To watch FULL SCREEN - Click "WATCH ON YOUTUBE" Then click the "Gear Icon" select 1080p and watch full screen!

LIVE Stream Schedule!

- Sunday - VIP - 8:30 pm EST - SPECIAL CO-HOST - W/ Savvy1 learn Fibonacci's!

- Sunday - VIP - 9:30 pm EST - Game Plan going into next week!

- Sunday - FREE - 7:30 pm EST - Game Plan + Vol. Profile EDU

Join FOCUS Group

- Intra-day levels for /ES

- DAILY Blog - Levels for 12 stocks every night!

- Discord Private Live Streams

- It provides a great focus as a focus group to engage rather than the masses on regular live streams where I go over weekly levels high level.

“Remember, the market transfers money from the impatient to the patient!”

Thoughts on /ES /CL /BTC🤔

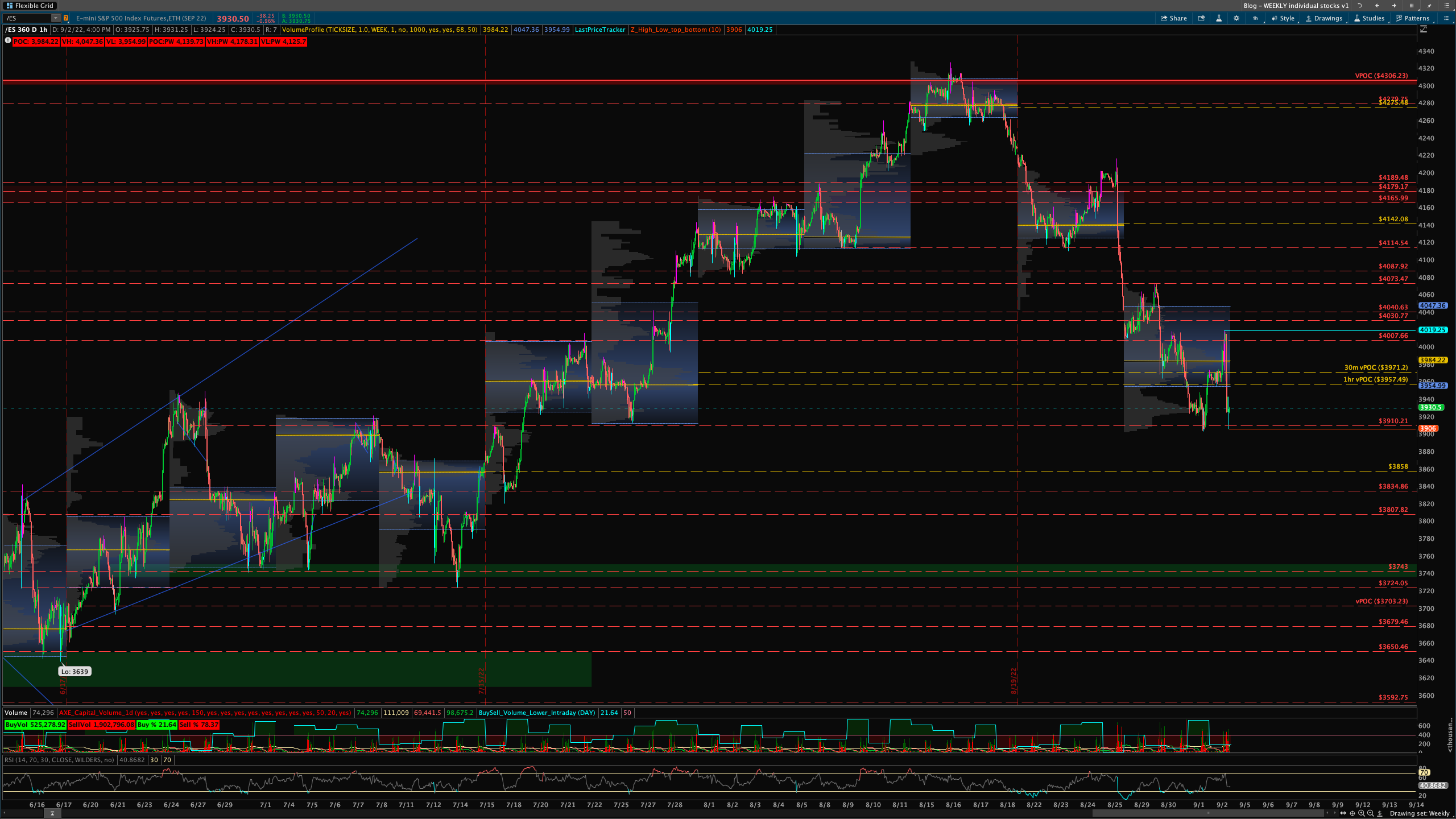

/ES

/ES

Tremendous sell of today after the short rally. From 4007 back down to 3910 zone. Next week will be key as if we give up this 3910 zone 3834 and 3743 could be exposed and below that back to June lows around 3639. Upside needs back over 39557 and a break and hold over 4007 really for any further upside potential.

/CL

Need 86 zone to hold. If so we can get back over 89 zone we can push to 94s again. We struggled to hold above 94 after a quick overshoot but through 98 we see 100 where big resistance is at. Downside if we break and hold below 86 we see 83s.

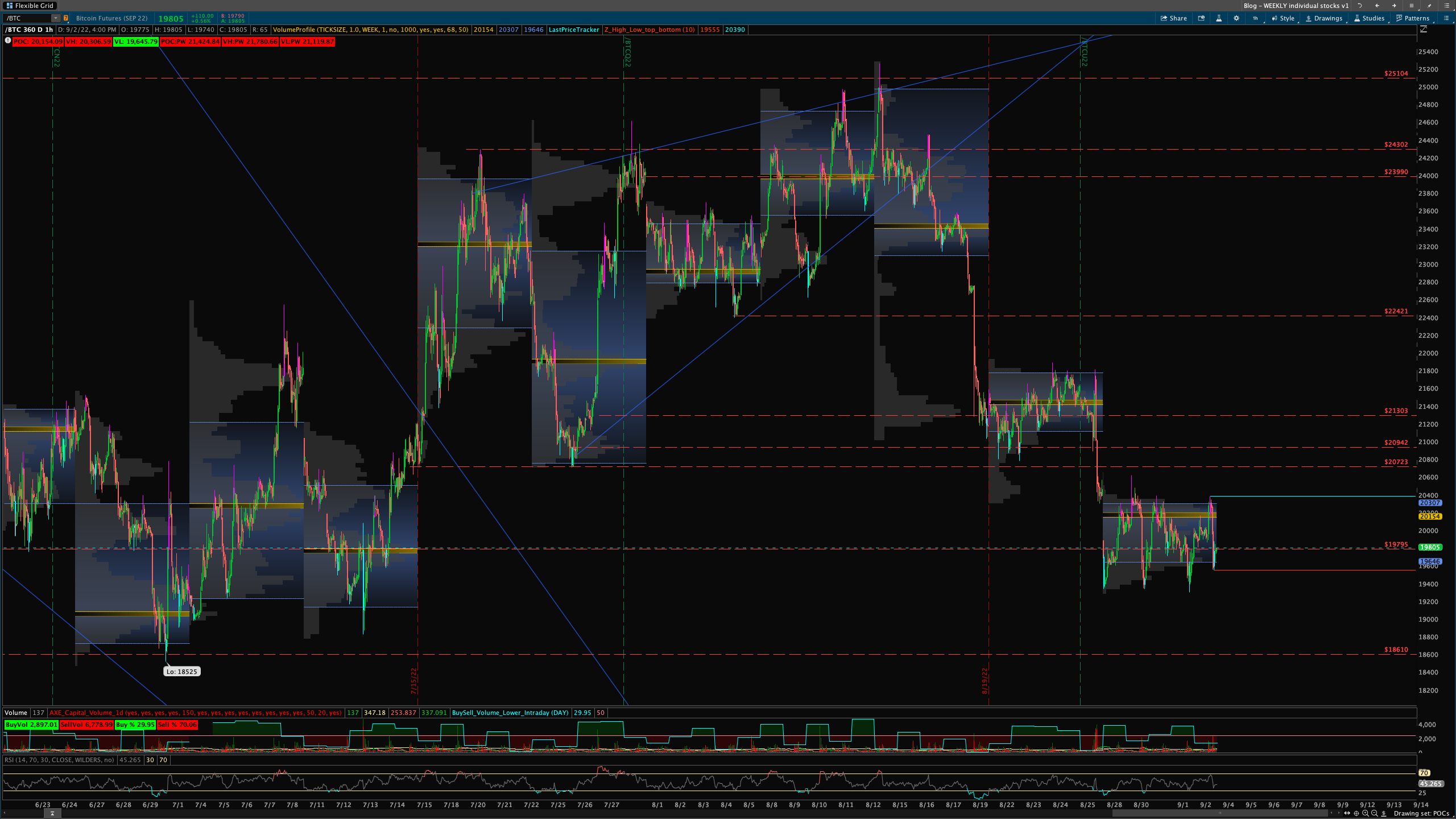

/BTC

If we hold below 19795 we can see 19400s tested again. Through that down to 18610 we will see. We can easily see 16480 and 12750 eventually. Upside needs over 2073 really to break and hold. If so push back to 21800s resistance is at.

Want To Learn Volume Profile?

Stocks We Will Be Reviewing

- FUTURES - /ES & /NQ

- ETFs - QQQ (tech) & IWM (small caps)

- VIX - Volatility Index

- STOCKS - AAPL / MSFT / AMD / NVDA / AMZN / GOOGL / TSLA

FOCUS Group:

- DAILY Levels for 12 stocks every night!

- Intra-day levels for /ES

- Discord Private Live Streams

- It provides a great focus as a focus group to engage rather than the masses on regular live streams where I go over weekly levels high level.

IMPORTANT NOTE - About Upside Levels This WEEK!

- SOME are WELL BELOW Weekly POC so for everyone section that says "Above POC" I put levels below it as upside targets as if we were to bounce from where we currently are!

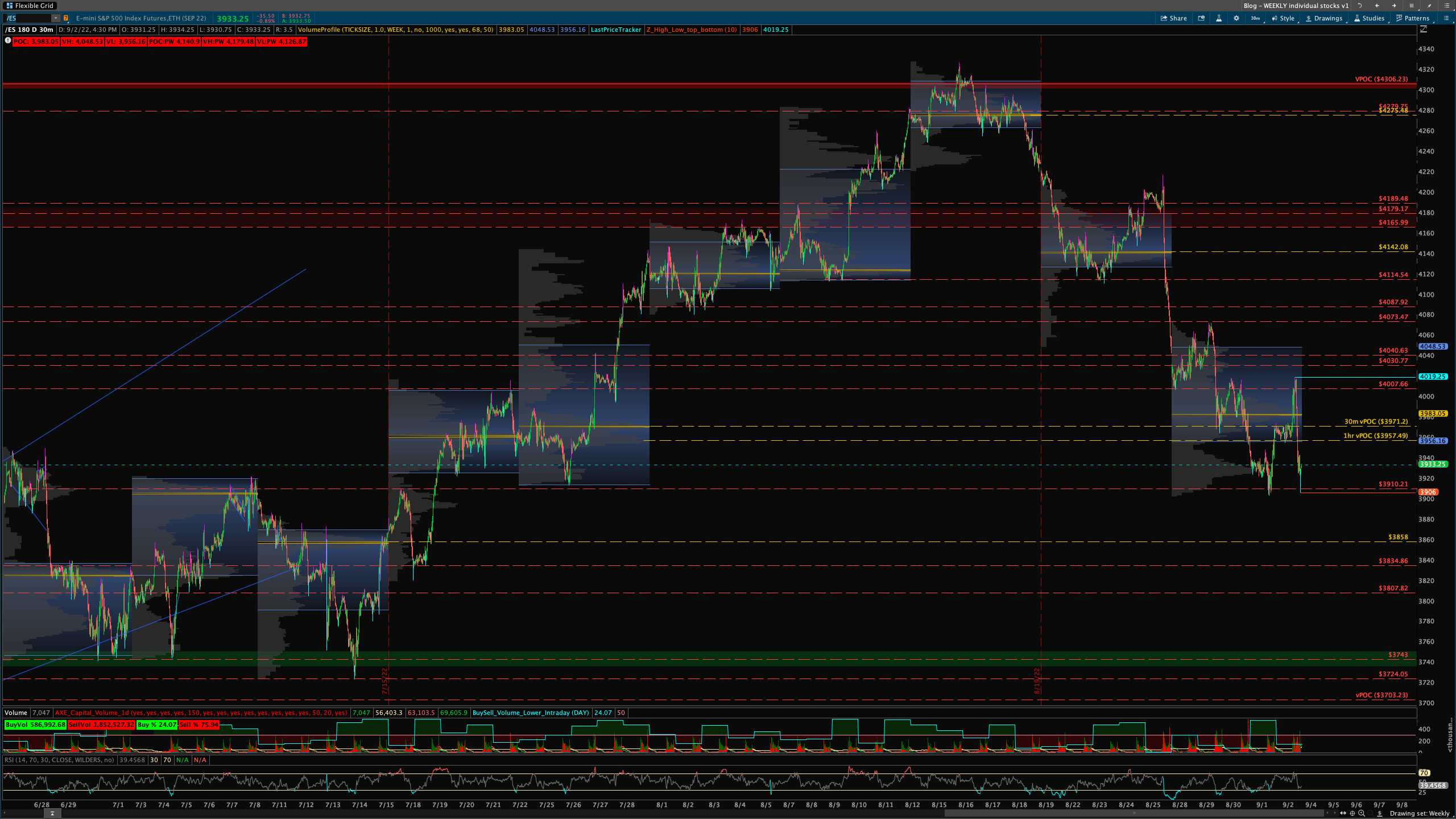

/ES

Game Plan:

- Above Weekly POC - 3983 - If we can get back over 3971 we can see 4007 again. Through that 4030 then 4073 where resistance is. Through that 4087 then 4114.

- Below Weekly POC - 3983 - Below 3910 we see 3858 then 3834. If all fails 3807 then 3743 is below.

POC: 3983 / VH: 4084 / VL: 3956

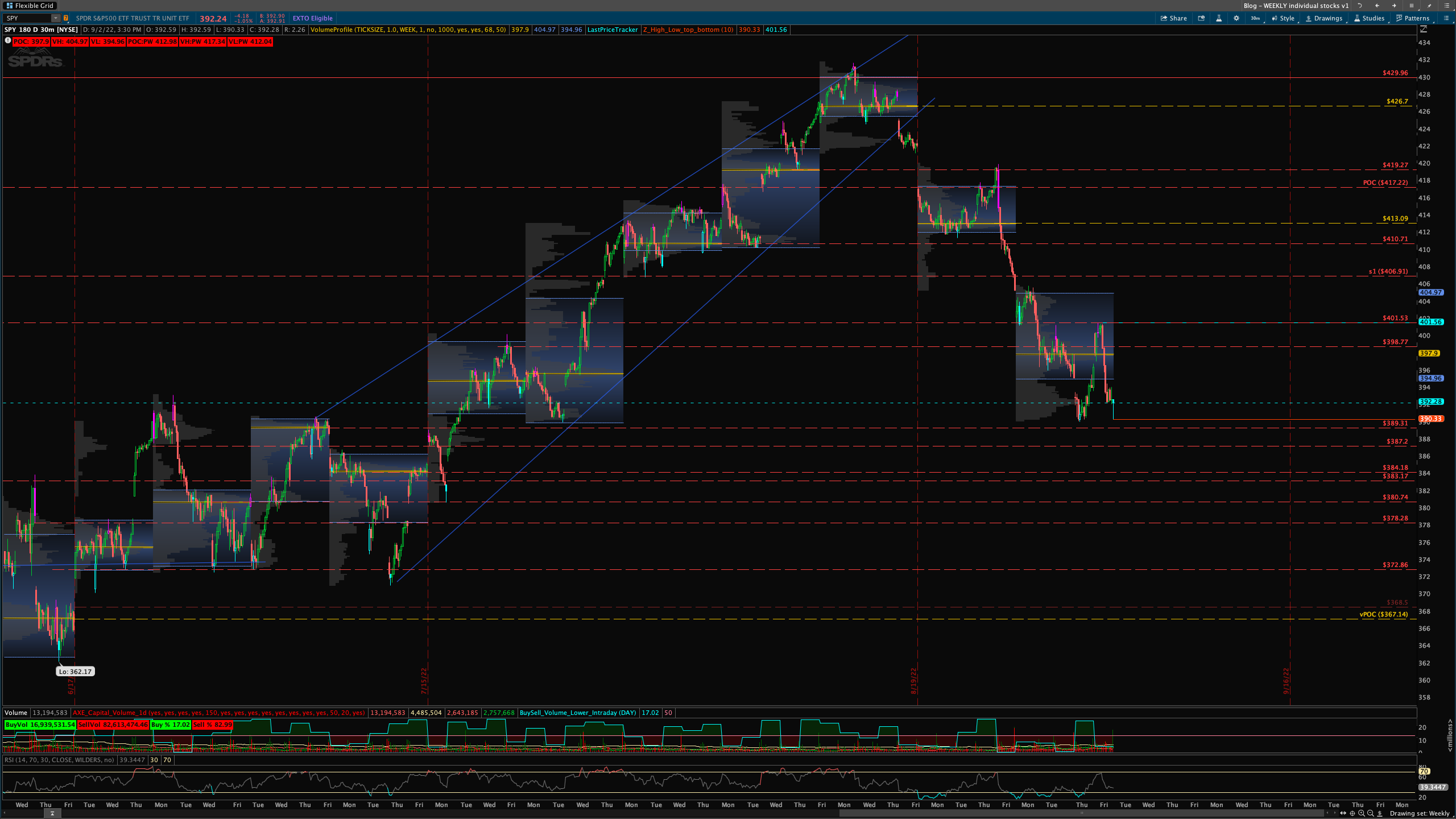

SPY

Game Plan:

- Above Weekly POC - 397 - Over POC we see 401.53 we see 406.91 then 410.71

- Below weekly POC - 397 - Below 389 we see 387.2 then 383 then 380.74. If we collapse 378 then big drop to 372 we see.

POC: 397 / VH: 404 / VL: 394

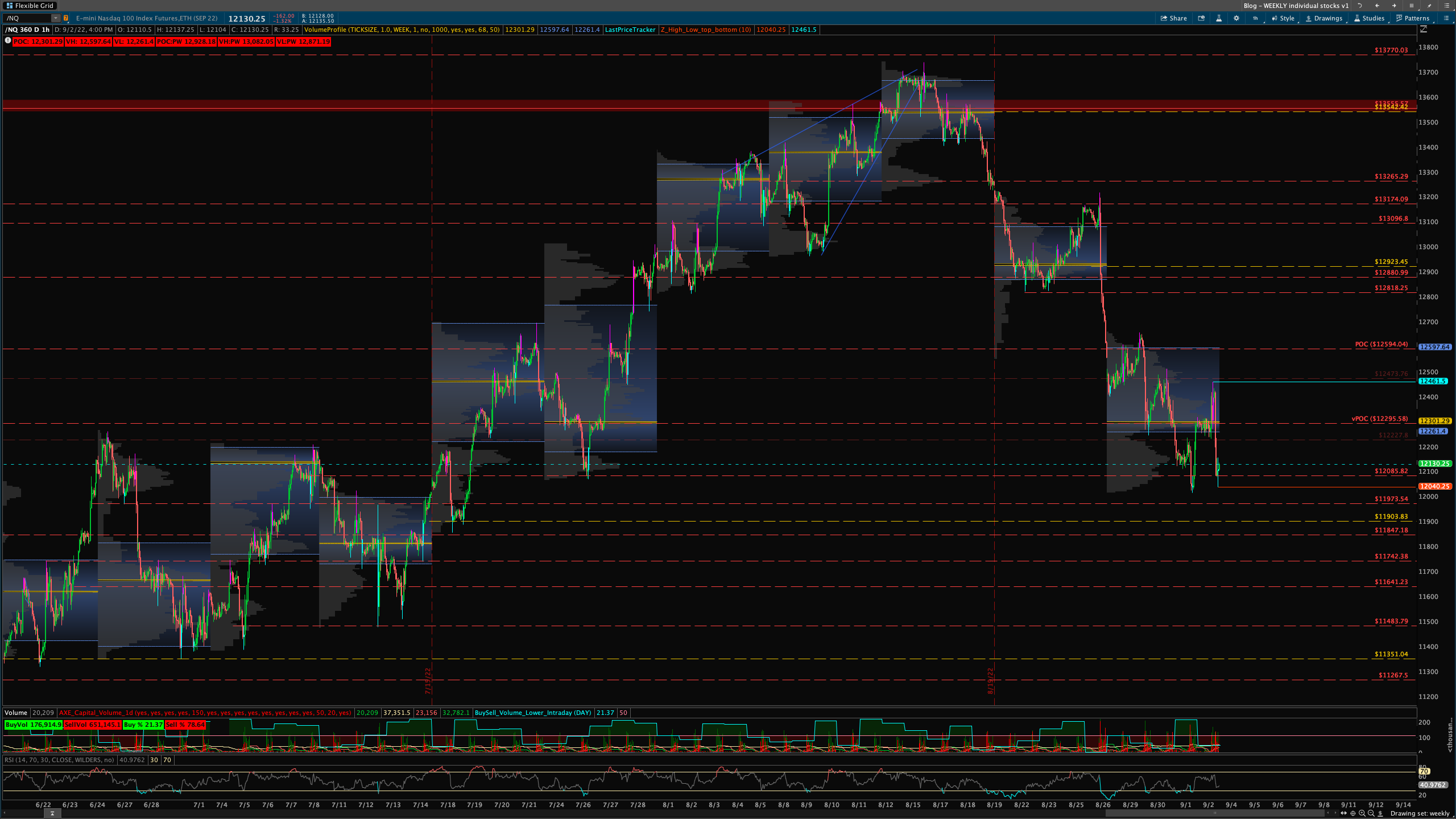

/NQ

Game Plan: WAY BELOW POC

- Above Weekly POC - 12301 - WAY BELOW POC so upside levels are... if we can get over 12227 we can test POC zone 12301. Over that pop to 12473. Through that 12473 test then 12594. Over that not much till 12818.

- Below Weekly POC - 12301 - Below 12085 11973 then 11903 follows. If we collapse 11742, 11641 then 11483 can follow.

POC: 12301 / VH: 12597 / VL: 12261

VIX

Game Plan:

- Need over 24.69 to hold if so we have a big range now till 27.52 over that 28.42

- Could possibly see 24.69 retested as confirmation if it fails to hold we can see 24.18 and not much support till back to 22/21 zone.

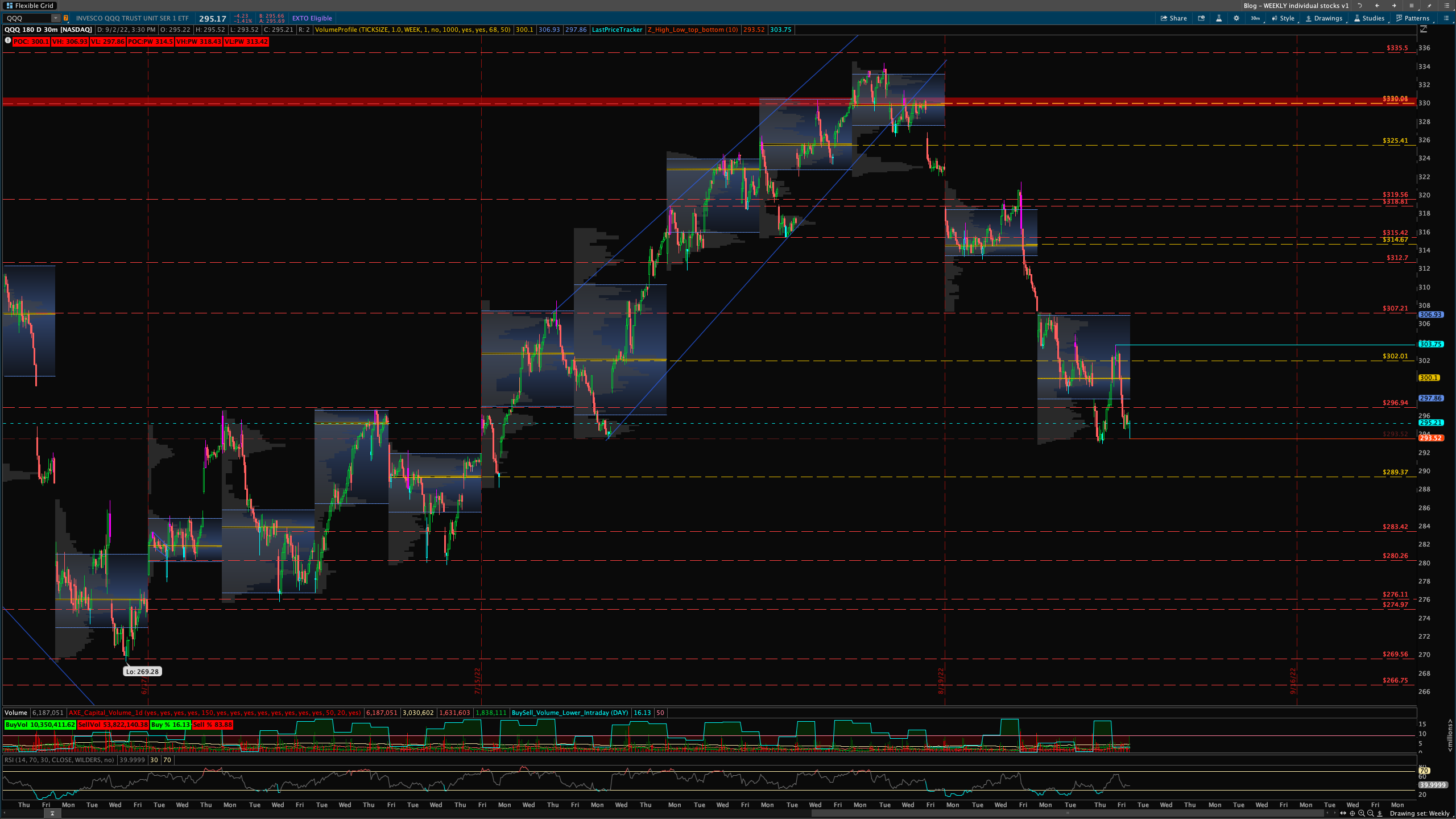

QQQ

Game Plan:

- Above Weekly POC - 300 - Need back over 296 then POC test. Over that 302 zone test and through that 307. If we really push we can see 312.

- Below Weekly POC - 300 - If we break below 293.52 zone we see 289 then 283. If we collapse 280 then 276 comes quick .

POC: 300 / VH: 306 / VL: 297

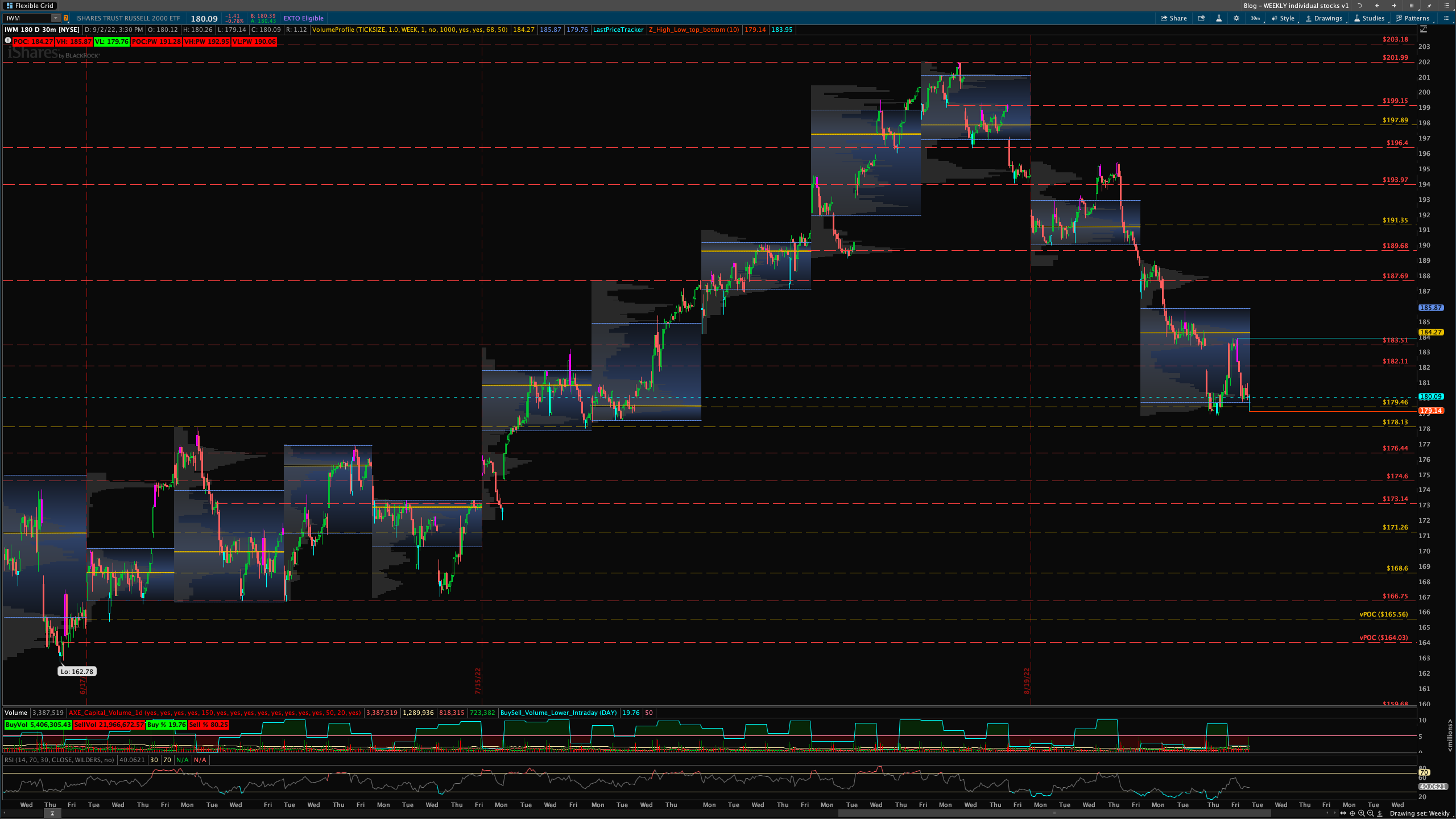

IWM

Game Plan:

- OPEN Above POC - 184 - Way below POC...need over 181.11 then 183 near POC where we rejected. Through that 185 then 187 we could see and 189 if we really push.

- OPEN Below POC - 184 - If we break and hold below 179 we see 178.13 tested. If that fails 176 then 174 is next. Below 173 then 171 and a nice drop to 168 /166 zone we could see if we collapse.

GAPS: 175.01 > 174.34 / 168.34 > 165.71 / 157.71 > 155.89

POC: 184 / VH: 184 / VL: 179

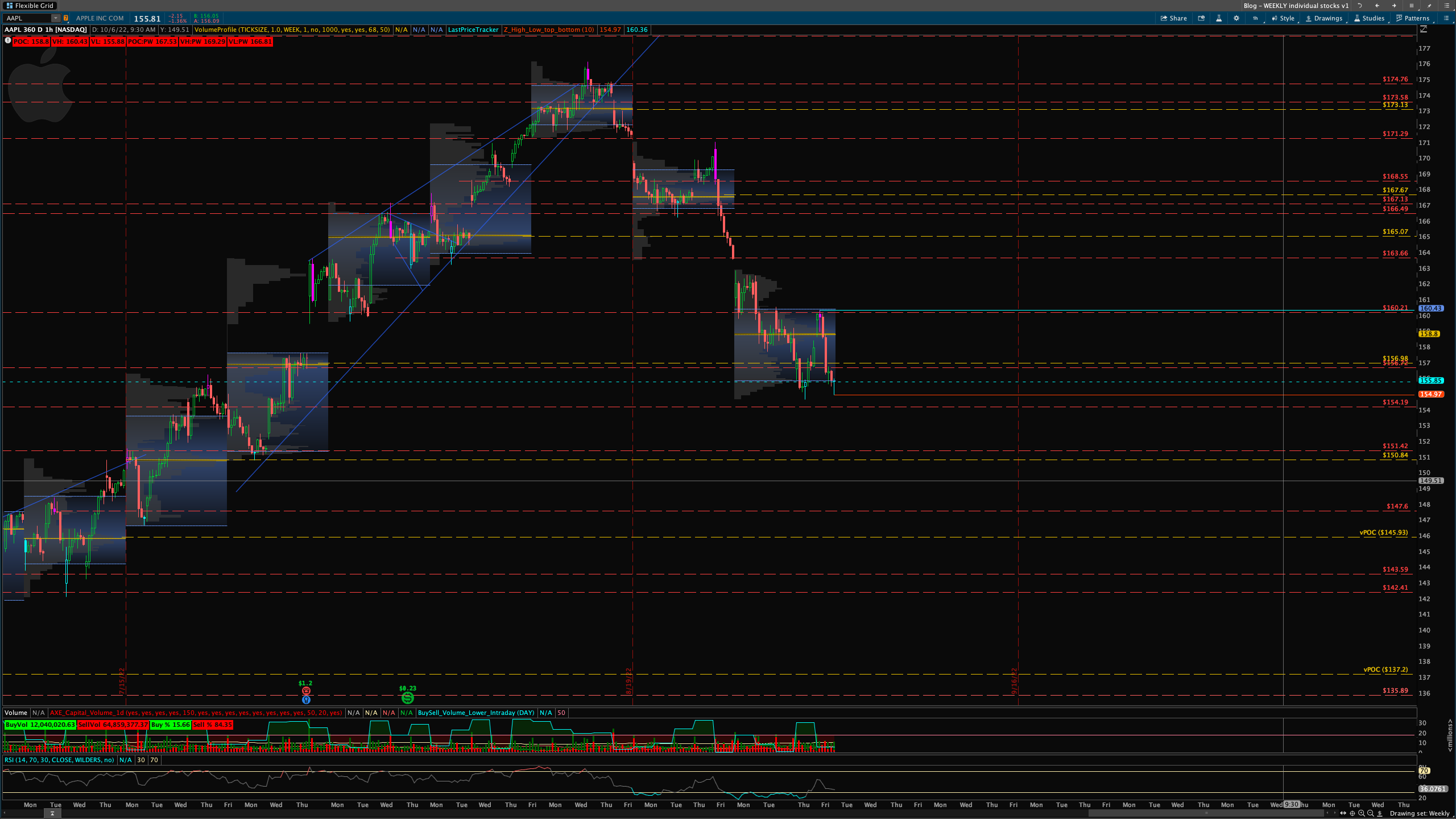

AAPL

Game Plan:

- Above Weekly POC - 167 - Below POC so for any upside need back over 156 zone. Through that 158 POC we test then 160 where current resistance is at. Through that close gap and break to 163 we can see.

- Below Weekly POC - 167 - Below 153 we see 151.42/150.84 zone tested. If that fails 147 then 145 is next. If all fails and we collapse we see 143 then 142 quick.

POC: 167 / VH: 169 / VL: 166

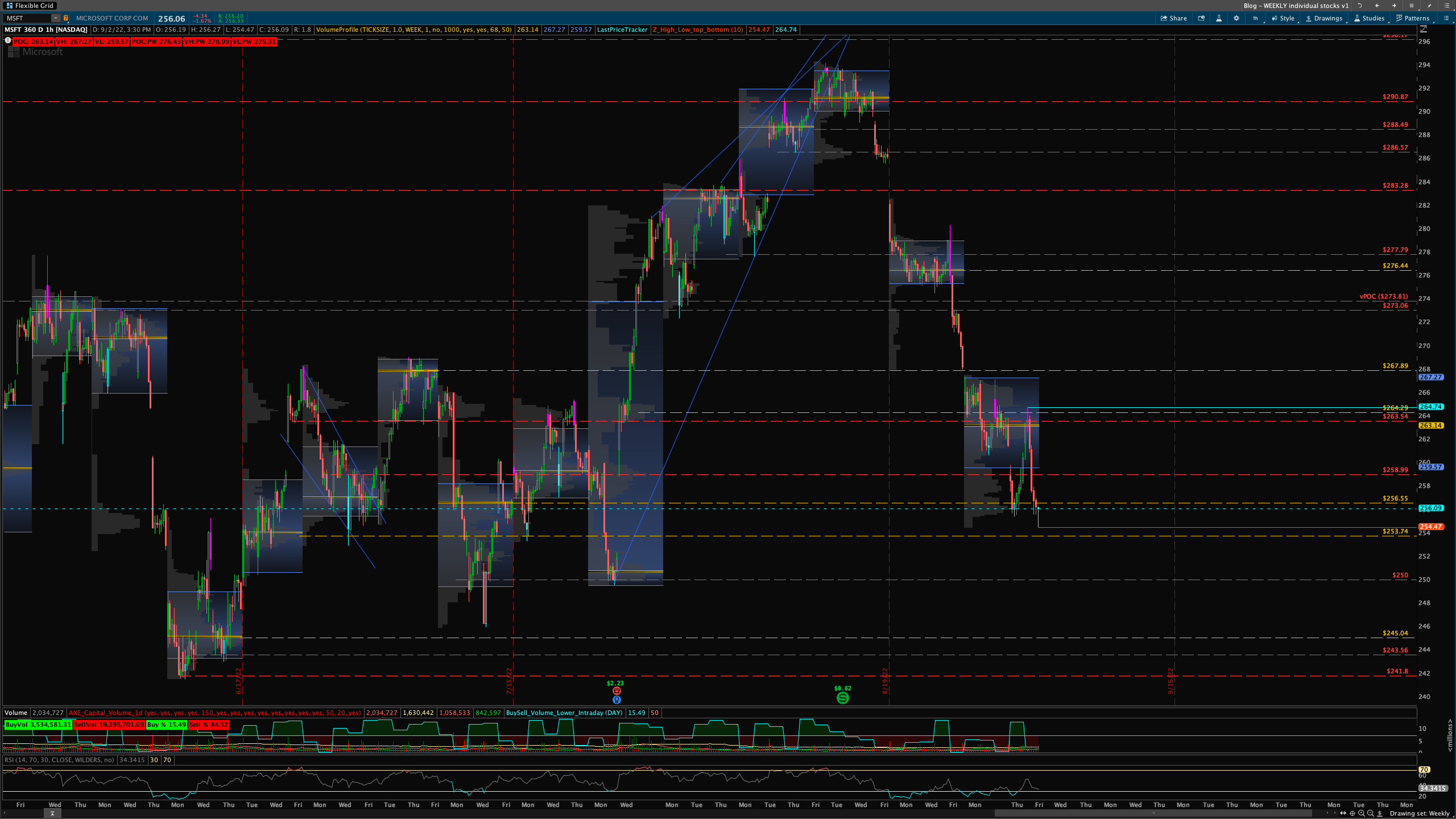

MSFT

Game Plan:

- Above Weekly POC - 263 - We are way below POC so for any upside we needback over 256. Through that 258 zone then 263 POC. If we manage to get over that 267 waits overhead then 273.

- Below Weekly POC - 263 - Hold below 256 we see 253. If that fails down to 250s we go and if that fails another big drop to 245 zone. Below that 243 then 241 and new lows for the year.

POC: 263 / VH: 267 / VL: 259

AMD

Game Plan:

- Above Weekly POC - 80 - Need to get back above 81.02. If so we can possibly push back to 84 zone then 85.92. Over that 87.73 zone. Through that 91.

- Below Weekly POC - 80 - Below 81.03 and hold retest 78.51 low. Through that 77.06 we see then 74.47 we see and if all fails down to 72 then 69.

POC: 80 / VH: 86 / VL: 78

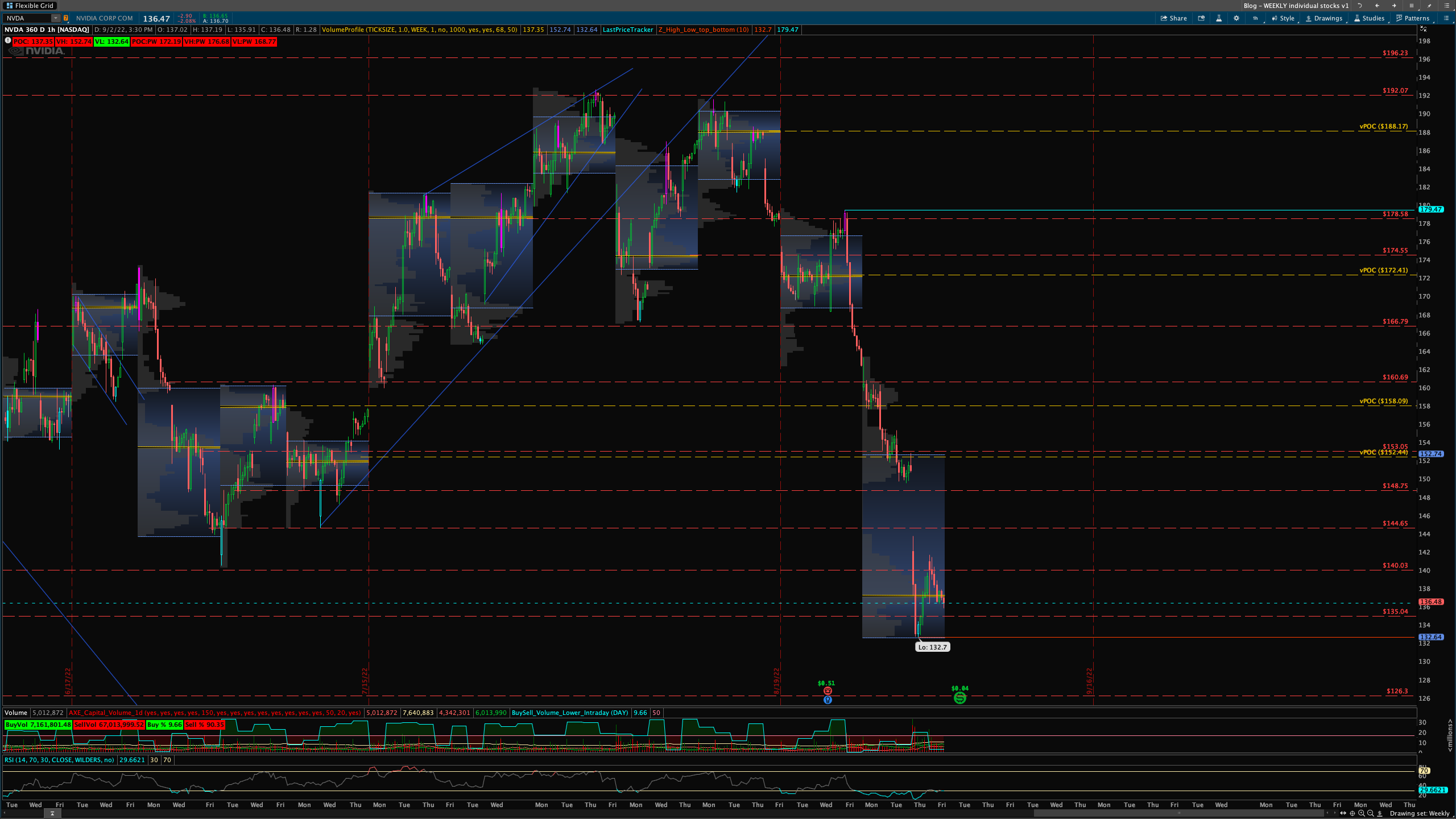

NVDA

Game Plan: Made new lows

- Above Weekly POC - 137 - Need back over 140.03. If so we canpush to 144.65 then try for 148.75. If we go for the gap close we can test 150s then 153.05.

- Below Weekly POC - 137 - If we break below 132.7 not much support till 126.3. If that fails 122.98 then 116.93 we could see.

POC: 137 / VH: 152 / VL: 132

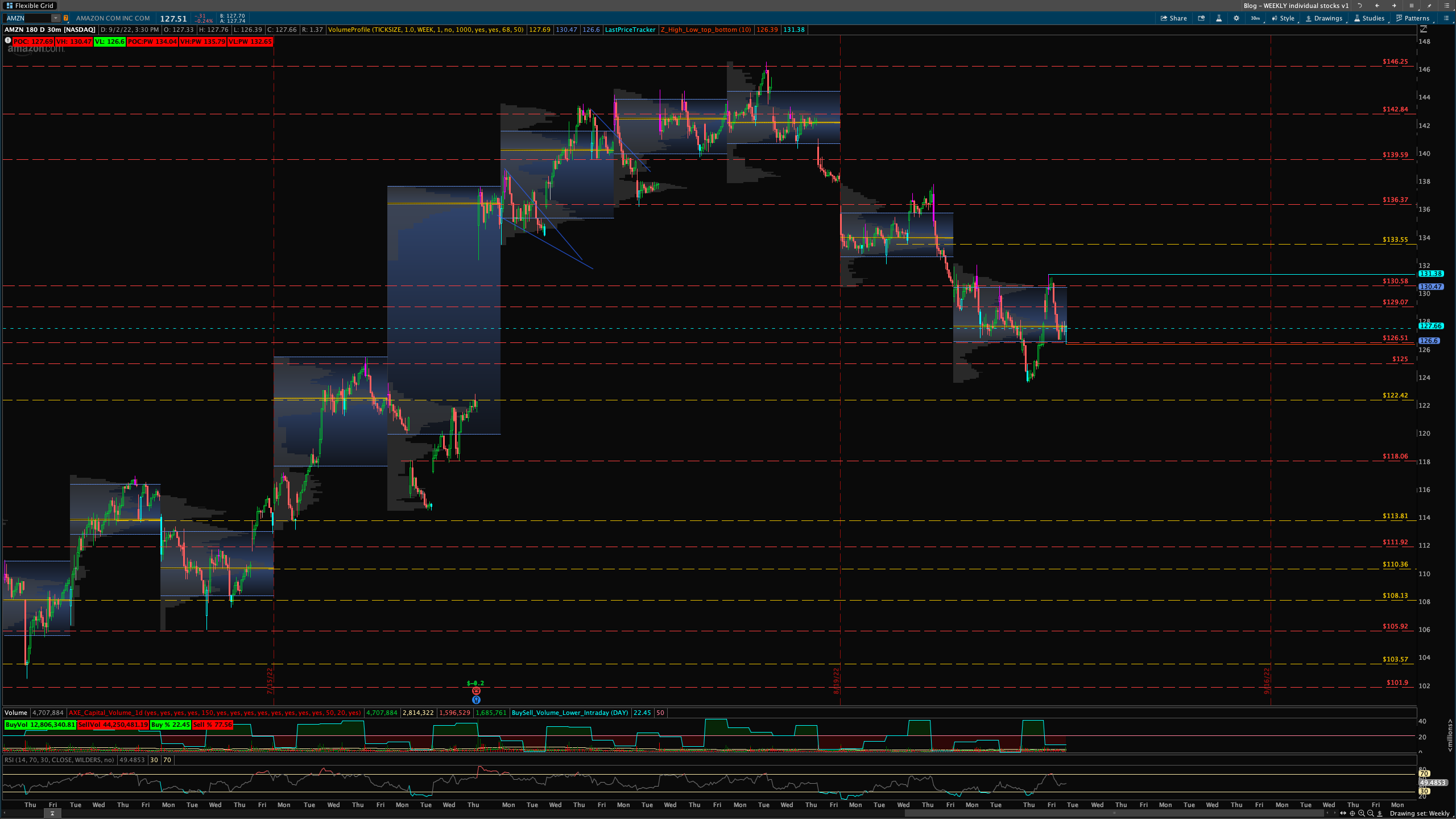

AMZN

Game Plan:

- Above Weekly POC - 127 - Need 126.51 to hold. If so we can test 129.07 and then 130.58. Through that 134.12 we see then 136.37.

- Below Weekly POC - 127 - Below 126.51 then 125. Below that 122.42 to close the gap. If we continue the decent 113.81 zone could get tested.

POC: 127 / VH: 130 / VL: 126

GOOGL

Game Plan:

- Above Weekly POC - 109 -Way below POC need back over POC of 109 for us to retest 110.31 zone. Through that 111.23/.61 zone. If we get through that 113.16 possibly we see 114.08 POC.

- Below Weekly POC - 109 - Below 107.09 we see 105.81 then 105.01. If all fails 104.12 then lows around 101 will be tested

POC: 109 / VH: 110 / VL: 108

TSLA

Game Plan:

- Above Weekly POC - 275 - Need back over weekly POC. If so we can test 280.49. Through that 284.78 then 289 POC zone. Over that not much resistance till 303s again.

- Below Weekly POC - 275 - Below 269.58 break and hold we will see 262. If that fails 256 then 248 zone of weekly vPOC. Below that big drop to 234s.

POC: 275 / VH: 281 / VL: 269

Did you enjoy this post?

If you want more detailed levels and game plan check out the Daily SubStack:

- Daily Levels for all 12 stocks

- User stock posts if you want a stock charted with levels, let’s talk about it and create a game plan

Live Streams with Q&A

To continue supporting my work I put into these blog posts you can subscribe to the monthly or annual plan!

Thank you for reading PHOENIX Capital Newsletter. Please share on Twitter!

Disclaimer: This newsletter is not trading or investment advice, but for general informational purposes only. This newsletter represents my personal opinions which I am sharing publicly as my personal blog. Futures, stocks, bonds trading of any kind involves a lot of risk. No guarantee of any profit whatsoever is made. In fact, you may lose everything you have. So be very careful. I guarantee no profit whatsoever, You assume the entire cost and risk of any trading or investing activities you choose to undertake. You are solely responsible for making your own investment decisions. Owners/authors of this newsletter, its representatives, its principals, its moderators and its members, are NOT registered as securities broker-dealers or investment advisors either with the U.S. Securities and Exchange Commission, CFTC or with any other securities/regulatory authority. Consult with a registered investment advisor, broker-dealer, and/or financial advisor. Reading and using this newsletter or any of my publications, you are agreeing to these terms. Any screenshots used here are the courtesy of Think or Swim. I am just an end user with no affiliations with them.

Thanks for reading PHOENIX Capital Newsletter! Subscribe for free to receive new posts and support my work.