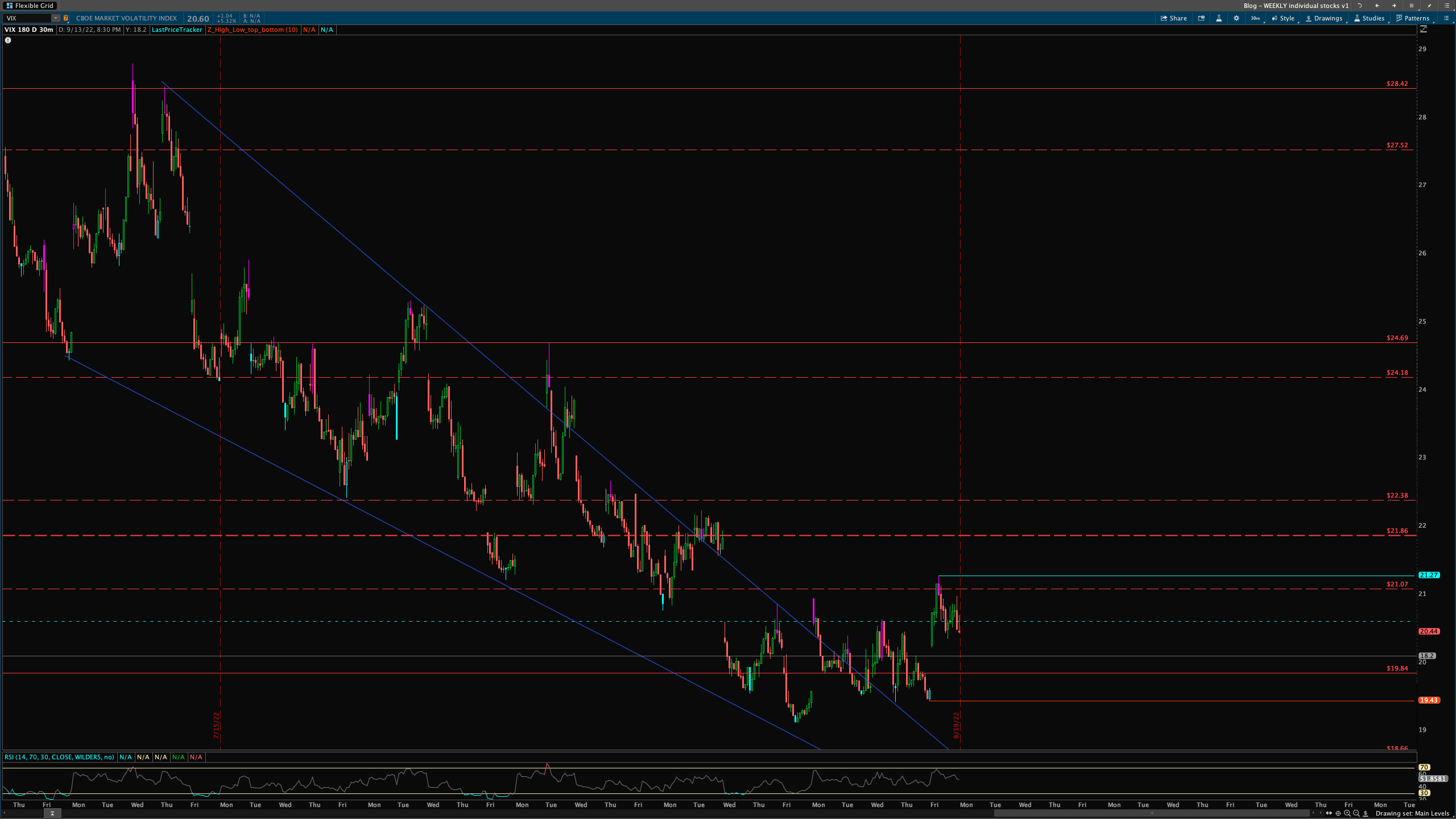

VIX

Game Plan: FALLING WEDGE

- Back over 2o we could see 21.07 then 24.69 eventually over that a breakout.

- Could possibly see 18.66 tested if we do manage to head lower.

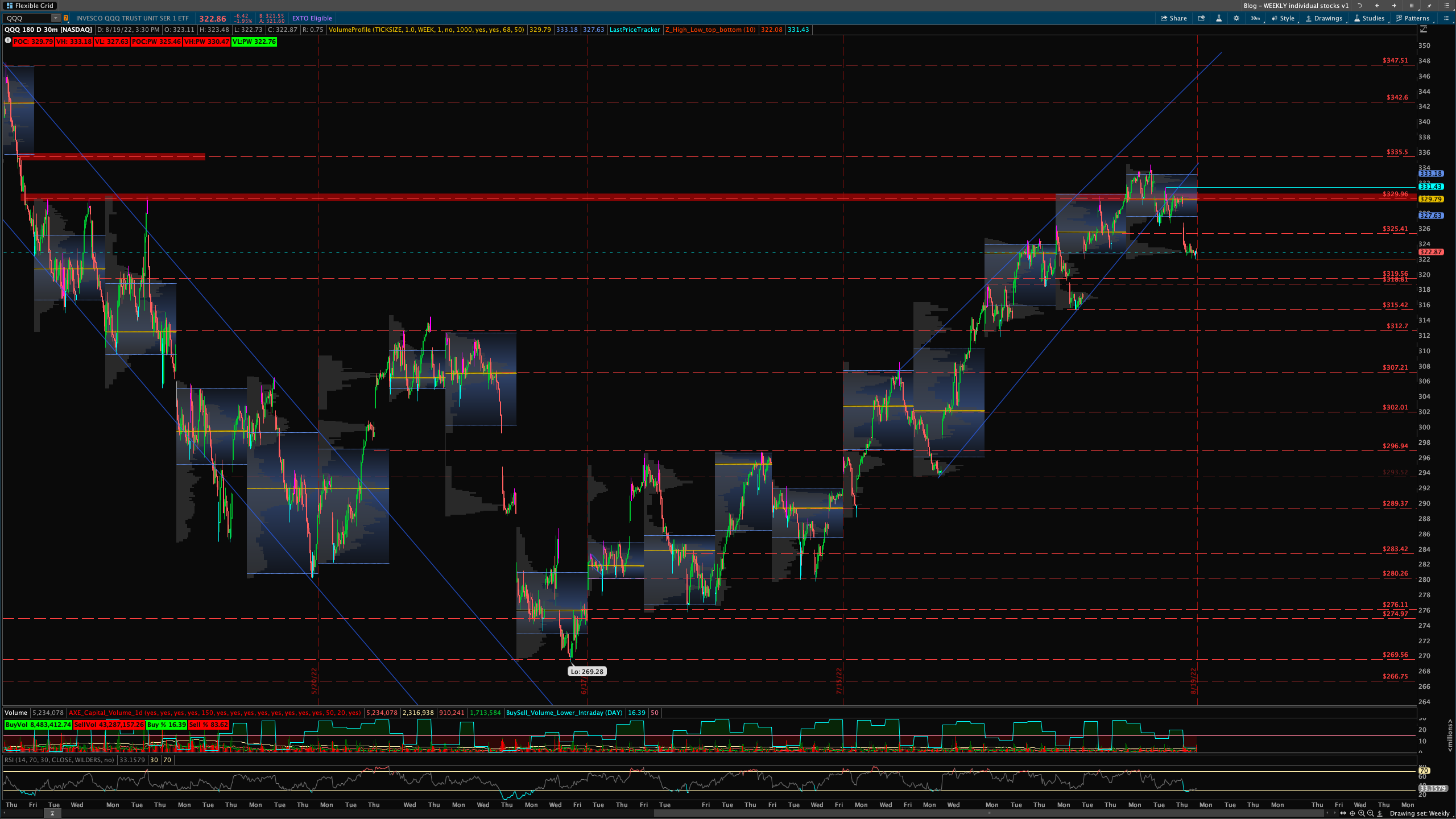

QQQ

Game Plan:

- Above Weekly POC - 329 - Need to break and hold 325.41. From there we can push back to 329.96 vPOC. Over that we can try for 335.5 POC.

- Below Weekly POC - 329 - If we break below 319.56/318.81 we can test 315.42 a light level then 312.7 POC zone from weeks ago. Below that 307 then 302.1 vPOC.

POC: 329 / VH: 333 / VL: 327

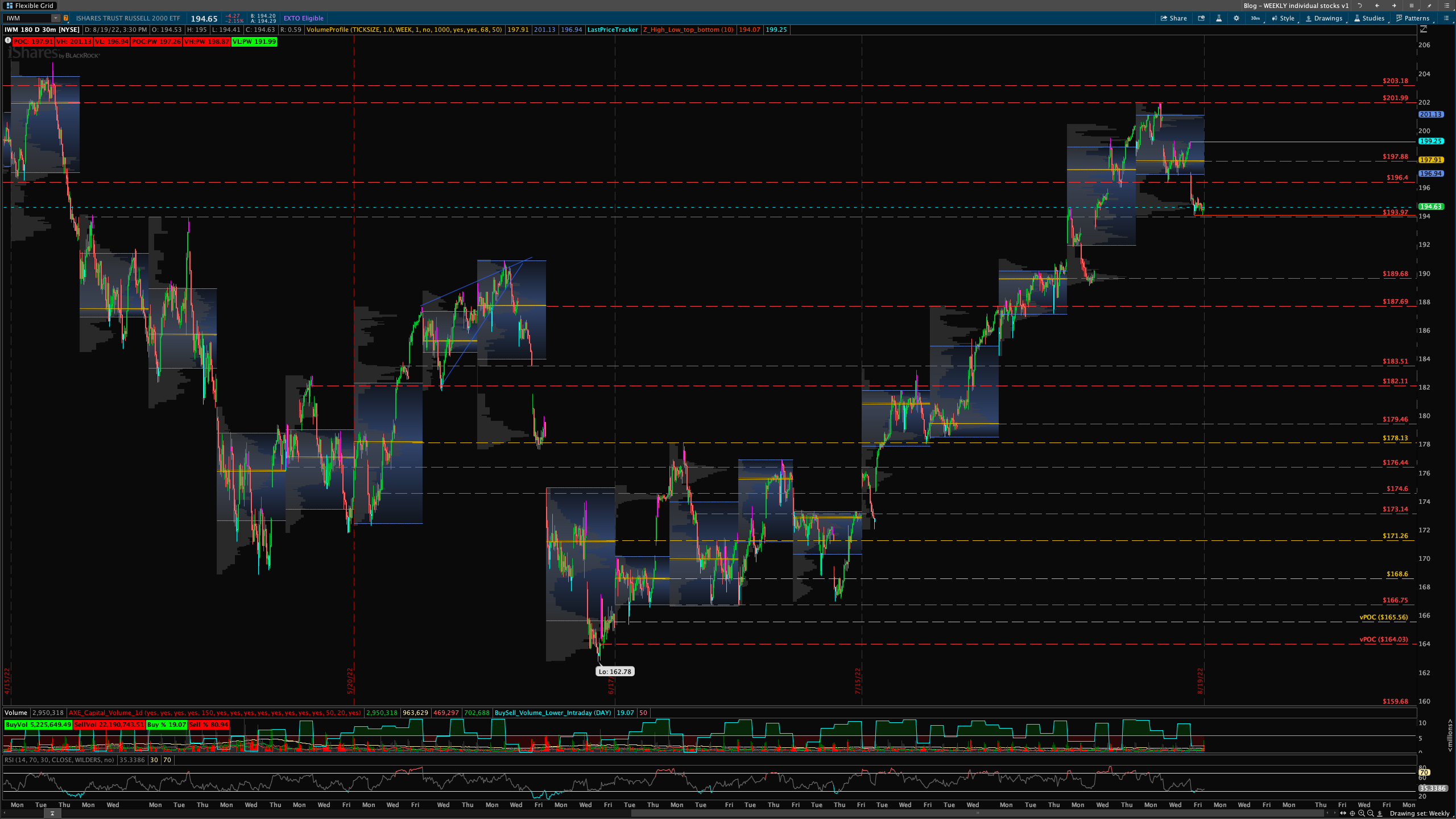

IWM

Game Plan:

- OPEN Above POC - 197 - Need 193.97 to hold. If so we can try to push back to 196.4. Over that then POC at 197.88. Through that 199.25 where we double topped. If we manage to really run we can see 201.99

- OPEN Below POC - 197 - If we break below 189.69 POC zone we see 187.69 POC. If all fails we can make our way down to 183.51/182.11 zone then 179.46 POC.

GAPS: 175.01 > 174.34 / 168.34 > 165.71 / 157.71 > 155.89

POC: 197 / VH: 201 / VL: 196

AAPL

Game Plan:

- Above Weekly POC - 173 - If we can hold 171.29 we can see 173.15 vPOC tested. Though that 174.76 test again. If we manage to push we can see 176 where we topped out then 177.79.

- Below Weekly POC - 173 - Below 171.29 we see 168.55 as possible support as not much support between till 167.13/166.49 zone. Below that we can head to POC at 165.06 then test 163.66. If that breaks not much support till 160.21 and if that breaks 156.72 vPOC is open for testing which will also close the gap.

POC: 173 / VH: 174 / VL: 172

MSFT

Game Plan:

- Above Weekly POC - 291 - We need to break and hold 286.57 then we can possibly push to 288.49 POC. Through that back to 291.15 vPOC. If we continue to push 293.52 could be tested for a push to 296.17.Over that 300.08 vPOC is next. That 296.17 level we could finally close the gap and also seem to be decent resistance at.

- Below Weekly POC - 291 - Break and hold below 286.57 we can see 283.28 then 277.79 zone tested. Below that 273.81/.06 zone will be tested. If that fails 267.97 POC is next.

POC: 291 / VH: 293 / VL: 290

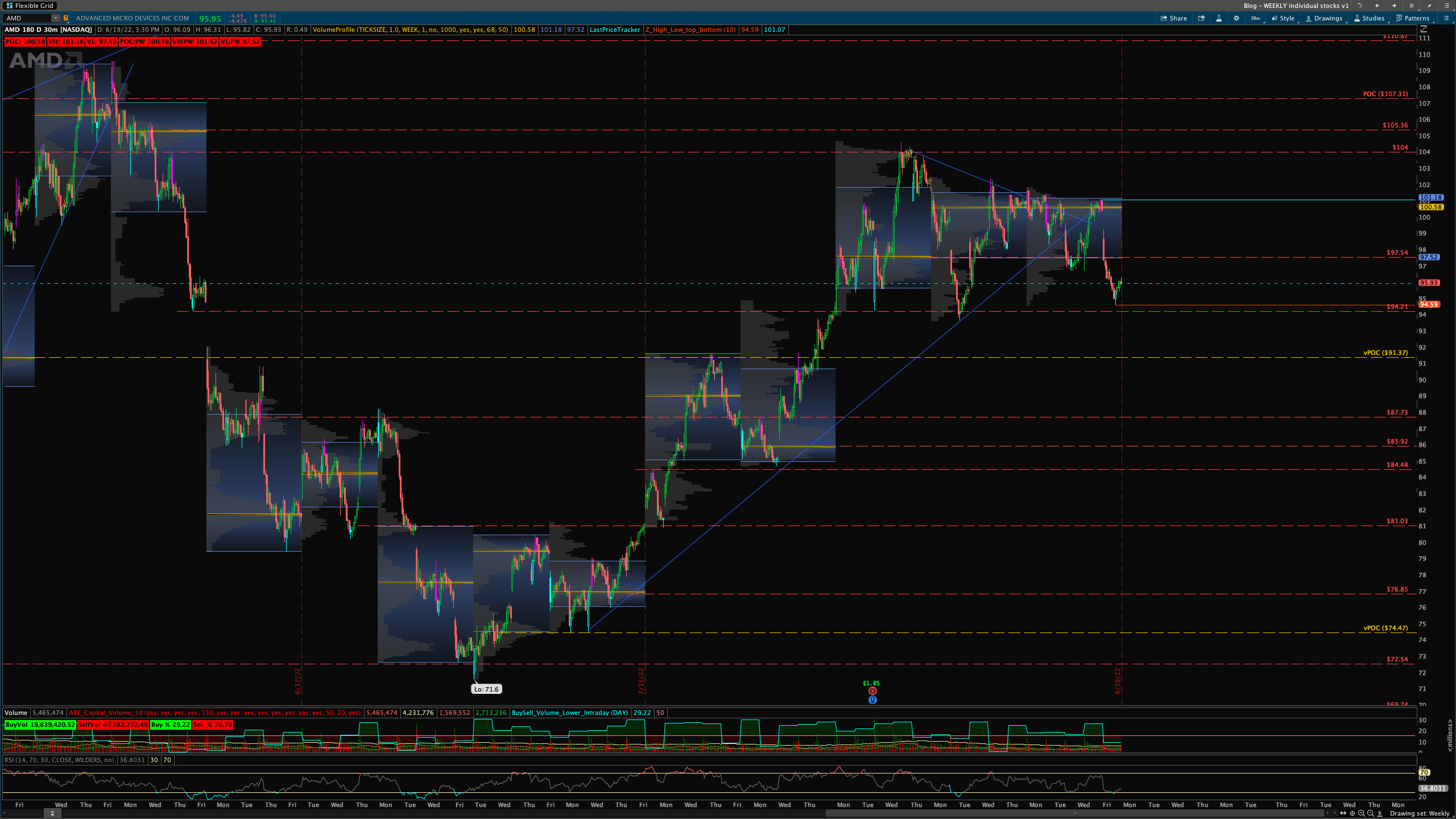

AMD

Game Plan:

- Above Weekly POC - 100 - Need to get back above 97.54. If so we can push back to weekly vPOC at 100.58. Through that we push to 104 and from there test 105.36 vPOC.Over that 107.31 POC then 109.57 to 110.87 zone could be tested and provide heavy resistance if we make it up there.

- Below Weekly POC - 100 - Below 94.21 and below that 91.37. If that fails we will see 87.73 zone tested then 85.92 vPOC.

POC: 100 / VH: 101 / VL: 97

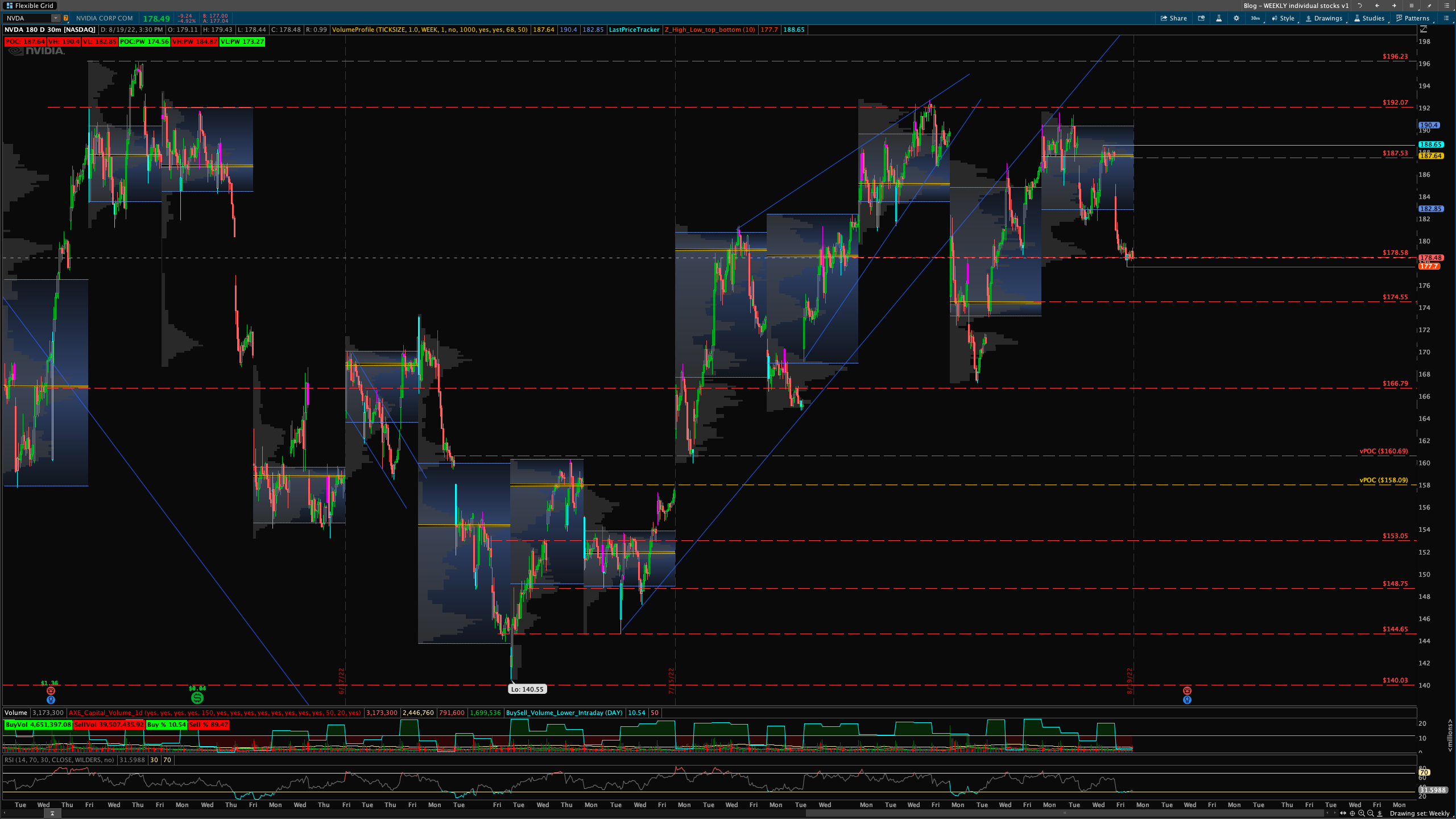

NVDA Game Plan:

- Above Weekly POC - 187 - Need 178.58 to hold. If so we can push back to 182.85 zone. Through that back to 187.53 POC. If we really push back to 192.07 where we rejected.

- Below Weekly POC - 187 - If we break back below 178.58 we see 174.55 Below that 166.79 we see and if all fails 160.69.

POC: 187 / VH: 190 / VL: 182

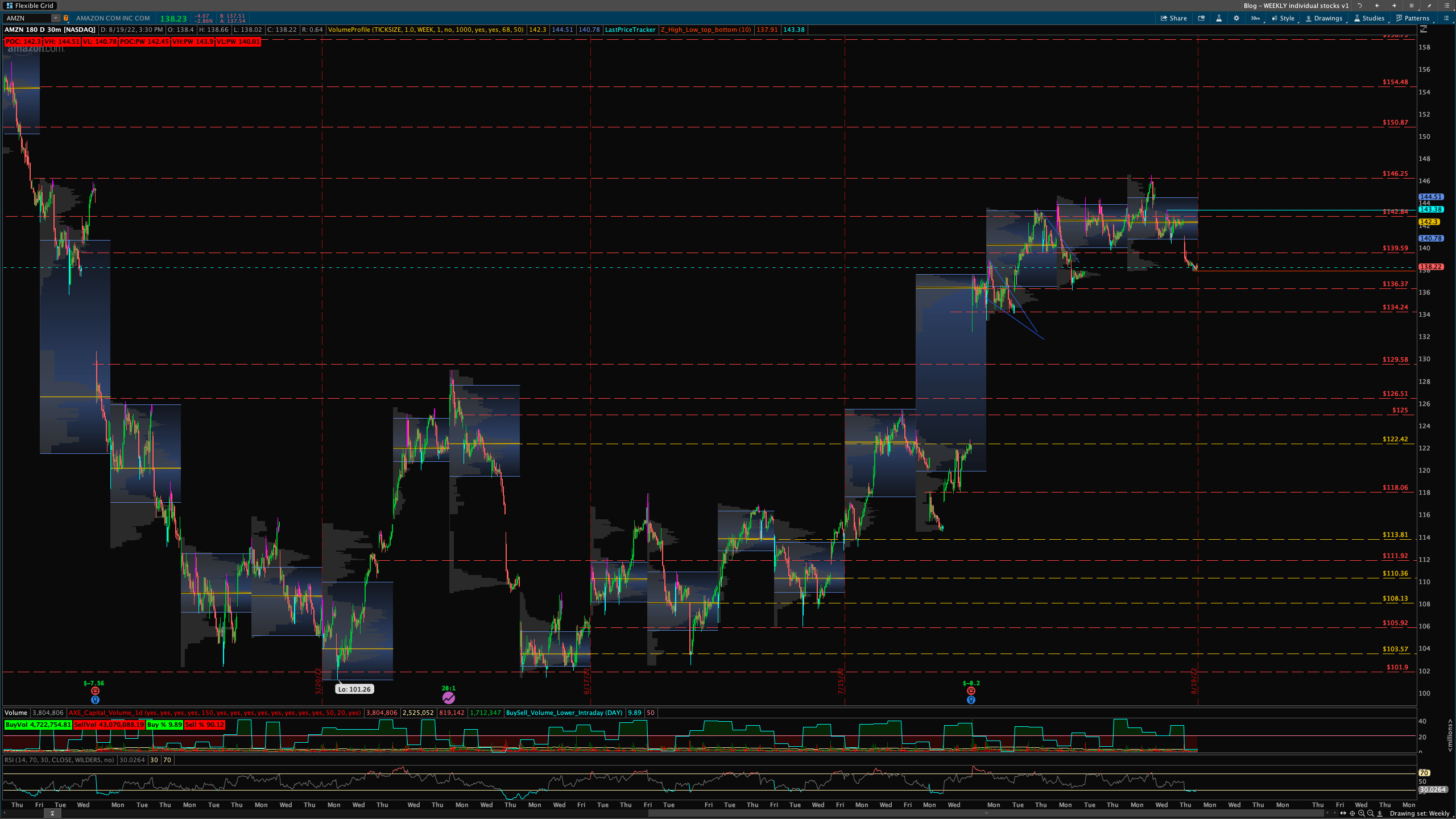

AMZN

Game Plan:

- Above Weekly POC - 142 - Need to get back over 139.59 for any upside potential. If so we can push to VL 140.78 and through that back to POC 142.3. If we manage to clear that we can see 142.84 then 144.27 zone. If we overshoot 146.25 retest.

- Below Weekly POC - 142 - If we hold below 139.59 we can see 136.37 and 134.24 tested as light levels. Below 134 we will go for the gap fill but it may not be a straight line. 129.58 is first up then 126.51 then 125. Below that 122.42 to close the gap. If we continue the decent 113.81 zone could get tested.

POC: 142 / VH: 144 / VL: 140

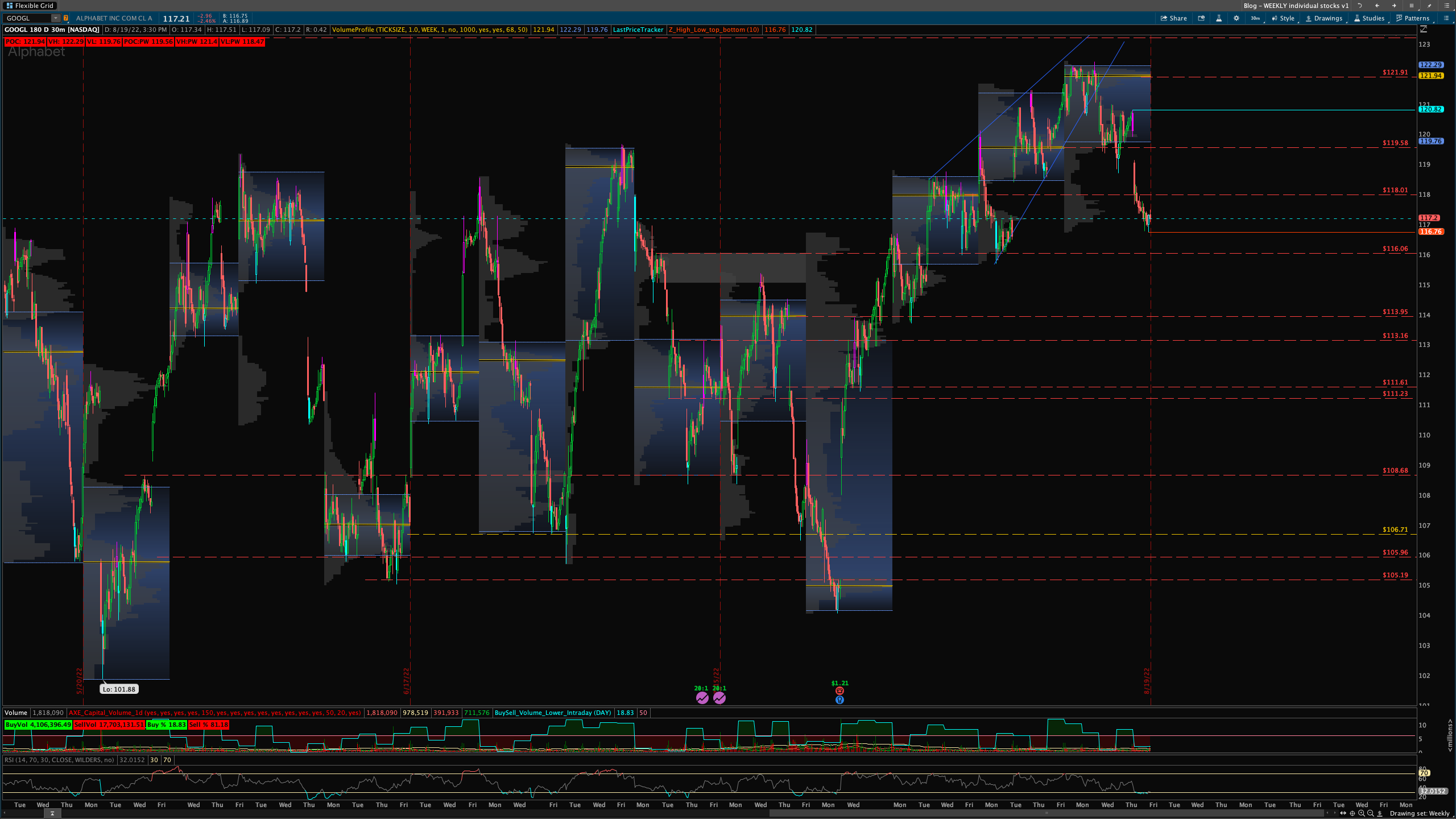

GOOGL

Game Plan:

- Above Weekly POC - 121 - Need to get back over and hold 118.01. From there we can push and retest 119.58 possibly. If we get through that 120.82 level is key to get through then from there we can test 121.91 POC and VH at 122.29.

- Below Weekly POC - 121 - Below 118.01 if we hold we can possibly see 116.06 tested and if that fails not much support till 113.95/.36 zone. If we continue to fall 111.61/.23 zone will be tested.

POC: 121 / VH: 122 / VL: 119

TSLA

Game Plan: Could be a massive inverse head and shoulder so watch carefully this week. 877 zone is key!

- Above Weekly POC - 910 - Need 877 zone to hold. If so we can push back to 909/910 POC zone. If we get through that we can see 934 then 956. If we mega squeeze 975 is possible but heavy resistance is at.

- Below Weekly POC - 910 - Below 877 we see 869.39 vPOC tested. If that breaks 854.64 then 841 zone test. If that breaks not much support till 809 andbelow that straight down to 763 and 747 zone.

POC: 910 / VH: 934 / VL: 907

Did you enjoy this post?

If you want more detailed levels and game plan check out the Daily SubStack:

- Daily Levels for all 12 stocks

- User stock posts if you want a stock charted with levels, let’s talk about it and create a game plan

Live Streams with Q&A

To continue supporting my work I put into these blog posts you can subscribe to the monthly or annual plan!

Thank you for reading PHOENIX Capital Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.